Question: Accounting Principles - Exercises Part A On June 1,2013 AEC Company paid $30,000 for 1,000 common shares and later that same year received a 10

Accounting Principles - Exercises

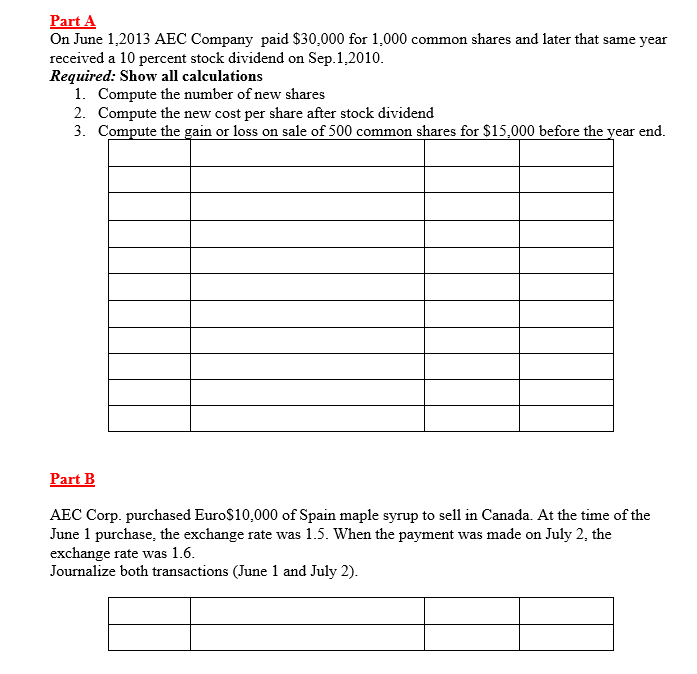

Part A On June 1,2013 AEC Company paid $30,000 for 1,000 common shares and later that same year received a 10 percent stock dividend on Sep.1,2010. Required: Show all calculations 1. Compute the number of new shares 2. Compute the new cost per share after stock dividend 3. Compute the gain or loss on sale of 500 common shares for $15,000 before the year end. Part B AEC Corp. purchased Euro$10,000 of Spain maple syrup to sell in Canada. At the time of the June 1 purchase, the exchange rate was 1.5. When the payment was made on July 2, the exchange rate was 1.6. Journalize both transactions (June 1 and July 2)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock