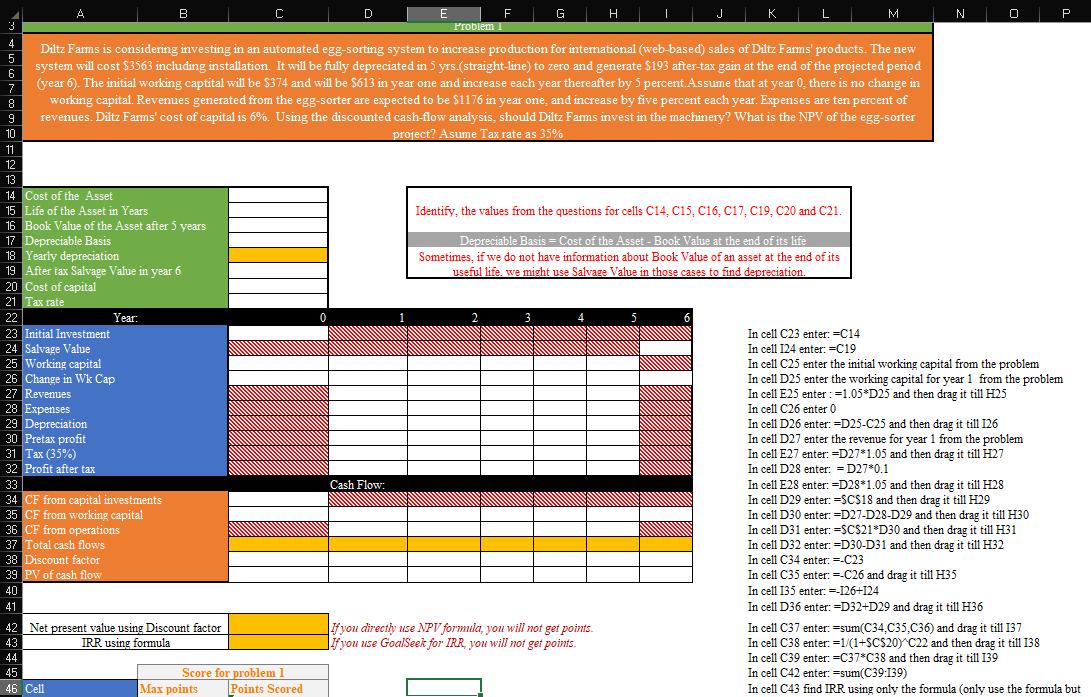

Question: 3 4 5 6 7 8 9 10 11 12 13 A 14 Cost of the Asset 15 Life of the Asset in Years

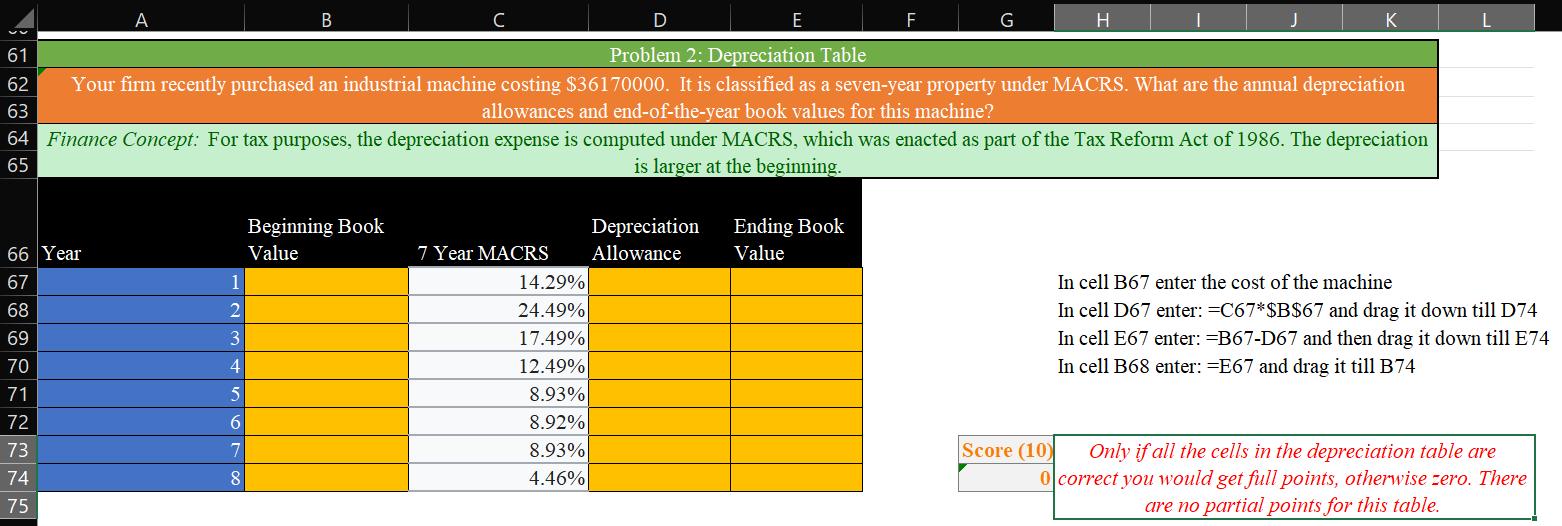

3 4 5 6 7 8 9 10 11 12 13 A 14 Cost of the Asset 15 Life of the Asset in Years 16 Book Value of the Asset after 5 years 17 Depreciable Basis 18 Yearly depreciation 19 After tax Salvage Value in year 6 20 Cost of capital 21 Tax rate 40 41 B 22 23 Initial Investment 24 Salvage Value 25 Working capital 26 Change in Wk Cap 27 Revenues 28 Expenses 29 Depreciation Year: 30 Pretax profit 31 Tax (35%) 32 Profit after tax 33 34 CF from capital investments 35 CF from working capital 36 CF from operations 37 Total cash flows 38 Discount factor 39 PV of cash flow 42 Net present value using Discount factor 43 IRR using formula 44 45 46 Cell C Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will cost $3563 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $193 after-tax gain at the end of the projected period (year 6). The initial working captital will be $374 and will be $613 in year one and increase each year thereafter by 5 percent. Assume that at year 0, there is no change in working capital. Revenues generated from the egg-sorter are expected to be $1176 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6%. Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? Asume Tax rate as 35% Score for problem 1 Max points Points Scored D 0 Cash Flow: E 1 F Problem 1 G 2 3 H Identify, the values from the questions for cells C14, C15, C16, C17, C19, C20 and C21. Depreciable Basis = Cost of the Asset - Book Value at the end of its life Sometimes, if we do not have information about Book Value of an asset at the end of its useful life, we might use Salvage Value in those cases to find depreciation. 4 If you directly use NPV formila, you will not get points. If you use GoalSeek for IRR, you will not get points. J 5 KL 6 M N 0 In cell C23 enter: -C14 In cell 124 enter: =C19 In cell C25 enter the initial working capital from the problem In cell D25 enter the working capital for year 1 from the problem In cell E25 enter :=1.05*D25 and then drag it till H25 In cell C26 enter 0 In cell D26 enter: =D25-C25 and then drag it till 126 In cell D27 enter the revenue for year 1 from the problem In cell E27 enter: =D27*1.05 and then drag it till H27 In cell D28 enter: = D27*0.1 In cell E28 enter: =D28*1.05 and then drag it till H28 In cell D29 enter: -SCS18 and then drag it till H29 | P In cell D30 enter: =D27-D28-D29 and then drag it till H30 In cell D31 enter: -SCS21*D30 and then drag it till H31 In cell D32 enter: =D30-D31 and then drag it till H32 In cell C34 enter: --C23 In cell C35 enter: --C26 and drag it till H35 In cell 135 enter: =-126+124 In cell D36 enter: =D32+D29 and drag it till H36 In cell C37 enter: -sum(C34,C35,C36) and drag it till 137 In cell C38 enter: =1/(1+SCS20) C22 and then drag it till 138 In cell C39 enter: -C37 C38 and then drag it till 139 In cell C42 enter: =sum(C39:139) In cell C43 find IRR using only the formula (only use the formula but D Problem 2: Depreciation Table 61 62 Your firm recently purchased an industrial machine costing $36170000. It is classified as a seven-year property under MACRS. What are the annual depreciation 63 allowances and end-of-the-year book values for this machine? 64 Finance Concept: For tax purposes, the depreciation expense is computed under MACRS, which was enacted as part of the Tax Reform Act of 1986. The depreciation is larger at the beginning. 65 888RFNMNN 66 Year 67 68 69 70 71 72 73 74 75 A 1 2 3 4 5 6 7 8 B Beginning Book Value C 7 Year MACRS 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Depreciation Allowance E Ending Book Value F G Score (10) H J L In cell B67 enter the cost of the machine In cell D67 enter: =C67*$B$67 and drag it down till D74 In cell E67 enter: B67-D67 and then drag it down till E74 In cell B68 enter: E67 and drag it till B74 Only if all the cells in the depreciation table are 0 correct you would get full points, otherwise zero. There are no partial points for this table.

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

To analyze the investment in the automated eggsorting system for Diltz Farms well perform a discounted cash flow analysis and calculate the net presen... View full answer

Get step-by-step solutions from verified subject matter experts