Question: Strawberry Ltd, a reporting entity, acquired a 40% interest in the issued capital of Cream Ltd for $220.000 on 1 July 2019. Strawberry Ltd

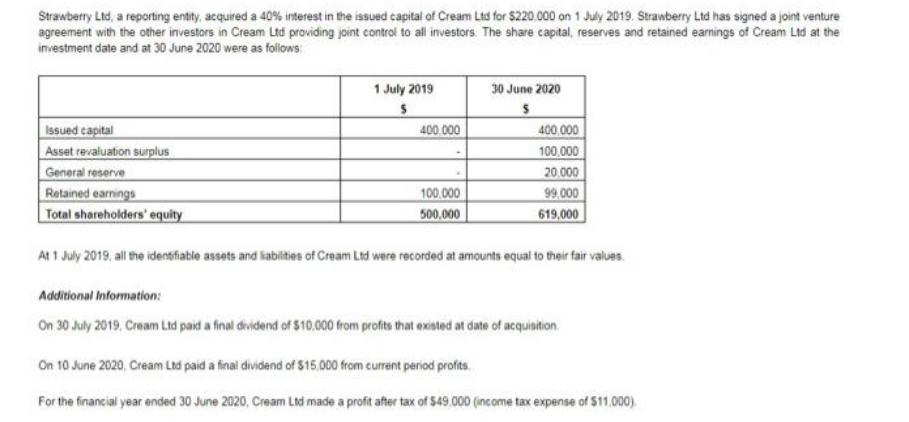

Strawberry Ltd, a reporting entity, acquired a 40% interest in the issued capital of Cream Ltd for $220.000 on 1 July 2019. Strawberry Ltd has signed a joint venture agreement with the other investors in Cream Ltd providing joint control to all investors. The share capital, reserves and retained earnings of Cream Ltd at the investment date and at 30 June 2020 were as follows: 1 July 2019 30 June 2020 Issued capital Asset revaluation surplus General reserve Retained earnings Total shareholders' equity 400.000 400,000 100.000 20.000 99.000 100.000 500.000 619,000 At 1 July 2019, all the identifiable assets and labities of Cream Ltd were recorded at amounts equal to their fair values. Additional Information: On 30 July 2019. Cream Ltd paid a final dividend of $10,000 from profts that existed at date of acquisition. On 10 June 2020, Cream Ltd paid a final dividend of $15.000 from current period profits. For the financial year ended 30 June 2020, Cream Ltd made a profit after tax of $49,000 (income tax expense of $11,000). Increases in Cream Ltd reserves reported during the year were as follows: General (transferred from retained earnings): 520,000 Asset revaluation (revaluation of freehold land and buildings at 30 June 2020): $100.000 Strawbery Ltd does not prepare consolidated financial statements The corporate tax rate is 30%. Required: In accordance with the requirements of AASB 128 linvestment in Associates and Joint Ventures prepare the journal entries required by Strawberry Ltd relating to its investment in Cream Ltd for 30 June 2020. ALL workings MUST be shown for ALL journal entries. Additional journal entries will atract negative marks.

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts