Question: Please try to create a two-branch binomial tree for a stock price. Assume a 1-year option expiry. Using a volatility of 25% What is

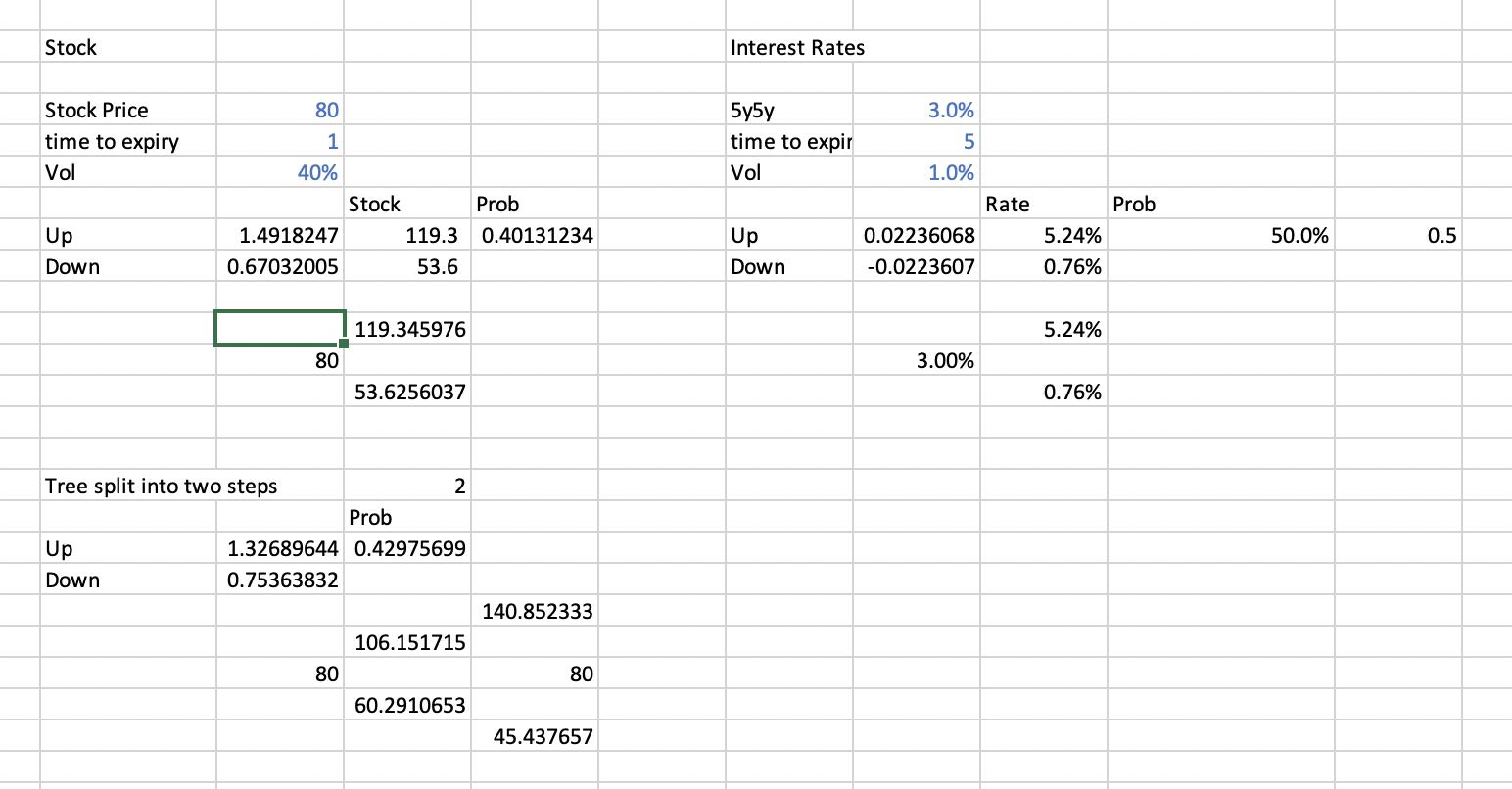

Please try to create a two-branch binomial tree for a stock price. Assume a 1-year option expiry. Using a volatility of 25% What is the probability up and down for each step? What are your up and down amounts? What would the price of a call option struck at 110% of the forward cost? (Hint: Recall risk neutral means you care only about expected payoffs. So just calculate a payoff and probability at the end of the tree.) Now let's make this a one-branch normal model (so two outcomes at the end). Suppose forward interest rates are 2% and volatility is 1%. Time is 1 year. What is the up move and down move? Is the probability of 1% higher, the same, or more than the probability of 3%? What is the value of a 2% floor (payoff = max(2% - rate, 0)? Stock Interest Rates Stock Price 80 5y5y time to expir 3.0% time to expiry 1 Vol 40% Vol 1.0% Stock Prob Rate Prob Up 1.4918247 119.3 0.40131234 Up 0.02236068 5.24% 50.0% 0.5 Down 0.67032005 53.6 Down -0.0223607 0.76% 119.345976 5.24% 80 3.00% 53.6256037 0.76% Tree split into two steps 2 Prob Up 1.32689644 0.42975699 Down 0.75363832 140.852333 106.151715 80 80 60.2910653 45.437657

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

n Near end poia year begining peireyeas begining peia Calculation 12 Annual rate of rtuun ... View full answer

Get step-by-step solutions from verified subject matter experts