Question: Accounting practice problem 1 Timberly Construction makes a lump sum purchase of several assets on January 1 at a total cash price of $840,000. The

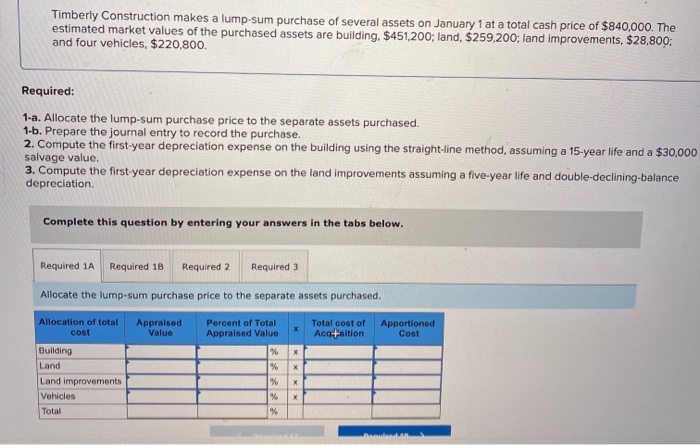

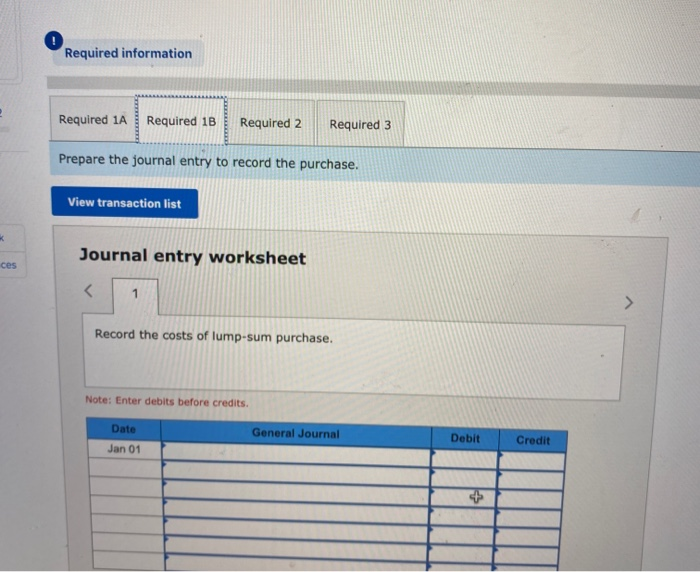

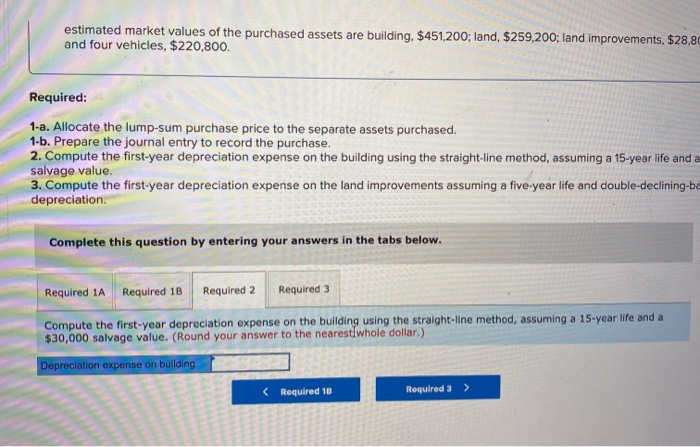

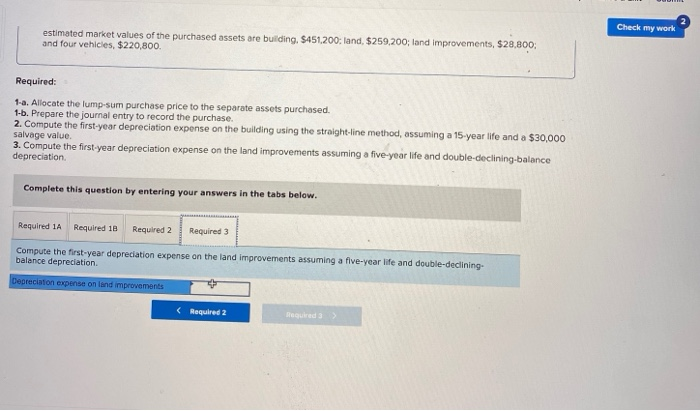

Timberly Construction makes a lump sum purchase of several assets on January 1 at a total cash price of $840,000. The estimated market values of the purchased assets are building, $451,200; land, $259,200; land improvements, $28,800: and four vehicles, $220,800. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 2 Required 3 Allocate the lump sum purchase price to the separate assets purchased. Allocation of total cost Appraised Value Percent of Total Appraised Value Total cost of Acq+sition Apportioned Cost Building Land Land improvements Vehicles Total Required information Required 1A Required 1B Required 2 Required 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet ces Record the costs of lump-sum purchase. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 estimated market values of the purchased assets are building, $451,200, land, $259,200; land improvements, $28,80 and four vehicles, $220,800. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-ba depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. (Round your answer to the nearest whole dollar.) Depreciation expense on building Check my work estimated market values of the purchased assets are building. $451.200: land, $259,200, land improvements, $28.800, and four vehicles, $220,800 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Compute the first year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation. Depreciation expense on land improvements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts