Question: Accounting Review Problems - Part 2 A company has current assets of $ 4 , 2 0 0 , net fixed assets $ 6 ,

Accounting Review Problems Part

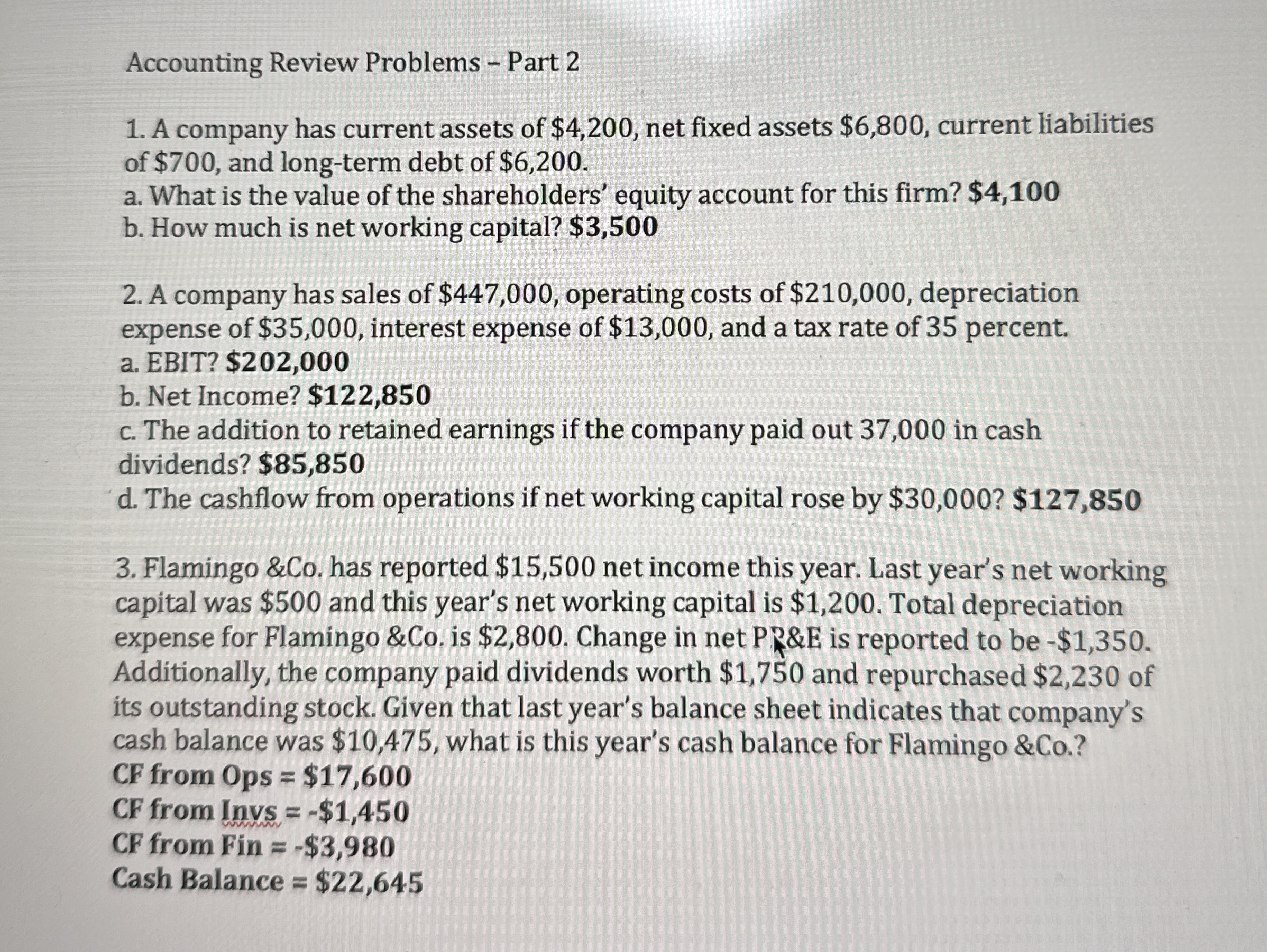

A company has current assets of $ net fixed assets $ current liabilities of $ and longterm debt of $

a What is the value of the shareholders' equity account for this firm? $

b How much is net working capital? $

A company has sales of $ operating costs of $ depreciation expense of $ interest expense of $ and a tax rate of percent.

a EBIT? $

b Net Income? $

c The addition to retained earnings if the company paid out in cash dividends? $

d The cashflow from operations if net working capital rose by $ $

Flamingo &Co has reported $ net income this year. Last year's net working capital was $ and this year's net working capital is $ Total depreciation expense for Flamingo &Co is $ Change in net P&E is reported to be $ Additionally, the company paid dividends worth $ and repurchased $ of its outstanding stock. Given that last year's balance sheet indicates that company's cash balance was $ what is this year's cash balance for Flamingo &Co

CF from ps $

CF from Invs $

CF from Fin $

Cash Balance $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock