Question: Use the FHA Maximum Loan Values by State table or the Monthly Payments (Principal and Interest) for Each $1000 Borrowed table. Calculator answers may

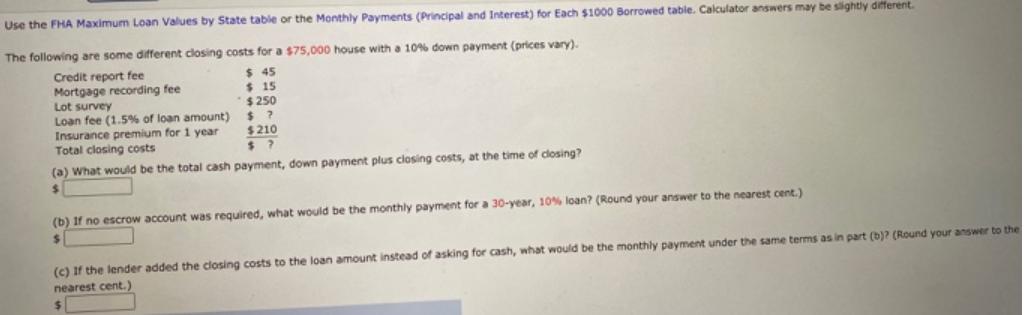

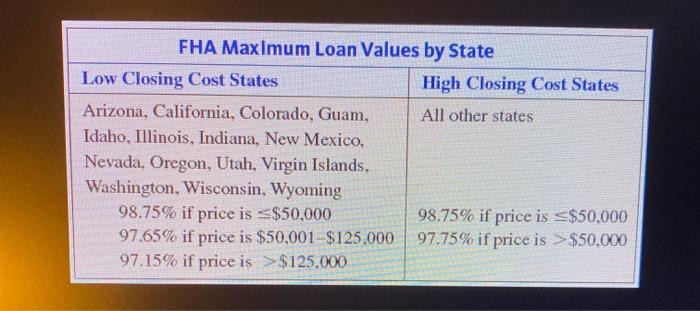

Use the FHA Maximum Loan Values by State table or the Monthly Payments (Principal and Interest) for Each $1000 Borrowed table. Calculator answers may be slightly different. The following are some different closing costs for a $75,000 house with a 10% down payment (prices vary). $ 45 $ 15 $250 $? $210 $7 Credit report fee Mortgage recording fee Lot survey Loan fee (1.5% of loan amount) Insurance premium for 1 year Total closing costs (a) What would be the total cash payment, down payment plus closing costs, at the time of closing? $ (b) If no escrow account was required, what would be the monthly payment for a 30-year, 10% loan? (Round your answer to the nearest cent.) $ (c) If the lender added the closing costs to the loan amount instead of asking for cash, what would be the monthly payment under the same terms as in part (b)? (Round your answer to the nearest cent.) $ FHA Maximum Loan Values by State Low Closing Cost States Arizona, California, Colorado, Guam, Idaho, Illinois, Indiana, New Mexico, Nevada, Oregon, Utah, Virgin Islands, Washington, Wisconsin, Wyoming 98.75% if price is $50,000 97.65% if price is 97.15% if price is $125.000 $50,001-$125,000 High Closing Cost States All other states 98.75% if price is $50,000 97.75% if price is > $50,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the answers well follow the given information step by step a Total cash payment at the time of closing The down payment is 10 of the hous... View full answer

Get step-by-step solutions from verified subject matter experts