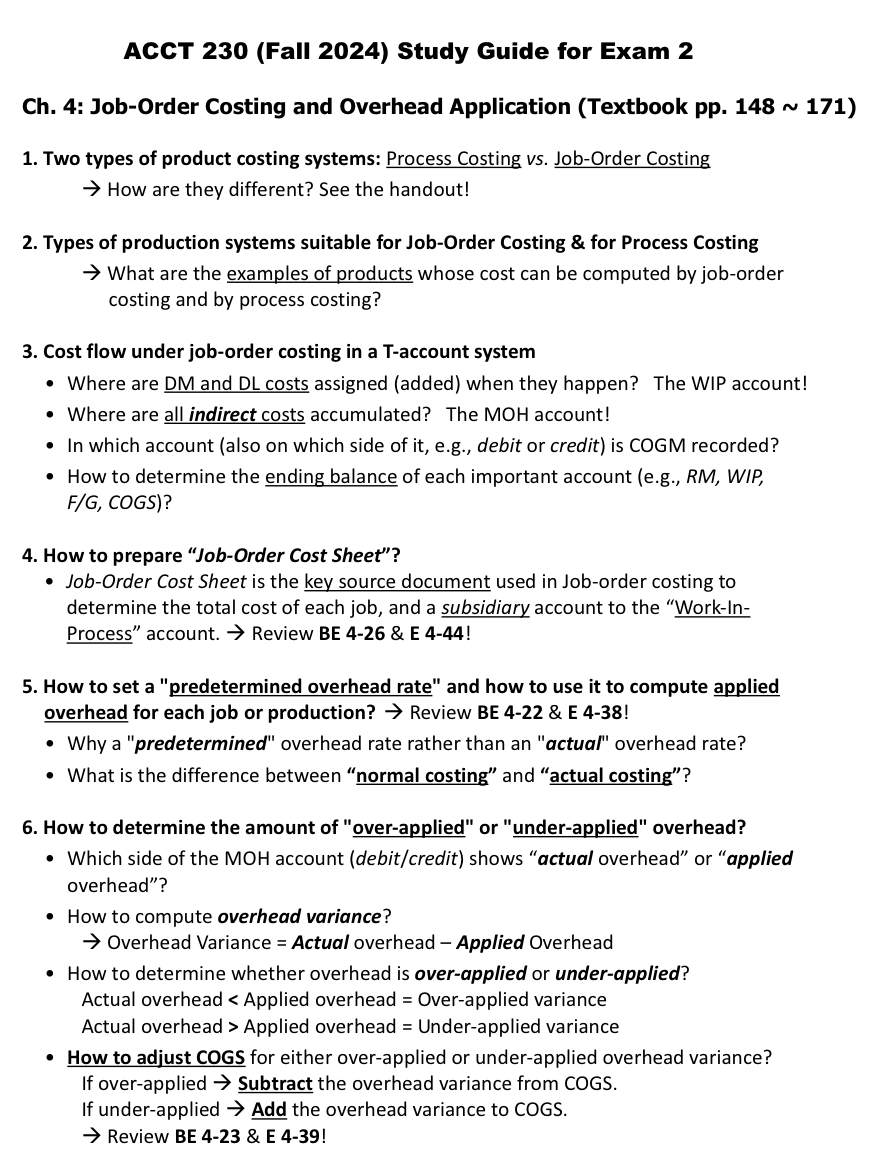

Question: ACCT 2 3 0 ( Fall 2 0 2 4 ) Study Guide for Exam 2 Ch . 4 : Job - Order Costing and

ACCT Fall Study Guide for Exam

Ch: JobOrder Costing and Overhead Application Textbook pp

Two types of product costing systems: Process Costing vs JobOrder Costing

rightarrow How are they different? See the handout!

Types of production systems suitable for JobOrder Costing & for Process Costing

rightarrow What are the examples of products whose cost can be computed by joborder costing and by process costing?

Cost flow under joborder costing in a Taccount system

Where are DM and DL costs assigned added when they happen? The WIP account!

Where are all indirect costs accumulated? The MOH account!

In which account also on which side of it eg debit or credit is COGM recorded?

How to determine the ending balance of each important account eg RM WIP, F G C O G S

How to prepare "JobOrder Cost Sheet"?

JobOrder Cost Sheet is the key source document used in Joborder costing to determine the total cost of each job, and a subsidiary account to the "WorkInProcess" account. rightarrow Review BE & E

How to set a "predetermined overhead rate" and how to use it to compute applied overhead for each job or production? rightarrow Review BE & E

Why a "predetermined" overhead rate rather than an "actual" overhead rate?

What is the difference between "normal costing" and "actual costing"?

How to determine the amount of "overapplied" or "underapplied" overhead?

Which side of the MOH account debitcredit shows "actual overhead" or "applied overhead"?

How to compute overhead variance?

rightarrow Overhead Variance Actual overhead Applied Overhead

How to determine whether overhead is overapplied or underapplied?

Actual overhead Applied overhead Overapplied variance

Actual overhead Applied overhead Underapplied variance

How to adjust COGS for either overapplied or underapplied overhead variance?

If overapplied rightarrow Subtract the overhead variance from COGS.

If underapplied rightarrow Add the overhead variance to COGS.

rightarrow Review BE & E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock