Question: A hurricane has destroyed many of the records of the Georgia Company. For insurance re imbursement purposes, you have been asked to determine the

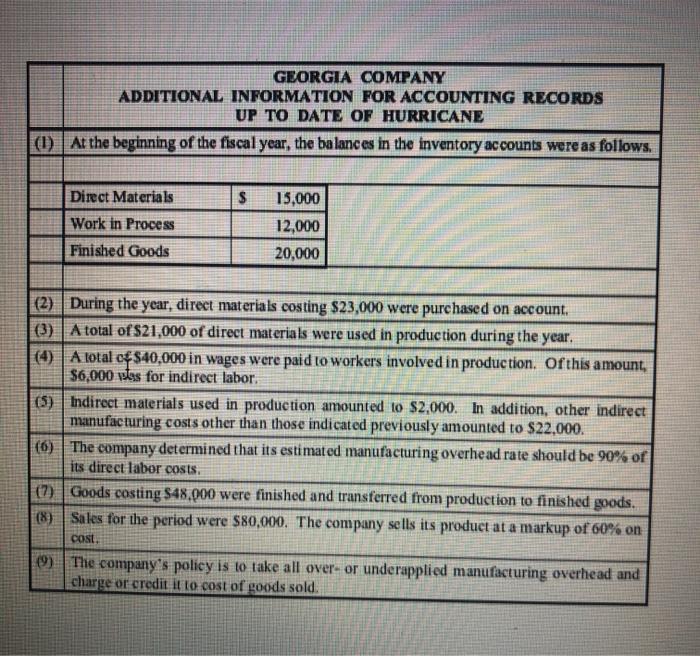

A hurricane has destroyed many of the records of the Georgia Company. For insurance re imbursement purposes, you have been asked to determine the cost of inventory destroyed by the huricane. The company uses a job order costing system. You have been able to obtain the attached information concerning the various inventory accounts for the current fiscal year up to the date of the hurricane. REQUIRED: ) Using T accounts, make all the required entries to the following accounts, using the above information: Direct Materials Inventory, Work in Process Inventory. Finished Goods Inventory, Cost of Goods Sold, and Manufacturing Overhead. Compute the ending balances in the three inventory accounts as of the date of the hurricane. (2) GEORGIA COMPANY ADDITIONAL INFORMATION FOR ACCOUNTING RECORDS UP TO DATE OF HURRICANE (1) At the beginning of the fiscal year, the balances in the inventory accounts were as follows. Direct Materials 15,000 Work in Proce ss 12,000 Finished Goods 20,000 |(2) During the year, direct materials costing $23,000 were purchased on account. |(3) A total of$21,000 of direct materials were used in production during the year. (4) A total of$40,000 in wages were paid to workers involved in production. Ofthis amount, $6,000 vlas for indirect labor. (5) Indirect materials used in production amounted to $2,000. In addition, other indirect manufacturing costs other than those indicated previously amounted to $22,000. (6) The company determined that its estimated manufacturing overhead rate should be 90% of its direct labor costs. (7) Goods costing $48,000 were finished and transferred from production to finished goods. (8) Sales for the period were S80,000. The company sells its product at a markup of 60% on Cost. (9) The company's policy is to take all over- or underapplied manufacturing overhead and charge or credit it to cost of goods sold.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

1 Material Inventory Account To Balance bd 15000 ac 21000 Work in Progress Inventory To Accounts pay... View full answer

Get step-by-step solutions from verified subject matter experts