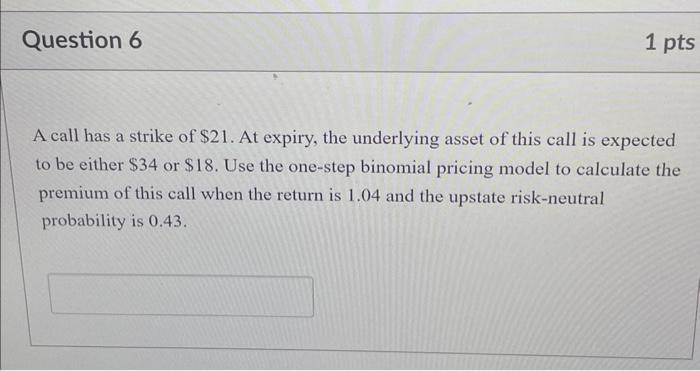

Question: Question 6 1 pts A call has a strike of $21. At expiry, the underlying asset of this call is expected to be either

Question 6 1 pts A call has a strike of $21. At expiry, the underlying asset of this call is expected to be either $34 or $18. Use the one-step binomial pricing model to calculate the premium of this call when the return is 1.04 and the upstate risk-neutral probability is 0.43.

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Question EXERCISE 54 Allocation of Cost and Workpaper Entries at Date of Acquisition LU 2 On Janua... View full answer

Get step-by-step solutions from verified subject matter experts