Question: Accounting Problem (Simple) Instructions Refer to Question 8 Background.png , Use that information to complete the Journal Entries in Question 8.png. Use the List of

Accounting Problem (Simple)

Instructions

Refer to Question 8 Background.png, Use that information to complete the Journal Entries in Question 8.png. Use the List of Accounts Below.

List of Accounts

- Accounts Payable

- Accounts Receivable

- Accumulated Amortization - Copyrights

- Accumulated Amortization - Customer List

- Accumulated Amortization - Development Costs

- Accumulated Amortization - Franchises

- Accumulated Amortization - Licenses

- Accumulated Amortization - Patents

- Accumulated Amortization - Software

- Accumulated Amortization - Trademarks

- Accumulated Depreciation

- Accumulated Impairment Losses - Copyrights

- Accumulated Impairment Losses - Goodwill

- Accumulated Impairment Losses - Licences

- Accumulated Impairment Losses - Patents

- Accumulated Impairment Losses - Trademark

- Administrative Expenses

- Advances to Employees

- Advertising Expense

- Allowance for Doubtful Accounts

- Amortization Expense

- Bad Debt Expense

- Bank Loans

- Buildings

- Cash

- Common Shares

- Cost of Goods Sold

- Delivery Expense

- Depreciation Expense

- Equipment

- FV - NI Investments

- Gain on Disposal of Intangible Assets

- Gain on Sale of Equipment

- Gain on Sale of Land

- Goodwill

- Income Summary

- Intangible Assets - Copyrights

- Intangible Assets - Customer List

- Intangible Assets - Customer List

- Intangible Assets - Development Costs

- Intangible Assets - Franchises

- Intangible Assets - Patents

- Intangible Assets - Software

- Intangible Assets - Software (New)

- Intangible Assets - Software (Old)

- Intangible Assets - Trade Names

- Intangible Assets - Trademarks

- Interest Expense

- Interest Income

- Interest Receivable

- Inventory

- Land

- Leasehold Improvements

- Licenses

- Licensing Agreement

- Loss on Disposal of Copyright

- Loss on Disposal of Intangible Assets

- Loss on Disposal of Software

- Loss on Impairment

- Machinery

- Maintenance and Repairs Expense

- Miscellaneous Expense

- No Entry

- Notes Payable

- Notes Receivable

- Office Expense

- Prepaid Expenses

- Prepaid Rent

- Recovery of Loss from Impairment

- Rent Expense

- Research and Development Expense

- Retained Earnings

- Revaluation Gain or Loss

- Revaluation Surplus

- Revaluation Surplus (OCI)

- Royalty Expense

- Sales Revenue

- Selling Expenses

- Service Revenue

- Servicing Liability

- Sick Pay Wages Payable

- Supplies

- Supplies Expense

- Unearned Revenue

Background

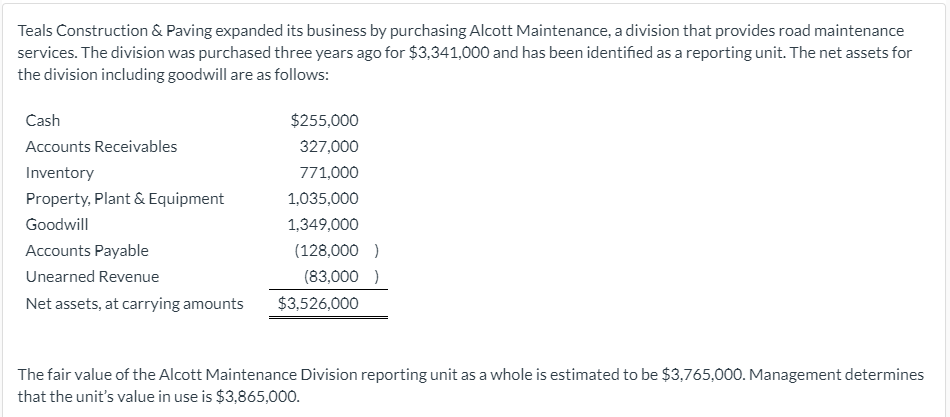

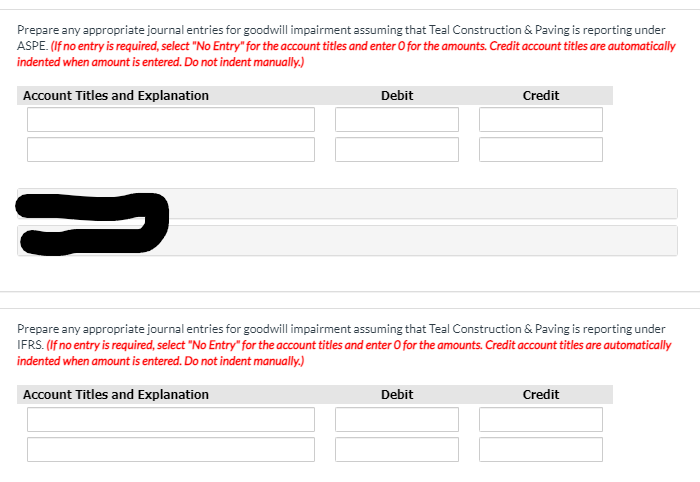

Teals Construction & Paving expanded its business by purchasing Alcott Maintenance, a division that provides road maintenance services. The division was purchased three years ago for $3,341,000 and has been identified as a reporting unit. The net assets for the division including goodwill are as follows: Cash $255,000 Accounts Receivables 327,000 Inventory 771,000 Property, Plant & Equipment 1,035,000 Goodwill 1,349,000 Accounts Payable (128,000 ) Unearned Revenue (83,000 Net assets, at carrying amounts $3,526,000 The fair value of the Alcott Maintenance Division reporting unit as a whole is estimated to be $3,765,000. Management determines that the unit's value in use is $3,865,000.Prepare any appropriate journal entries for goodwill impairment assuming that Teal Construction & Paving is reporting under ASPE. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Prepare any appropriate journal entries for goodwill impairment assuming that Teal Construction & Paving is reporting under IFRS. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts