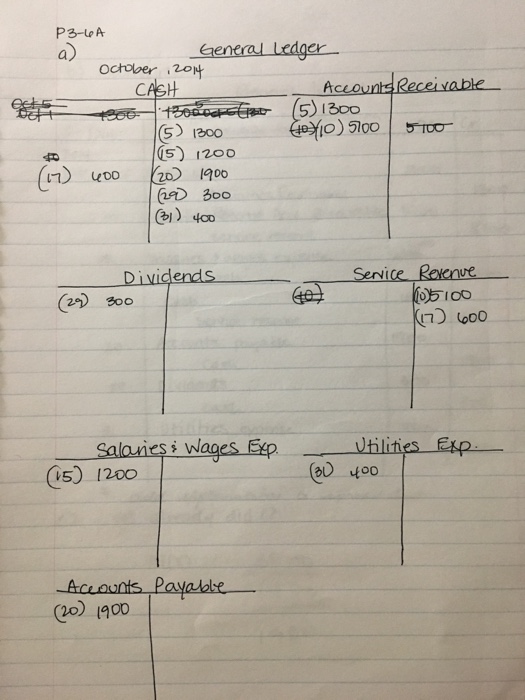

Question: accounting tools for business decision making 5e Chapter 3 P3-6A did I screw up my t-accounts? I have no confidence to post them to ledger

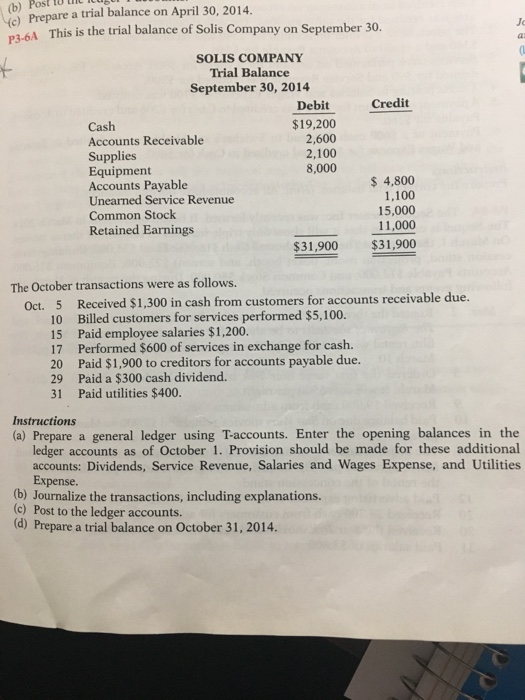

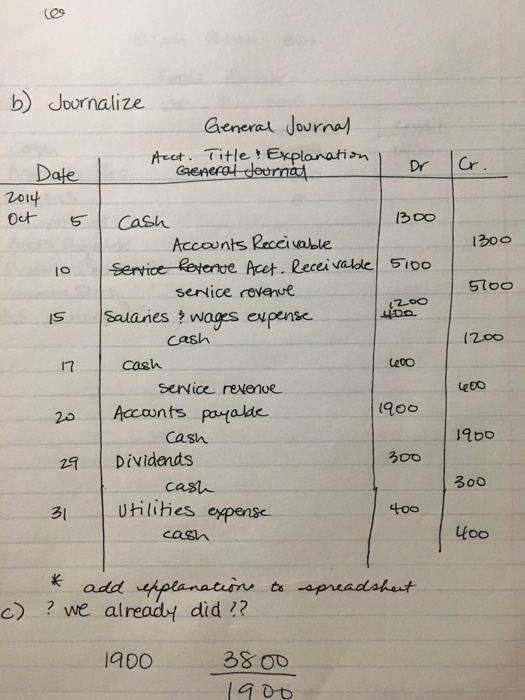

(b) Post to th iu ) Prepare a trial balance on April 30, 2014. P3-6A This is the trial balance of Solis Company on September 30. P. SOLIS COMPANY Trial Balance September 30, 2014 Debit Credit Cash Accounts Receivable Supplies Equipment Accounts Payable Unearned Service Revenue Common Stock Retained Earnings $19,200 2,600 2,100 8,000 $ 4,800 1,100 15,000 11,000 $31,900 $31,900 The October transactions were as follows. 5 10 15 17 20 29 31 Received $1,300 in cash from customers for accounts receivable due. Billed customers for services performed $5,100. Paid employee salaries $1,200. Performed $600 of services in exchange for cash. Paid $1,900 to creditors for accounts payable due. Paid a $300 cash dividend. Paid utilities $400. Oct. Instructions (a) Prepare a general ledger using Taccounts. Enter the opening balances in the ledger accounts as of October 1. Provision should be made for these additional accounts: Dividends, Service Revenue, Salaries and Wages Expense, and Utilities Expense. (b) Journalize the transactions, including explanations. (c) Post to the ledger accounts. (d) Prepare a trial balance on October 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts