Question: accroding to the question, I cannot pate the whole table from 1991 to 2021,so can you use the table from 1991 to 1993 to solve

accroding to the question, I cannot pate the whole table from 1991 to 2021,so can you use the table from 1991 to 1993 to solve the questions? I will use your answer to solve the whole question, thx please upload your formula when you use the excel.

| Date | Share price indices: China Taiwan: Weighted |

| Jan-1991 | 4023.72 |

| Feb-1991 | 5033.3701 |

| Mar-1991 | 5139.9399 |

| Apr-1991 | 5921.29 |

| May-1991 | 5610.7202 |

| Jun-1991 | 5900.7002 |

| Jul-1991 | 5178.0601 |

| Aug-1991 | 4542.9302 |

| Sep-1991 | 4867.1299 |

| Oct-1991 | 4389.8599 |

| Nov-1991 | 4391.6099 |

| Dec-1991 | 4540.5498 |

| Jan-1992 | 5391.6299 |

| Feb-1992 | 5031.6899 |

| Mar-1992 | 4800.9399 |

| Apr-1992 | 4496.1899 |

| May-1992 | 4519.27 |

| Jun-1992 | 4523.8101 |

| Jul-1992 | 4108.52 |

| Aug-1992 | 3946.3501 |

| Sep-1992 | 3524.21 |

| Oct-1992 | 3631.73 |

| Nov-1992 | 3675.01 |

| Dec-1992 | 3377.0601 |

| Jan-1993 | 3251.23 |

| Feb-1993 | 4049.5 |

| Mar-1993 | 4825.29 |

| Apr-1993 | 4563.52 |

| May-1993 | 4267.8999 |

| Jun-1993 | 3995.51 |

| Jul-1993 | 3994.2 |

| Aug-1993 | 3892.04 |

| Sep-1993 | 3832.6899 |

| Oct-1993 | 4086.1699 |

| Nov-1993 | 4353.8999 |

| Dec-1993 | 6070.5601 |

please answee this question using this table, because the data are huge, so use the part of data to do. and I will follow your step to answer the whole question. thx

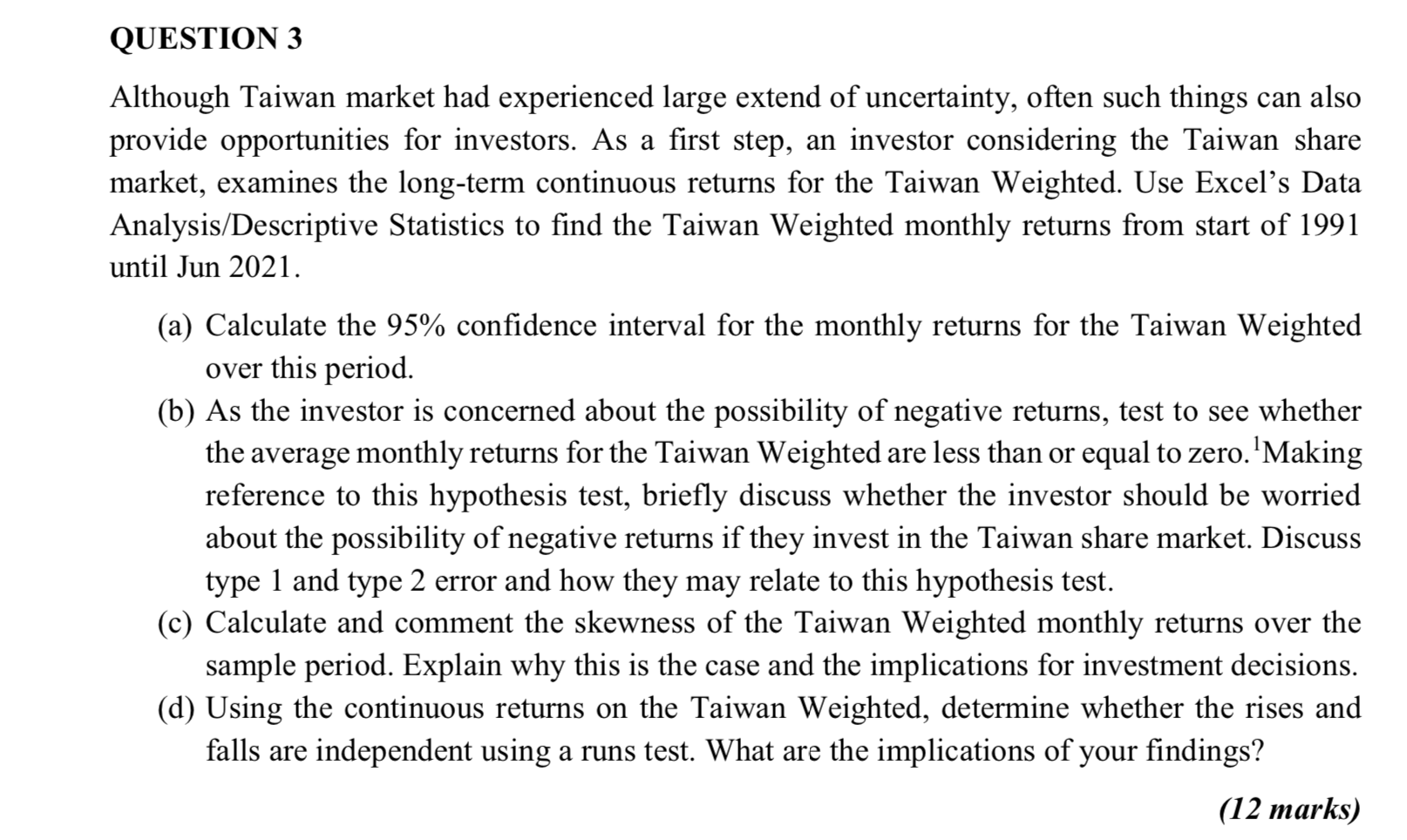

QUESTION 3 Although Taiwan market had experienced large extend of uncertainty, often such things can also provide opportunities for investors. As a first step, an investor considering the Taiwan share market, examines the long-term continuous returns for the Taiwan Weighted. Use Excel's Data Analysis/Descriptive Statistics to find the Taiwan Weighted monthly returns from start of 1991 until Jun 2021. (a) Calculate the 95% confidence interval for the monthly returns for the Taiwan Weighted over this period. (b) As the investor is concerned about the possibility of negative returns, test to see whether the average monthly returns for the Taiwan Weighted are less than or equal to zero. 'Making reference to this hypothesis test, briefly discuss whether the investor should be worried about the possibility of negative returns if they invest in the Taiwan share market. Discuss type 1 and type 2 error and how they may relate to this hypothesis test. (c) Calculate and comment the skewness of the Taiwan Weighted monthly returns over the sample period. Explain why this is the case and the implications for investment decisions. (d) Using the continuous returns on the Taiwan Weighted, determine whether the rises and falls are independent using a runs test. What are the implications of your findings? (12 marks) QUESTION 3 Although Taiwan market had experienced large extend of uncertainty, often such things can also provide opportunities for investors. As a first step, an investor considering the Taiwan share market, examines the long-term continuous returns for the Taiwan Weighted. Use Excel's Data Analysis/Descriptive Statistics to find the Taiwan Weighted monthly returns from start of 1991 until Jun 2021. (a) Calculate the 95% confidence interval for the monthly returns for the Taiwan Weighted over this period. (b) As the investor is concerned about the possibility of negative returns, test to see whether the average monthly returns for the Taiwan Weighted are less than or equal to zero. 'Making reference to this hypothesis test, briefly discuss whether the investor should be worried about the possibility of negative returns if they invest in the Taiwan share market. Discuss type 1 and type 2 error and how they may relate to this hypothesis test. (c) Calculate and comment the skewness of the Taiwan Weighted monthly returns over the sample period. Explain why this is the case and the implications for investment decisions. (d) Using the continuous returns on the Taiwan Weighted, determine whether the rises and falls are independent using a runs test. What are the implications of your findings? (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts