Question: Accounting Question 3.1 Part 1: Part 2: Part 3: Answer the all of the parts correctly for a Like! Current Attempt in Progress Crede Inc.

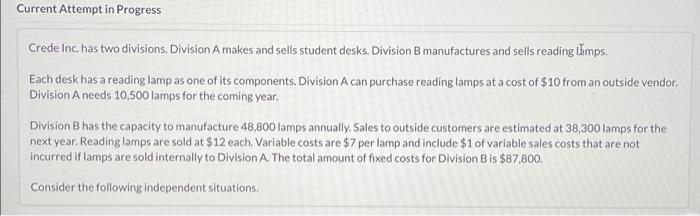

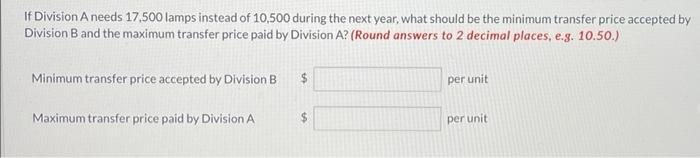

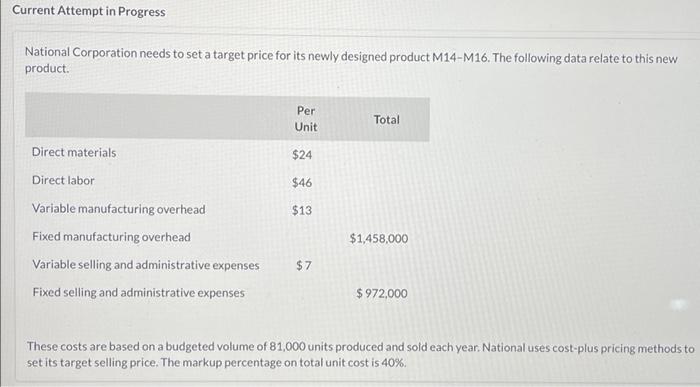

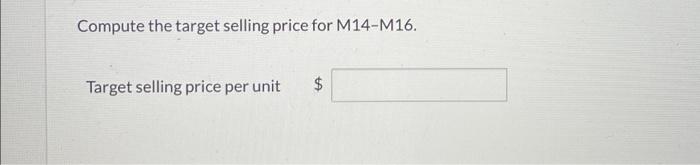

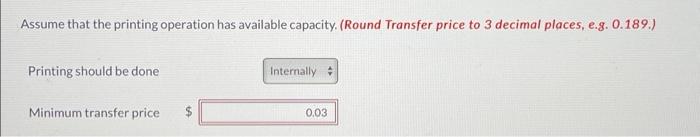

Current Attempt in Progress Crede Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading Limps. Each desk has a reading lamp as one of its components. Division A can purchase reading lamps at a cost of $10 from an outside vendor. Division A needs 10,500 lamps for the coming year. Division B has the capacity to manufacture 48,800 lamps annually. Sales to outside customers are estimated at 38,300 lamps for the next year. Reading lamps are sold at $12 each. Variable costs are $7 per lamp and include $1 of variable sales costs that are not incurred if lamps are sold internally to Division A The total amount of fixed costs for Division Bis $87,800. Consider the following independent situations. If Division A needs 17,500 lamps instead of 10,500 during the next year, what should be the minimum transfer price accepted by Division B and the maximum transfer price paid by Division A? (Round answers to 2 decimal places, e.g. 10.50.) Minimum transfer price accepted by Division B $ per unit Maximum transfer price paid by Division A $ per unit Current Attempt in Progress National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product Per Unit Total $24 $46 $13 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $1,458,000 $7 $ 972,000 These costs are based on a budgeted volume of 81,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the target selling price for M14-M16. Target selling price per unit $ Current Attempt in Progress Word Wizard is a publishing company with a number of different book lines. Each line has contracts with a number of different authors. The company also owns a printing operation called Quick Press. The book lines and the printing operation each operate as a separate profit center. The printing operation earns revenue by printing books by authors under contract with the book lines owned by Word Wizard, as well as authors under contract with other companies. The printing operation bills out at $0.01 per page, and a typical book requires 410 pages of print. A manager from Business Books, one of Word Wizard's book lines, has approached the manager of the printing operation offering to pay $0.007 per page for 1,500 copies of a 410-page book. The book line pays outside printers $0.008 per page. The printing operation's variable cost per page is $0.004. Determine whether the printing should be done internally or externally, and the appropriate transfer price, under each of the following situations Assume that the printing operation has available capacity. (Round Transfer price to 3 decimal places, e.g. 0.189.) Printing should be done Internally Minimum transfer price 0.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts