Question: Accountingb Part 2: Answer the following problems in the space provided You may use a calculator but no cell phones. Master Grill Company sells outdoor

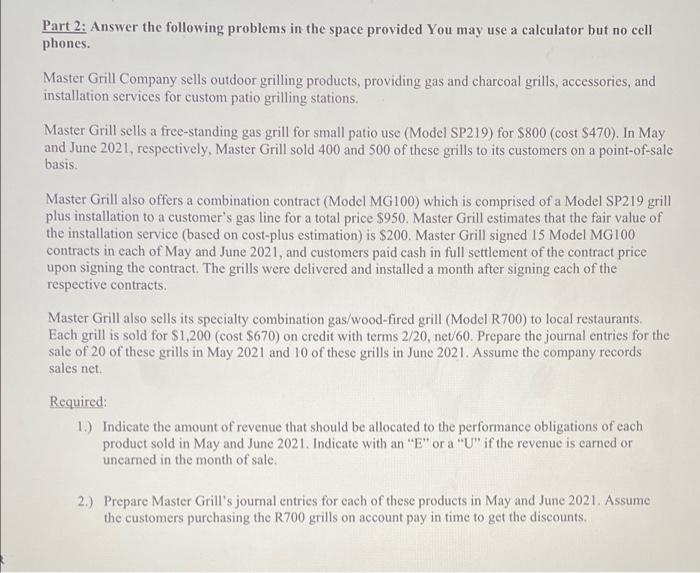

Part 2: Answer the following problems in the space provided You may use a calculator but no cell phones. Master Grill Company sells outdoor grilling products, providing gas and charcoal grills, accessories, and installation services for custom patio grilling stations. Master Grill sells a free-standing gas grill for small patio use (Model SP219) for $800 (cost $470). In May and June 2021, respectively, Master Grill sold 400 and 500 of these grills to its customers on a point-of-sale basis. a Master Grill also offers a combination contract (Model MG100) which is comprised of a Model SP219 grill plus installation to a customer's gas line for a total price $950. Master Grill estimates that the fair value of the installation service (based on cost-plus estimation) is $200. Master Grill signed 15 Model MG100 contracts in each of May and June 2021, and customers paid cash in full settlement of the contract price upon signing the contract. The grills were delivered and installed a month after signing each of the respective contracts Master Grill also sells its specialty combination gas/wood-fired grill (Model R700) to local restaurants Each grill is sold for $1,200 (cost $670) on credit with terms 2/20, net/60. Prepare the journal entries for the sale of 20 of these grills in May 2021 and 10 of these grills in June 2021. Assume the company records sales net Required: 1.) Indicate the amount of revenue that should be allocated to the performance obligations of each product sold in May and Junc 2021. Indicate with an "E" or a "U" if the revenue is camned or uncarned in the month of sale. 2.) Prepare Master Grill's journal entries for cach of these products in May and June 2021. Assume the customers purchasing the R700 grills on account pay in time to get the discounts. Part 2: Answer the following problems in the space provided You may use a calculator but no cell phones. Master Grill Company sells outdoor grilling products, providing gas and charcoal grills, accessories, and installation services for custom patio grilling stations. Master Grill sells a free-standing gas grill for small patio use (Model SP219) for $800 (cost $470). In May and June 2021, respectively, Master Grill sold 400 and 500 of these grills to its customers on a point-of-sale basis. a Master Grill also offers a combination contract (Model MG100) which is comprised of a Model SP219 grill plus installation to a customer's gas line for a total price $950. Master Grill estimates that the fair value of the installation service (based on cost-plus estimation) is $200. Master Grill signed 15 Model MG100 contracts in each of May and June 2021, and customers paid cash in full settlement of the contract price upon signing the contract. The grills were delivered and installed a month after signing each of the respective contracts Master Grill also sells its specialty combination gas/wood-fired grill (Model R700) to local restaurants Each grill is sold for $1,200 (cost $670) on credit with terms 2/20, net/60. Prepare the journal entries for the sale of 20 of these grills in May 2021 and 10 of these grills in June 2021. Assume the company records sales net Required: 1.) Indicate the amount of revenue that should be allocated to the performance obligations of each product sold in May and Junc 2021. Indicate with an "E" or a "U" if the revenue is camned or uncarned in the month of sale. 2.) Prepare Master Grill's journal entries for cach of these products in May and June 2021. Assume the customers purchasing the R700 grills on account pay in time to get the discounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts