Question: ACCT 1 2 5 - Introductory Accounting II Assignment # 1 Chapter 9 3 9 marks Name: Student Number: table [ [ Moksh ]

ACCT Introductory Accounting II

Assignment #

Chapter

marks

Name:

Student Number:

tableMoksh

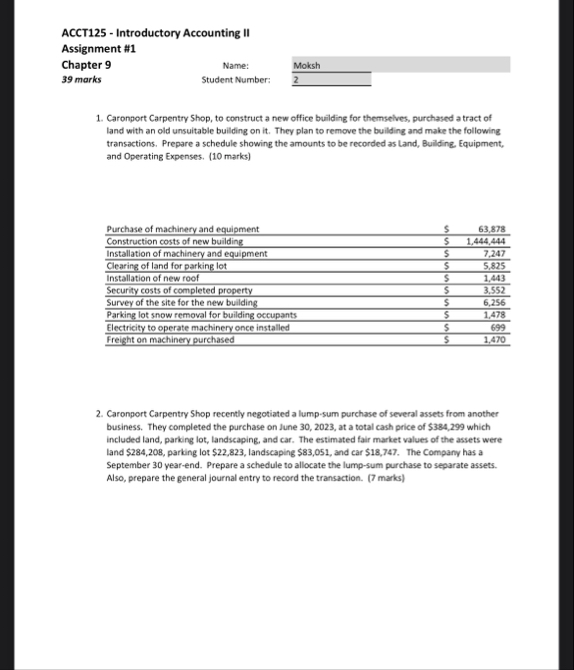

Caronport Carpentry Shop, to construct a new office building for themselves, purchased a tract of land with an old unsuitable building on it They plan to remove the building and make the following transactions. Prepare a schedule showing the amounts to be recorded as Land, Bulding, Equipment, and Operating Expenses. marks

tablePurchase of machinery and equipment,$Construction costs of new building,$Installation of machinery and equipment,$Clearing of land for parking lot,$Installation of new roof,$Security costs of completed property,$Survey of the site for the new building,$Parking lot snow removal for building occupants,$Electricity to operate machinery once installed,$Freight on machinery purchased,$

Caronport Carpentry Shop recently negotiated a lumpsum purchase of several assets from another business. They completed the purchase on June at a total cash price of $ which included land, parking lot, landscaping, and car. The estimated fair market values of the assets were land $ parking lot $ landscaping $ and car $ The Company has a September yearend. Prepare a schedule to allocate the lumpsum purchase to separate assets. Also, prepare the general journal entry to record the transaction. marksPrince Albert Company purchased a smartphone worth $ on September The a smartphone should have an estimated life of years or minutes. Residual value is estimated to be $ Calculate the depreciation expense under both the UnitsOfProduction and StraightLine methods for the first four years of the use of the asset. The company's fiscal year ends May Show all calculations, round dollar values to the nearest dollar units of production depreciation rate, round to decimals marks

tableYeartableUsageinformation:Unitminutesminutesminutesminutes

Saskatoon Supermarket Company, who has a yearend date of March disposed of a truck on September The asset had a cost of $ an estimated residual value of $ an estimated useful life of years or and accumulated depreciation at the start of the fiscal year of disposal of $ In the year of disposal, the company used the truck for kms On disposal, they received proceeds of $ There were no changes to any estimates, and the asset was purchased at the start of the fiscal year in which it was purchased. Answer the following questions about the disposal, calculating all answers to the nearest dollar unitofproduction, calculate the rate per unit to three decimal places: marks

a Calculate the amount of depreciation for the truck in the final year of disposal using the DoubleDeclining Balance method and provide the journal entry.

b Calculate the gainloss on disposal of the truck and provide the journal entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock