Question: ACCOUNTING QUESTION QUESTION 5 A. Gerak Bermula Sdn Bhd is preparing its budget for April 2021 and the following information is provided: 1. The cash

ACCOUNTING QUESTION

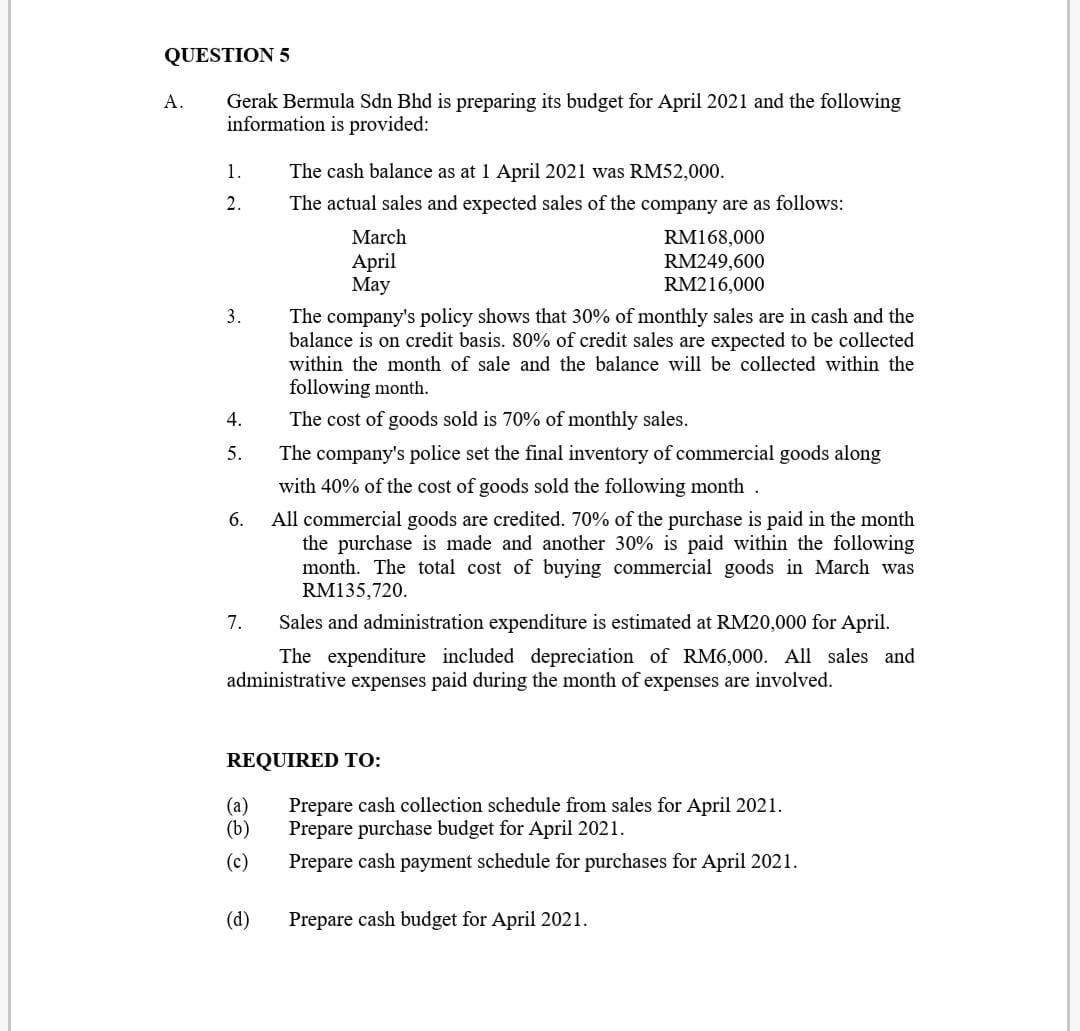

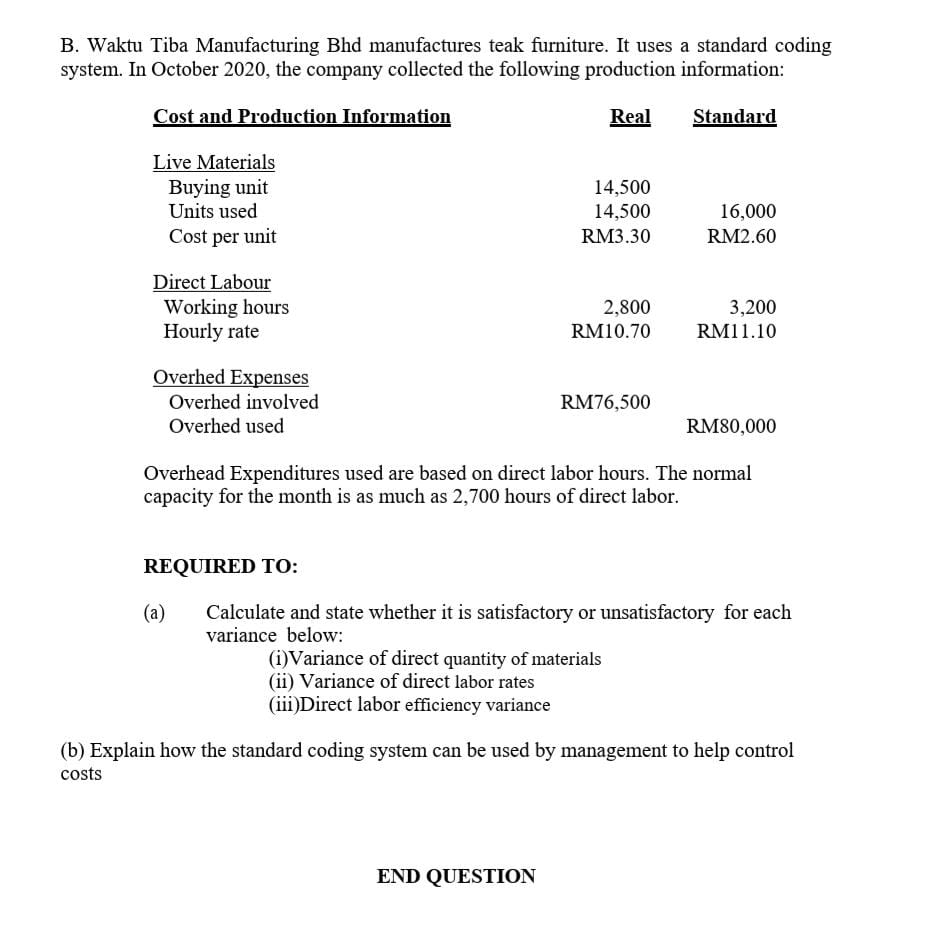

QUESTION 5 A. Gerak Bermula Sdn Bhd is preparing its budget for April 2021 and the following information is provided: 1. The cash balance as at 1 April 2021 was RM52,000. 2. The actual sales and expected sales of the company are as follows: March RMl 68,000 April RM249,600 May RM2 16,000 3. The company's policy shows that 30% of monthly sales are in cash and the balance is on credit basis. 80% of credit sales are expected to be collected within the month of sale and the balance will be collected within the following month. 4. The cost of goods sold is 10% of monthly sales. 5. The company's police set the nal inventory of commercial goods along with 40% of the cost of goods sold the following month . 6. All commercial goods are credited. 70% of the purchase is paid in the month the purchase is made and another 30% is paid within the following month. The total cost of buying commercial goods in March was RM135,720. 7. Sales and administration expenditure is estimated at RM20,000 for April. The expenditure included depreciation of RM6,000. All sales and administrative expenses paid during the month of expenses are involved. REQUIRED TO: (a) Prepare cash collection schedule from sales for April 2021. (b) Prepare purchase budget for April 2021. (c) Prepare cash payment schedule for purchases for April 2021. ((1) Prepare cash budget for April 202 l. B. Waktu Tiba Manufacturing Bhd manufactures teak furniture. It uses a standard coding system. In October 2020, the company collected the following production information: Cost and Production Information Real Standard Live Materials Buying unit 14,500 Units used 14,500 16,000 Cost per unit RM3.30 RM2.60 Direct Labour Working hours 2,800 3,200 Hourly rate RM10.70 RM1 1.10 Overhed Expenses Overhed involved RM76,500 Overhed used RM80,000 Overhead Expenditures used are based on direct labor hours. The normal capacity for the month is as much as 2,700 hours of direct labor. REQUIRED TO: (a) Calculate and state whether it is satisfactory or unsatisfactory for each variance below: (i) Variance of direct quantity of materials (ii) Variance of direct labor rates (iii)Direct labor efficiency variance (b) Explain how the standard coding system can be used by management to help control costs END

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts