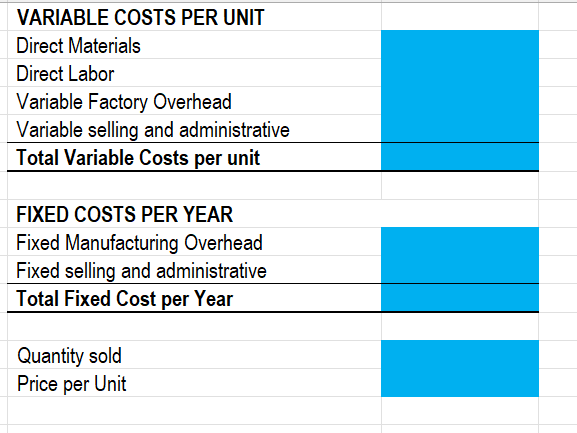

Question: Accounting Variable Costs per unit: Direct Materials $ 13.00 Direct Labor 25.00 Variable Factory Overhead 9.00 Variable selling and administrative 7.00 Total Variable Costs per

Accounting

| Variable Costs per unit: | |

| Direct Materials | $ 13.00 |

| Direct Labor | 25.00 |

| Variable Factory Overhead | 9.00 |

| Variable selling and administrative | 7.00 |

| Total Variable Costs per unit | 54.00 |

|

| |

| Fixed Costs Per year: | |

| Fixed Manufacturing Overhead | $600,000 |

| Fixed selling and administrative | $500,000 |

| Total Fixed Cost per year | $1,100,000 |

The company currently sells 70,000 units per year at $90 per unit.

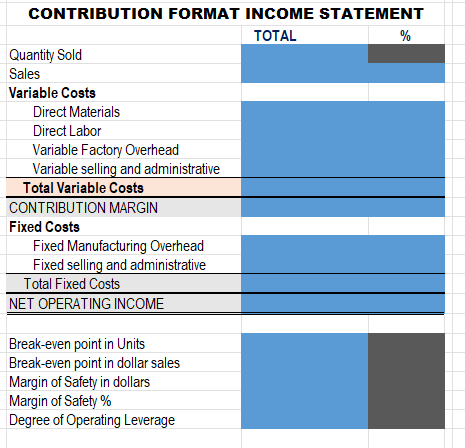

Plug each number into the excel spreadsheet in the blue with the correct formula. Show work.

Once you complete question 1,

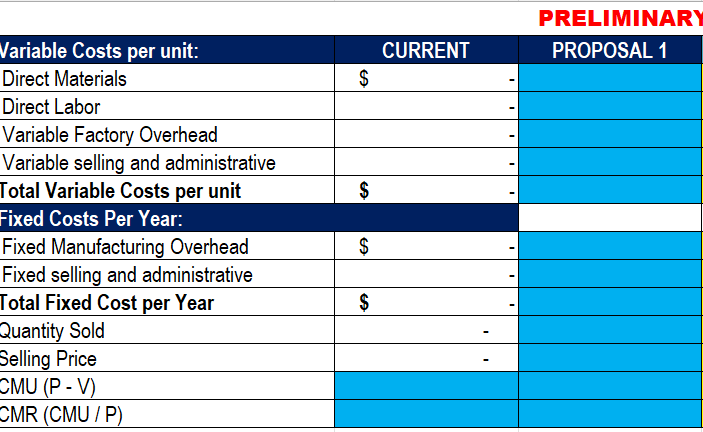

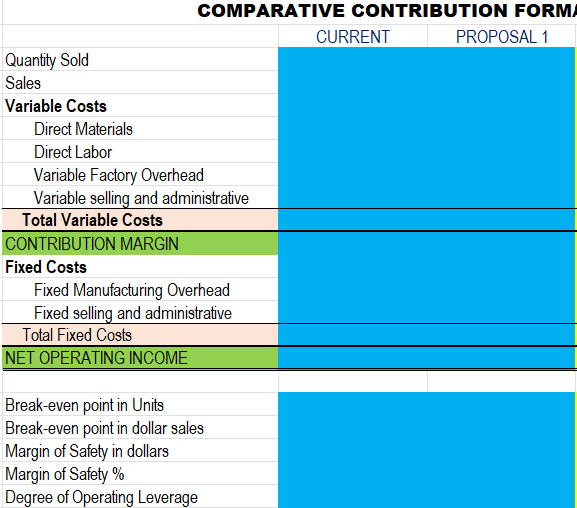

- Proposal : The variable selling and administrative cost will reduce by 80% while the fixed selling and administrative costs will increase to $660,000 per year. This is estimated to boost their morale, and thus, increase sales to 83,000 units per year.

Plug data in excel spreadsheet in the blue with the correct formula. Show work.

VARIABLE COSTS PER UNIT Direct Materials Direct Labor Variable Factory Overhead Variable selling and administrative Total Variable Costs per unit FIXED COSTS PER YEAR Fixed Manufacturing Overhead Fixed selling and administrative Total Fixed Cost per Year Quantity sold Price per Unit CONTRIBUTION FORMAT INCOME STATEMENT TOTAL % Quantity Sold Sales Variable Costs Direct Materials Direct Labor Variable Factory Overhead Variable selling and administrative Total Variable Costs CONTRIBUTION MARGIN Fixed Costs Fixed Manufacturing Overhead Fixed selling and administrative Total Fixed Costs NET OPERATING INCOME Break-even point in Units Break-even point in dollar sales Margin of Safety in dollars Margin of Safety % Degree of Operating Leverage PRELIMINARY PROPOSAL 1 CURRENT $ 1 - $ Variable Costs per unit: Direct Materials Direct Labor Variable Factory Overhead Variable selling and administrative Total Variable Costs per unit Fixed Costs Per Year: Fixed Manufacturing Overhead Fixed selling and administrative Total Fixed Cost per Year Quantity Sold Selling Price CMU (P-V) CMR (CMU/P) $ - $ COMPARATIVE CONTRIBUTION FORM CURRENT PROPOSAL 1 Quantity Sold Sales Variable Costs Direct Materials Direct Labor Variable Factory Overhead Variable selling and administrative Total Variable Costs CONTRIBUTION MARGIN Fixed Costs Fixed Manufacturing Overhead Fixed selling and administrative Total Fixed Costs NET OPERATING INCOME Break-even point in Units Break-even point in dollar sales Margin of Safety in dollars Margin of Safety % Degree of Operating Leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts