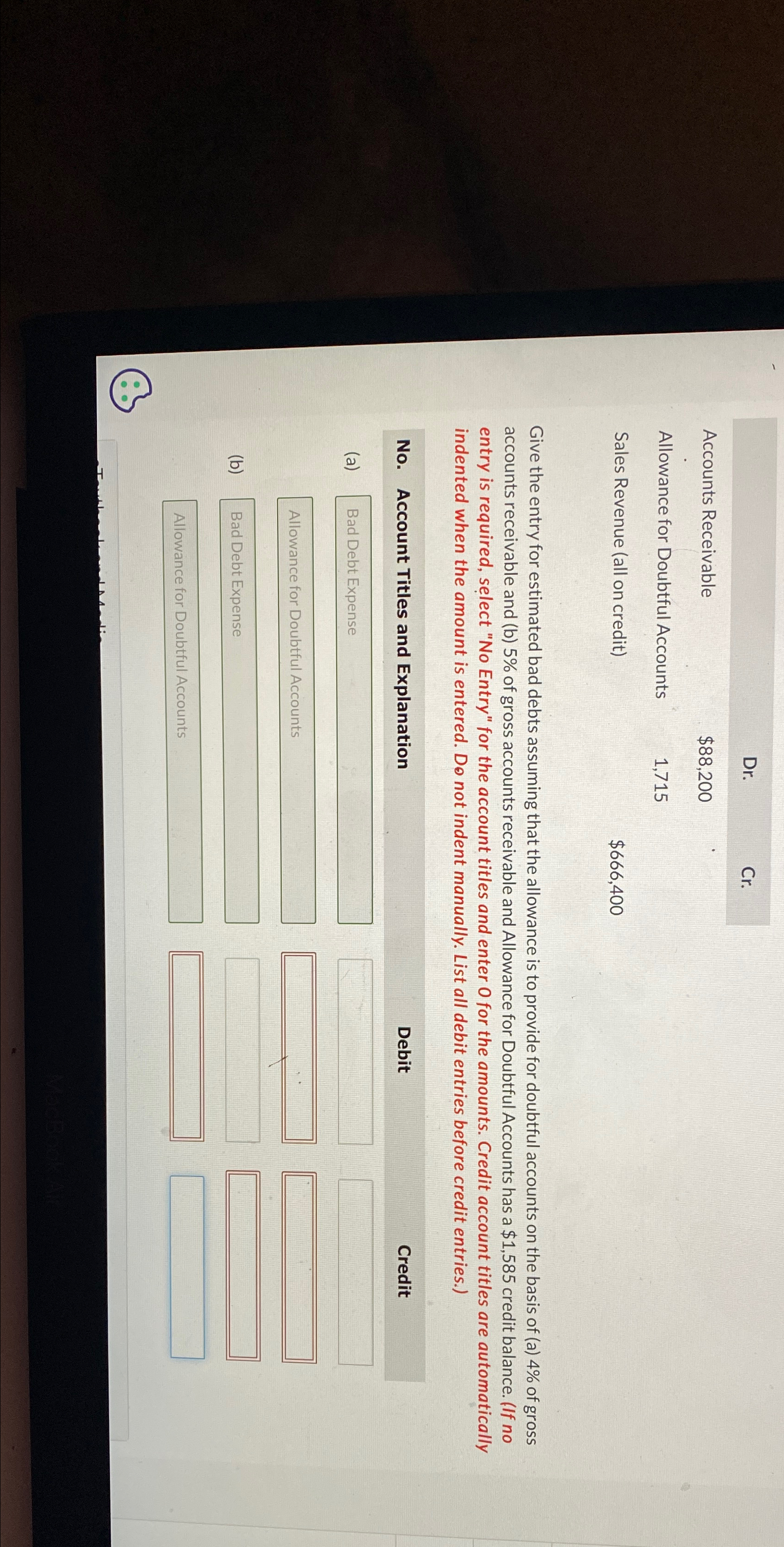

Question: Accounts Receivable $ 8 8 , 2 0 0 Allowance for Doubtful Accounts 1 , 7 1 5 Sales Revenue ( all on credit )

Accounts Receivable

$

Allowance for Doubtful Accounts

Sales Revenue all on credit

$

Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of a of gross accounts receivable and b of gross accounts receivable and Allowance for Doubtful Accounts has a $ credit balance. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.

No Account Titles and Explanation

Debit

Credit

a

Bad Debt Expense

Allowance for Doubtful Accounts

b

Bad Debt Expense

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock