On December 31, the capital balances and profit and loss ratios in the MRS Partnership are...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

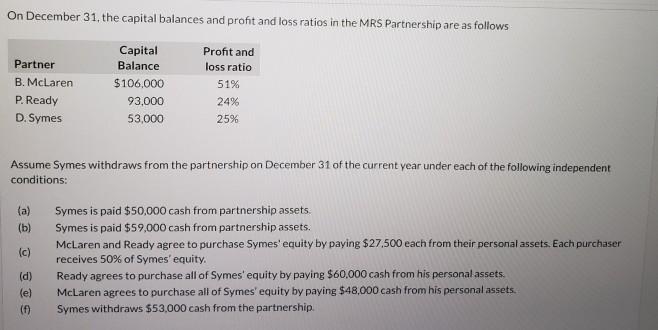

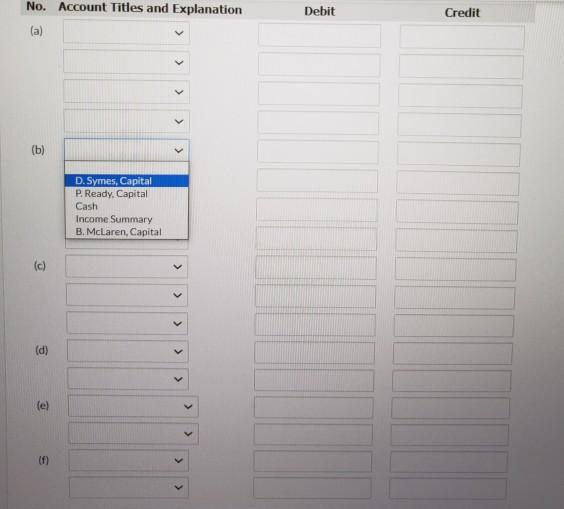

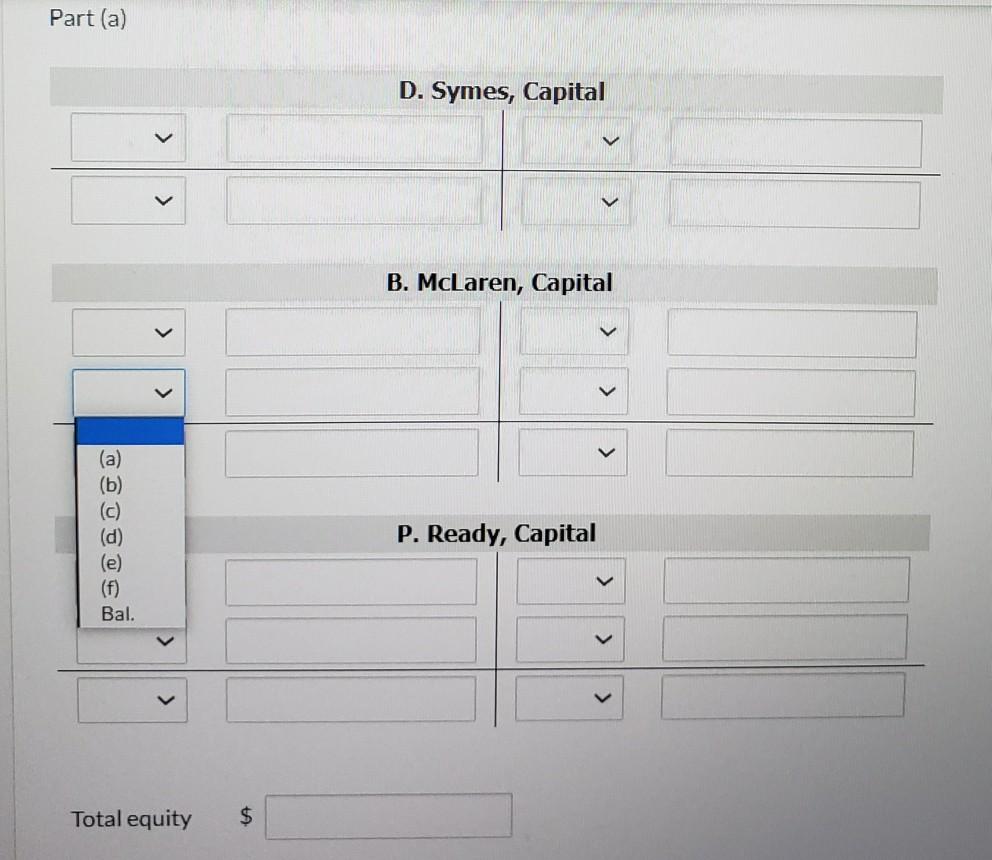

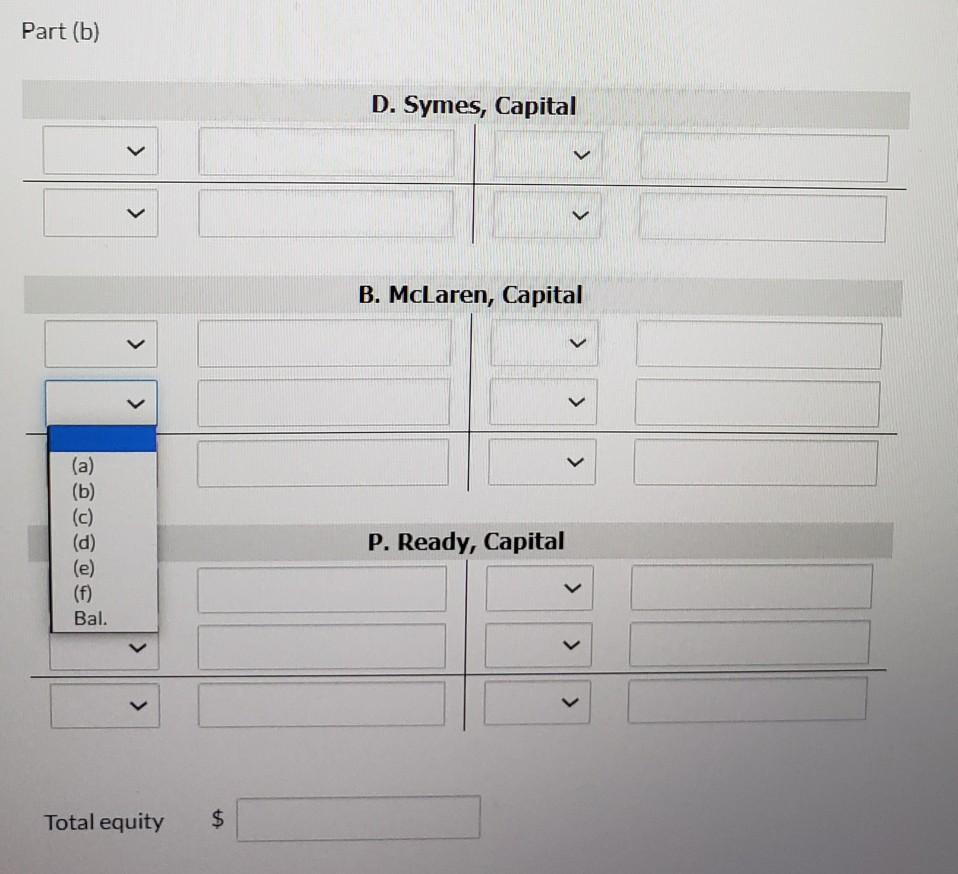

On December 31, the capital balances and profit and loss ratios in the MRS Partnership are as follows Capital Profit and Partner Balance loss ratio B. McLaren $106,000 51% P. Ready 93,000 24% D. Symes 53,000 25% Assume Symes withdraws from the partnership on December 31 of the current year under each of the following independent conditions: Symes is paid $50,000 cash from partnership assets. Symes is paid $59,000 cash from partnership assets. McLaren and Ready agree to purchase Symes' equity by paying $27,500 each from their personal assets. Each purchaser receives 50% of Symes' equity. (a) (b) (c) Ready agrees to purchase all of Symes' equity by paying $60.000 cash from his personal assets. McLaren agrees to purchase all of Symes' equity by paying $48,000 cash from his personal assets. Symes withdraws $53,000 cash from the partnership. (d) (e) (f) No. Account Titles and Explanation Debit Credit (a) (b) D. Symes, Capital P. Ready, Capital Cash Income Summary B. McLaren, Capital (c) (d) (e) (f) > > > > > > > Part (a) D. Symes, Capital B. McLaren, Capital (a) (b) (c) (d) (e) (f) P. Ready, Capital Bal. Total equity %24 > > > Part (b) D. Symes, Capital B. McLaren, Capital (a) (b) P. Ready, Capital (d) (e) (f) Bal. Total equity <> > > %24 <> On December 31, the capital balances and profit and loss ratios in the MRS Partnership are as follows Capital Profit and Partner Balance loss ratio B. McLaren $106,000 51% P. Ready 93,000 24% D. Symes 53,000 25% Assume Symes withdraws from the partnership on December 31 of the current year under each of the following independent conditions: Symes is paid $50,000 cash from partnership assets. Symes is paid $59,000 cash from partnership assets. McLaren and Ready agree to purchase Symes' equity by paying $27,500 each from their personal assets. Each purchaser receives 50% of Symes' equity. (a) (b) (c) Ready agrees to purchase all of Symes' equity by paying $60.000 cash from his personal assets. McLaren agrees to purchase all of Symes' equity by paying $48,000 cash from his personal assets. Symes withdraws $53,000 cash from the partnership. (d) (e) (f) No. Account Titles and Explanation Debit Credit (a) (b) D. Symes, Capital P. Ready, Capital Cash Income Summary B. McLaren, Capital (c) (d) (e) (f) > > > > > > > Part (a) D. Symes, Capital B. McLaren, Capital (a) (b) (c) (d) (e) (f) P. Ready, Capital Bal. Total equity %24 > > > Part (b) D. Symes, Capital B. McLaren, Capital (a) (b) P. Ready, Capital (d) (e) (f) Bal. Total equity <> > > %24 <>

Expert Answer:

Answer rating: 100% (QA)

MRS Partnership Journal Enteries Part a Trans Particulars Debit in Credit in DSymes Capital a Symes ... View the full answer

Related Book For

Accounting Principles

ISBN: 978-1119048473

7th Canadian Edition Volume 2

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Posted Date:

Students also viewed these accounting questions

-

On December 31, the capital balances and profit and loss ratios in the VKD Company are as follows: Partner Capital Balance Profit and Loss Ratio B....

-

On December 31, the capital balances and profit and loss ratios in FJA Company are as follows: Antoni is withdrawing from the partnership. Instructions Journalize the withdrawal of Antoni under each...

-

On December 31, the capital balances and profit and loss ratios in VKD Company are as follows: Instructions Journalize the withdrawal of Dixon under each of the following independent assumptions: (a)...

-

What (if anything) is wrong with each of the following statements? a. if (a > b) then c = 0; b. if a > b { c = 0; } c. if (a > b) c = 0; d. if (a > b) c = 0 else b = 0;

-

City Cab, Inc., uses two dispatchers to handle requests for service and to dispatch the cabs. The telephone calls that are made to City Cab use a common telephone number. When both dispatchers are...

-

What is a C-style string?

-

Evaluate the use that cash-basis IPSAS can have in promoting the adoption of full accrual accounting.

-

The lease of Theme Park, Inc., is about to expire. Management must decide whether to renew the lease for another 10 years or to relocate near the site of a proposed motel. The town planning board is...

-

During July of the current year, the management of Geniune Herb INC, asked the controller to prepare August manufacturing and income statement budgets. Demand was expected to be less 1,500 cases at...

-

Tom Scott is the owner, president, and primary salesperson for Scott Manufacturing. Because of this, the companys profits are driven by the amount of work Tom does. If he works 40 hours each week,...

-

Please use T accounts. Case 4-2 Save-Mart* Save-Mart was a retail store. Its account balances on February 28 (the end of its fiscal year), before adjust- ments, were as shown below. Credit Balances...

-

Gulf Shore Lawn and Garden Maintenance provides two general outdoor services: lawn maintenance and garden maintenance. The company charges customers $18.0 per hour for each type of service, but lawn...

-

Two level sections of an east highway (G=0) are to be connected. Currently, the two sections of highway are seperated by a 4000-ft (horizontal distance), 2% grade. The westernmost section of highway...

-

A solution contains 2 x 10-3 moles Ca2+/L and 3 x 10-4 moles Mg2+/L. Given the formation constants for CaEDTA2- and MgEDTA2- of 1010.6 and 108.7, respecively, calculate: 1) Concentration of MgEDTA2-...

-

The direct material (DM) price variance is $2,650 favorable and the DM usage variance is $3,000 unfavorable. The budgeted amount of DM for each unit of product is 2 lbs. to be purchased at the...

-

On January 1, 2023, AMI Corporation purchased the non-cash net assets of Oriole Ltd. for $8,399,900. Following is the statement of financial position of Oriole Ltd. from the company's year- end the...

-

The Nitrogen Fixation Department of Tomco Company began the month of December with beginning work in process of 4,000 units that are 100% complete as to materials and 30% complete as to conversion...

-

According to a New York Times columnist, The estate tax affects a surprisingly small number of people. In 2003, . . . just 1.25 percent of all deaths resulted in taxable estates, with most of them...

-

Royal Bank of Canada is one of the largest banks in Canada. According to its 2014 annual report, it had approximately 78,000 employees serving 16 million customers throughout the world. The bank's...

-

Selected financial data for Shumway Ltd. are shown below. Instructions (a) Calculate for each of 2017 and 2016 the following ratios: 1. Receivables turnover 2. Collection period 3. Inventory turnover...

-

Refer to the information presented for King Corp. in P17-7B. Additional information: 1. Net sales for the year were $927,250. 2. Cost of goods sold for the year was $552,750. 3. Operating expenses,...

-

What is the present value annuity factor of $1.00 at a discount rate of 10% for 15 years? a. 5.0 b. 7.6 c. 10.0 d. 13.9

-

Donald has $100 today. He is aware of TWO investment opportunities: (a) invest $50 and expect to receive $55 in one years time, or (b) invest $100 today and expect to receive $120 in one years time....

-

What quarterly payment is necessary to accumulate $3.75 million over 20 years if the annual interest rate is 4% compounded quarterly? Assume payments are made at the end of each quarter. a. $733.0 b....

Study smarter with the SolutionInn App