Question: ACCOUNTING, please help (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Which of the following is a characteristic of a current liability? Unearned

ACCOUNTING, please help

(1)

(2)

(2)

(3)

(3)

(4)

(4)

(5)

(5)

(6)

(6)

(7)

(7)

(8)

(8)

(9)

(9)

(10)

(10)

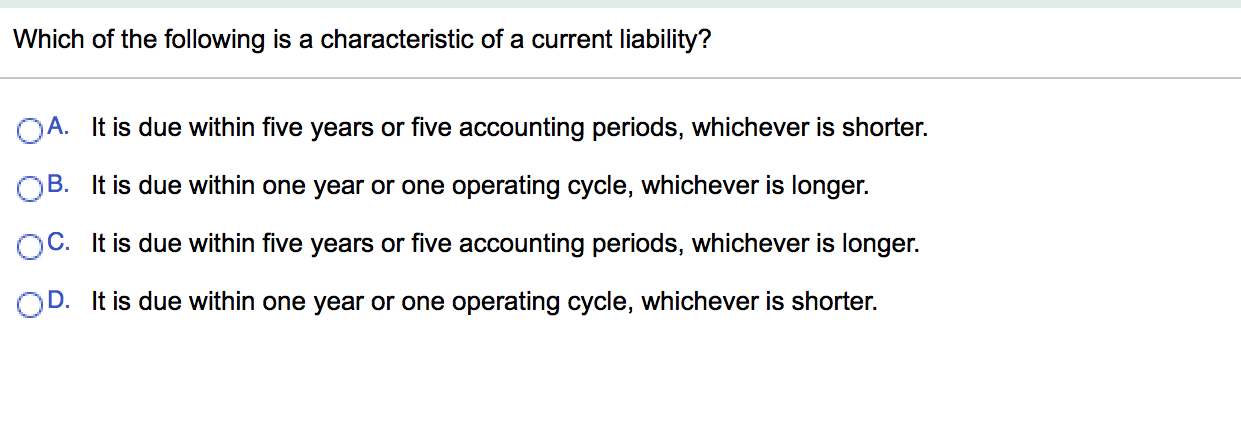

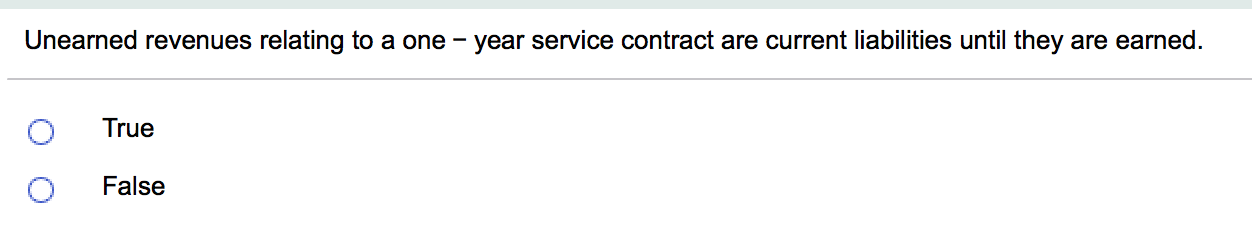

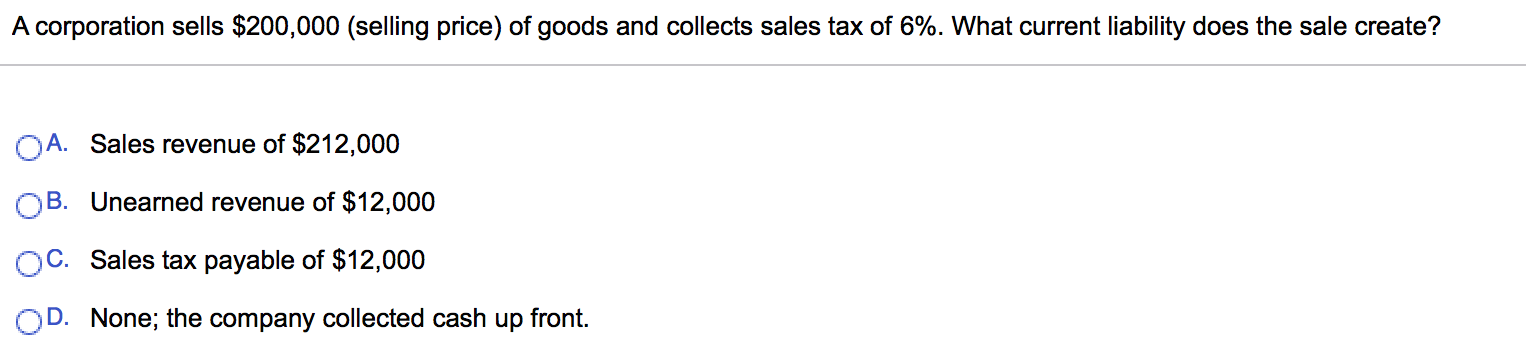

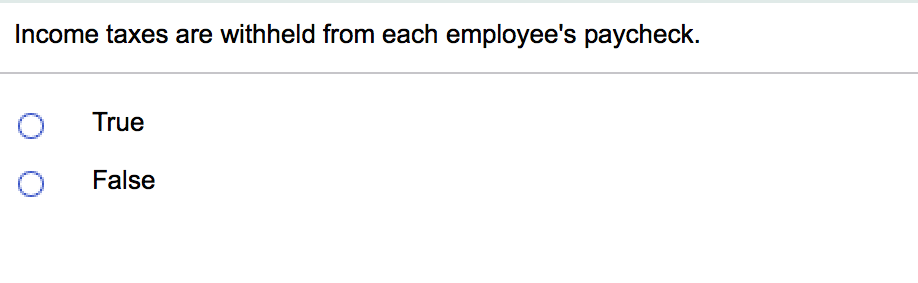

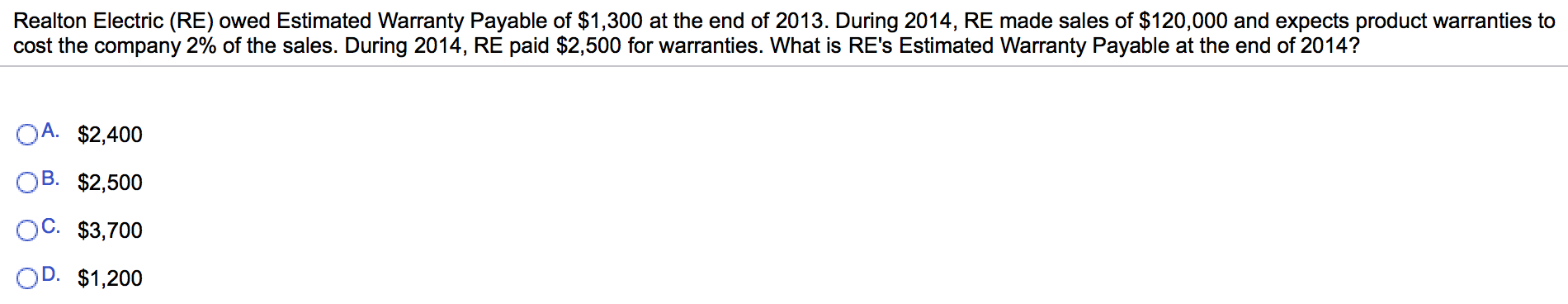

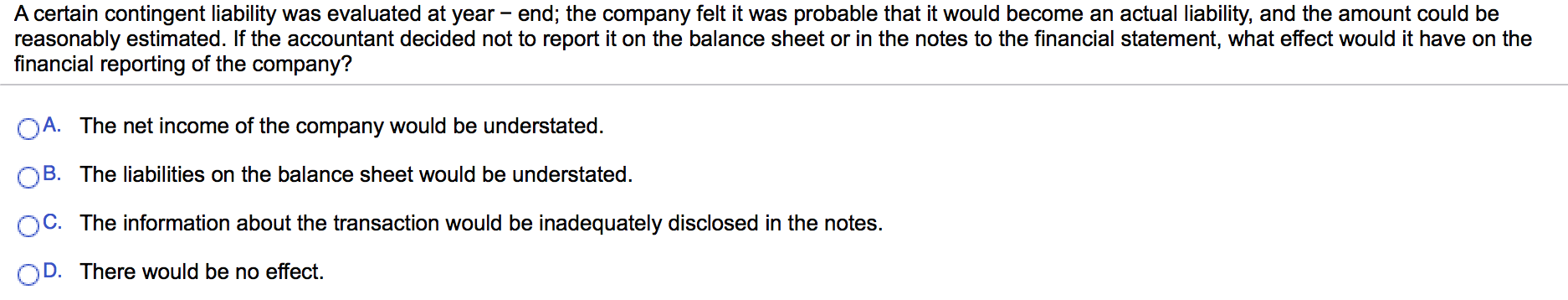

Which of the following is a characteristic of a current liability? Unearned revenus relating to a one - year service contract are current liabilities until they are earned. A corporation sells $200,000(selling price) of goods and collects sales tax of 6%. What current liability does the sale create? Income taxes are withheld from each employee's paycheck. FUTA, Federal unemployment compensation tax, is paid by the employer only and is not deducted from an employee's gross pay. FUTA, Federal unemployment compensation tax, is paid by the employer only and is not deducted from an employee's gross pay. State unemployment compensation tax (SUTA), is not withheld from employees' gross earnings. Investors use the times - interest - earned ratio to evalute a company's ability to pay interest expense. Realton Electric (RE) owed Estimated Warranty payable of $1,300 at the end of 2013, During 2014, RE made sales of $120,000 and expects product Warranties to cost the company 2% of the sales. During 2014, RE paid $2,500 for warranties. What is RE's Estimated warranty payable at the end of 2014? A certain contingent liability was evaluted at year- end; the company felt it was probable that it would become an actual liability, and the amount could be reasonably estimated. if the accountant decided not to report it on the balance sheet or in the notes to the financial statement, what effect would it have on the financial reporting of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts