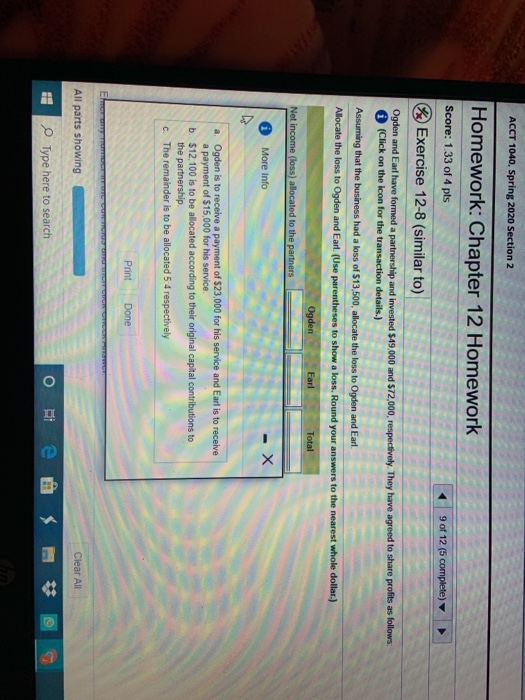

Question: ACCT 1040, Spring 2020 Section 2 Homework: Chapter 12 Homework 9 of 12 (5 complete) Score: 1.33 of 4 pts Exercise 12-8 (similar to) Ogden

ACCT 1040, Spring 2020 Section 2 Homework: Chapter 12 Homework 9 of 12 (5 complete) Score: 1.33 of 4 pts Exercise 12-8 (similar to) Ogden and Earl have formed a partnership and invested 549,000 and $72,000, respectively. They have agreed to share profits as follows: (Click on the icon for the transaction details.) Assurning that the business had a loss of $13,500, allocate the loss to Ogden and Earl. Allocate the loss to Ogden and Earl. (Use parentheses to show a loss. Round your answers to the nearest whole dollar.) Ogden Net income (loss) allocated to the partners More Info - X Earl Total a. Ogden is to receive a payment of $23,000 for his service and Earl is to receive a payment of $15,000 for his service b. $12,100 is to be allocated according to their original capital contributions to the partnership c. The remainder is to be allocated 5:4 respectively Print Done TOT TIEGT MITC MOTOCIT CORTICORUM All parts showing Clear All Type here to search otell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts