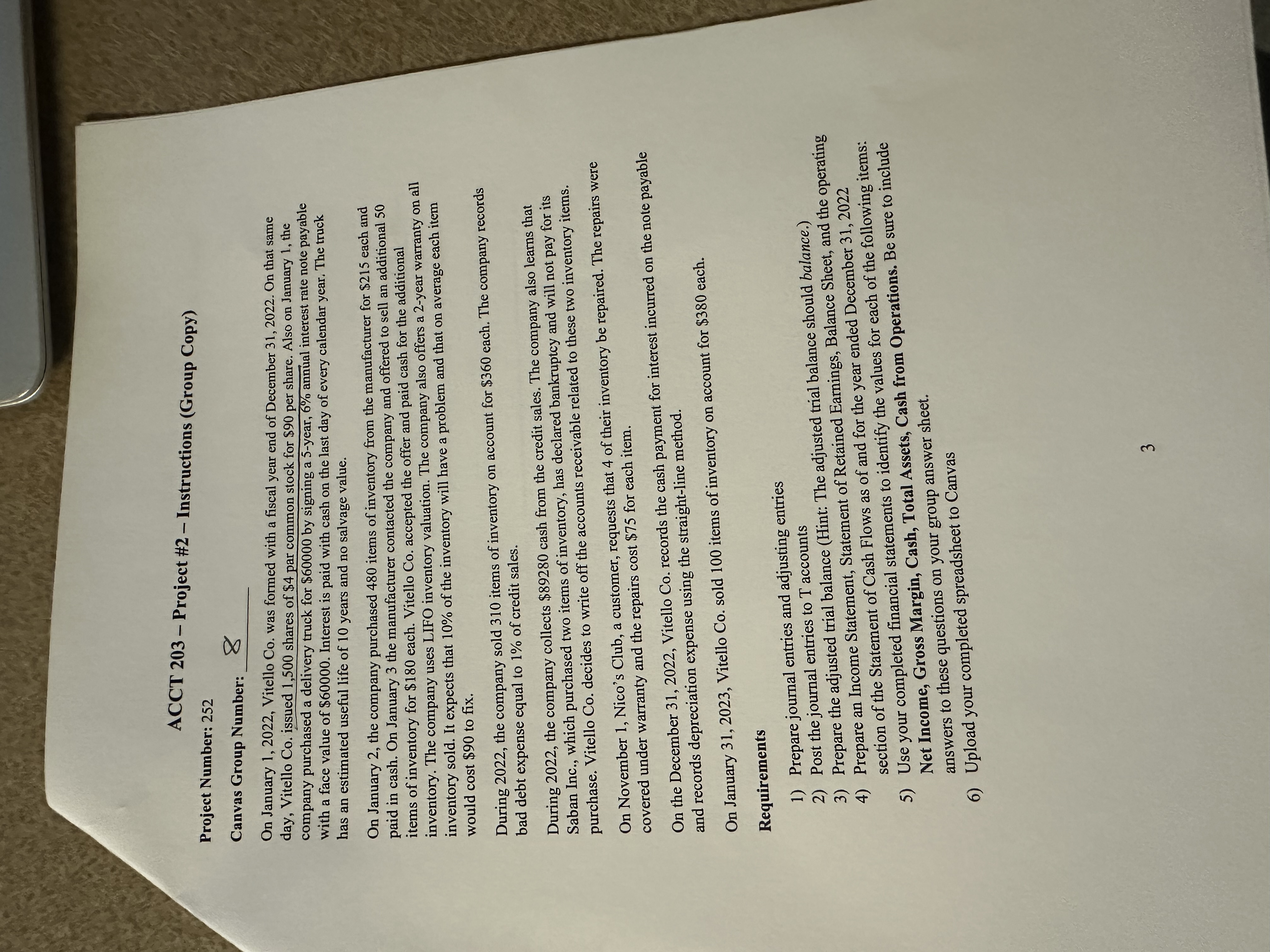

Question: ACCT 2 0 3 - Project # 2 - Instructions ( Group Copy ) Project Number: 2 5 2 Canvas Group Number: On January

ACCT Project # Instructions Group Copy

Project Number:

Canvas Group Number:

On January Vitello Co was formed with a fiscal year end of December On that same day, Vitello Co issued shares of $ par common stock for $ per share. Also on January the company purchased a delivery truck for $ by signing a year, annual interest rate note payable with a face value of $ Interest is paid with cash on the last day of every calendar year. The truck has an estimated useful life of years and no salvage value.

On January the company purchased items of inventory from the manufacturer for $ each and paid in cash. On January the manufacturer contacted the company and offered to sell an additional items of inventory for $ each. Vitello Co accepted the offer and paid cash for the additional inventory. The company uses LIFO inventory valuation. The company also offers a year warranty on all inventory sold. It expects that of the inventory will have a problem and that on average each item would cost $ to fix.

During the company sold items of inventory on account for $ each. The company records bad debt expense equal to of credit sales.

During the company collects $ cash from the credit sales. The company also learns that Saban Inc., which purchased two items of inventory, has declared bankruptcy and will not pay for its purchase. Vitello Co decides to write off the accounts receivable related to these two inventory items.

On November Nico's Club, a customer, requests that of their inventory be repaired. The repairs were covered under warranty and the repairs cost $ for each item.

On the December Vitello Co records the cash payment for interest incurred on the note payable and records depreciation expense using the straightline method.

On January Vitello Co sold items of inventory on account for $ each.

Requirements

Prepare journal entries and adjusting entries

Post the journal entries to T accounts

Prepare the adjusted trial balance Hint: The adjusted trial balance should balance.

Prepare an Income Statement, Statement of Retained Earnings, Balance Sheet, and the operating section of the Statement of Cash Flows as of and for the year ended December

Use your completed financial statements to identify the values for each of the following items: Net Income, Gross Margin, Cash, Total Assets, Cash from Operations. Be sure to include answers to these questions on your group answer sheet.

Upload your completed spreadsheet to Canvas

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock