Question: Accounts Receivable. Attached you will find the problem, the template for the Allowance T Account and Aging of Accounts Receivable (you must complete this based

Accounts Receivable. Attached you will find the problem, the template for the Allowance T Account and Aging of Accounts Receivable (you must complete this based on info from the problem), and a general journal template for your journal entries (using proper journal entry format).

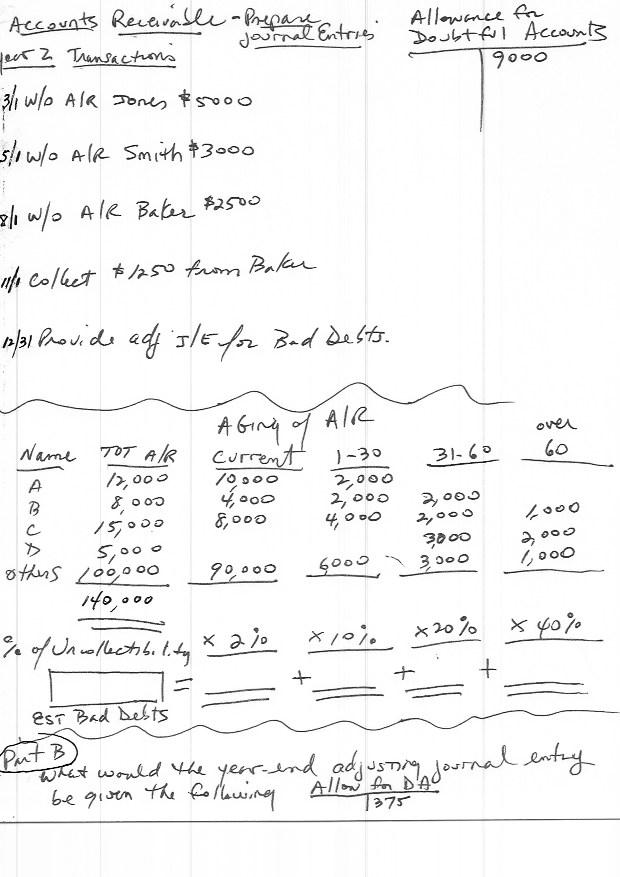

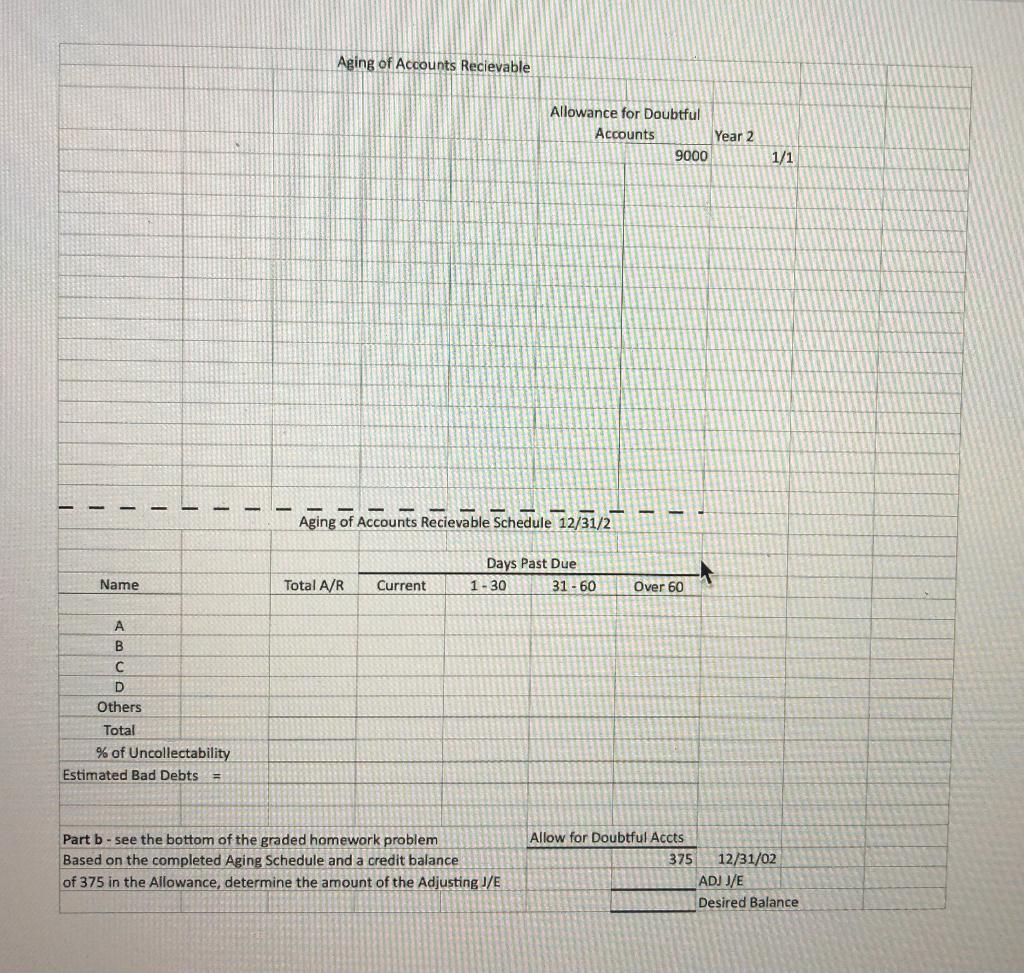

Allowance for Doubtful Accounts 9000 Accounts Receivable - Prepare Journal Entries year? - Transactions 3/1 w/ AIR Jones &5000 5/1w/o AIR Smith $3000 27/1 w/ AIR Baker $2500 life collect */250 from Bakar 12/31 Provide adj's/E for Bad Dests. Abing of AIR over 60 31-60 Name TOT AIR A 12,000 B &009 /500 >> 5,ooo others 200,000 11, Current 1-30 10.00 2,000 4,000 2,00 8000 3000 90000 6000 3300 2,000 4,000 2, 1,000 . x % % of Uncollectibility x 210 x 10% +20% x 40% * * + + EST Bad Dests Put B What would the year-end adjusting be given the following Journal entry gournal 7375 Aging of Accounts Recievable Allowance for Doubtful Accounts Year 2 9000 1/1 Aging of Accounts Recievable Schedule 12/31/2 Days Past Due 1-30 31-60 Name Total A/R Current Over 60 B D Others Total % of Uncollectability Estimated Bad Debts = Part b - see the bottom of the graded homework problem Based on the completed Aging Schedule and a credit balance of 375 in the Allowance, determine the amount of the Adjusting ]/E Allow for Doubtful Accts 375 12/31/02 ADJ J/E Desired Balance GENERAL JOURNAL Page 1 Date Account Titles & Explanation Ref. Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts