Question: Accounting problem - Based on my answers below please answer the What-If? section (it is attached underneath my answers) Thanks Exercise 2-12 Allocating Manufacturing Overhead

Accounting problem - Based on my answers below please answer the "What-If?" section (it is attached underneath my answers) Thanks

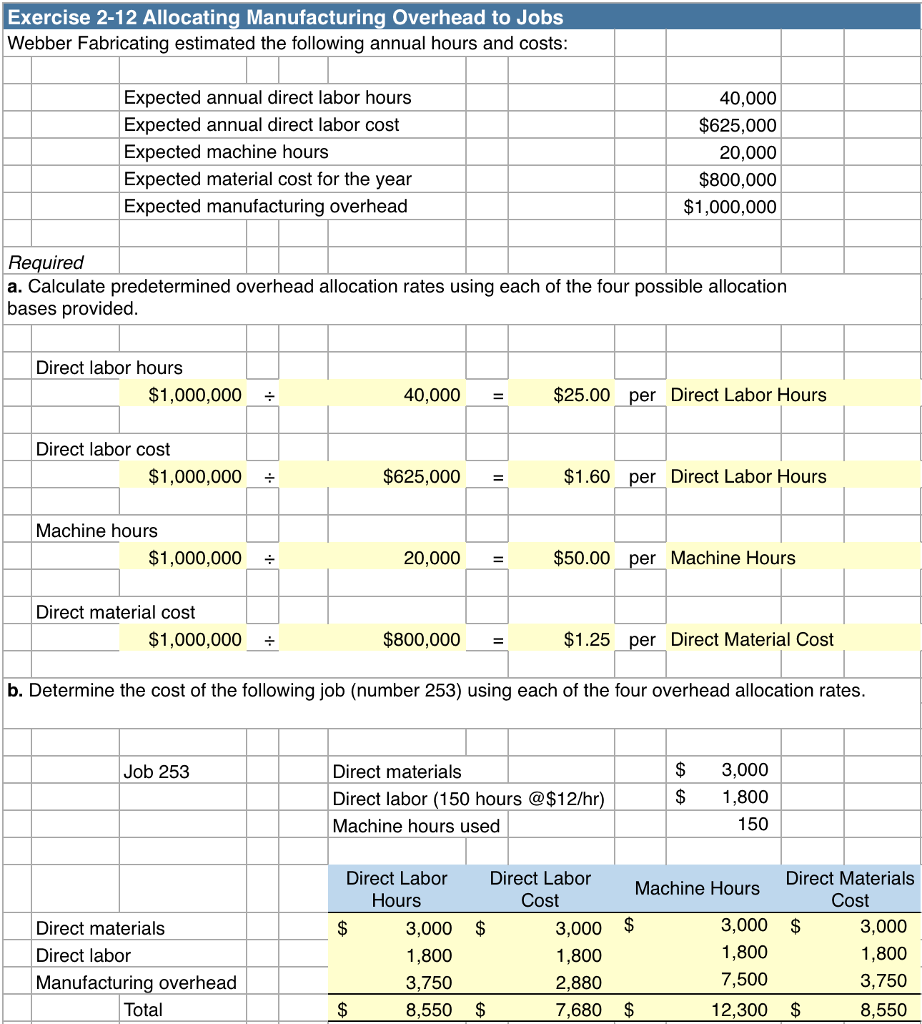

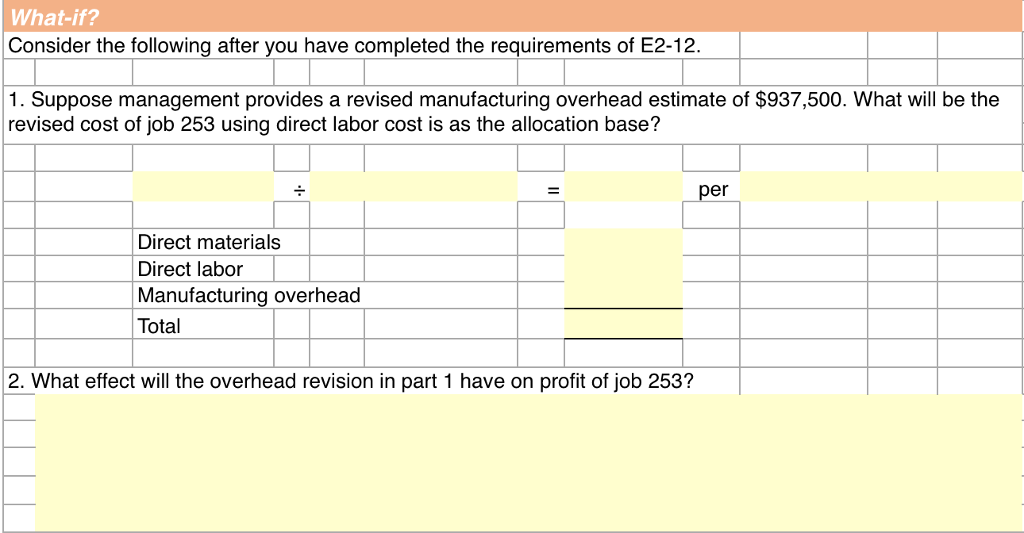

Exercise 2-12 Allocating Manufacturing Overhead to Jobs Webber Fabricating estimated the following annual hours and costs Expected annual direct labor hours Expected annual direct labor cost Expected machine hours Expected material cost for the year Expected manufacturing overhead 40,000 $625,000 20,000 $800,000 $1,000,000 Required a. Calculate predetermined overhead allocation rates using each of the four possible allocation bases provided Direct labor hours $1,000,000+ 40,000 - $25.00 per Direct Labor Hours Direct labor cost $1,000,000 - $625,000- $1.60 per Direct Labor Hours Machine hours $1,000,000 + 20,000 $50.00 per Machine Hours Direct material cost $1,000,000 - $800,000 $1.25 per Direct Material Cost b. Determine the cost of the following job (number 253) using each of the four overhead allocation rates $ 3,000 $ 1,800 150 Job 253 Direct materials Direct labor (150 hours @$12/hr Machine hours used Direct LaborDirect Labor Direct Materials Machine Hours Hours Cost Cost Direct materials Direct labor Manufacturing overhead 3,000 1,800 3,750 8,550 $ 3,000 $ 1,800 2,880 7,680 $ 3,000 $ 1,800 7,500 3,000 1,800 3,750 8,550 Total 12,300 $ Answer - this -part What-if? Consider the following after you have completed the requirements of E2-12. 1. Suppose management provides a revised manufacturing overhead estimate of $937,500. What will be the revised cost of job 253 using direct labor cost is as the allocation base? er Direct materials Direct labor Manufacturing overhead Total 2. What effect will the overhead revision in part 1 have on profit of job 253

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts