Question: Accounting questions B. Net Present Value Method C. Internal Rate of Return Method D. None of the above. All of these methods consider the use

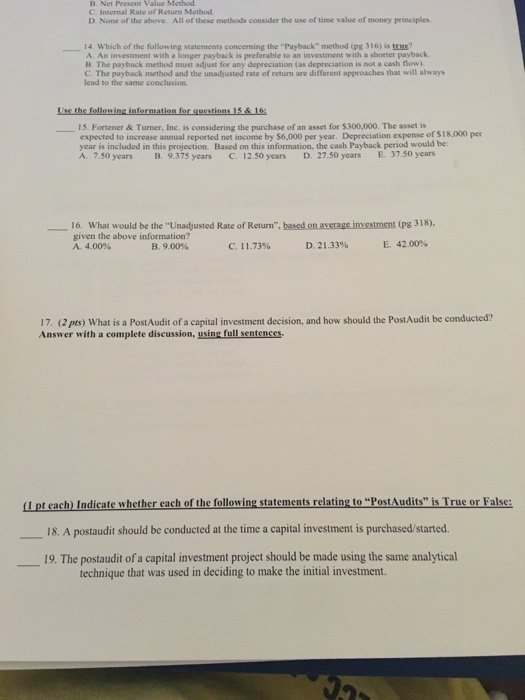

B. Net Present Value Method C. Internal Rate of Return Method D. None of the above. All of these methods consider the use of time value of money principles -14. Which of the following statements concerning the "Payback" method (pg 316) is trus? A. An investment with a longer payback is preferable to an investment with a shorter payback B. The payback method must adjust for any depreciation (as depreciation is not a cash flow C. The payback method and the unadjusted rate of return are different approaches that will always lead to the same conclusion 15. Fortener & Turner, Inc. is considering the purchase of an asset for S300.000. The asset is expected to increase annual reported net income by $6,000 per year. Depreciation expense of S18,000 per year is included in this projection. Based on this information, the cash Payback period would be: A. 7.50 years B. 9.375 years C. 12.50 years D. 27.50 years E. 37.50 years 16. What would be the "Unadjusted Rate of Return", based on average investment (pg 318) given the above information? A. 4.00% B. 9.00% C. 11.73% D. 21.33% E. 42.000% 17. (2 pts) What is a PostAudit of a capital investment decision, and how should the PostAudit be conducted? Answer with a complete discussion, using full sentences L pt each) Indicate whether each of the following statements relating to "PostAudits" is True or False: 18. A postaudit should be conducted at the time a capital investment is purchased started. 19. The postaudit of a capital investment project should be made using the same analytical technique that was used in deciding to make the initial investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts