Question: ACCT 2301 High/Low Method Handout #9 mixed cost has a blend of fixed and variable costs. Examples of mixed costs might be rental costs for

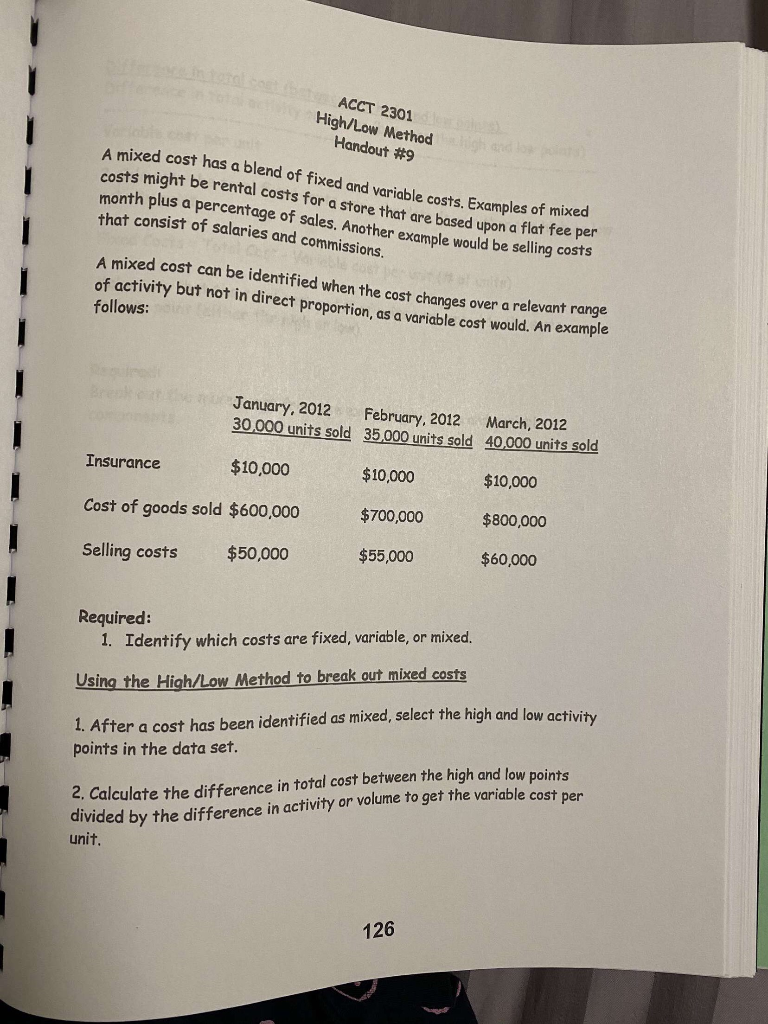

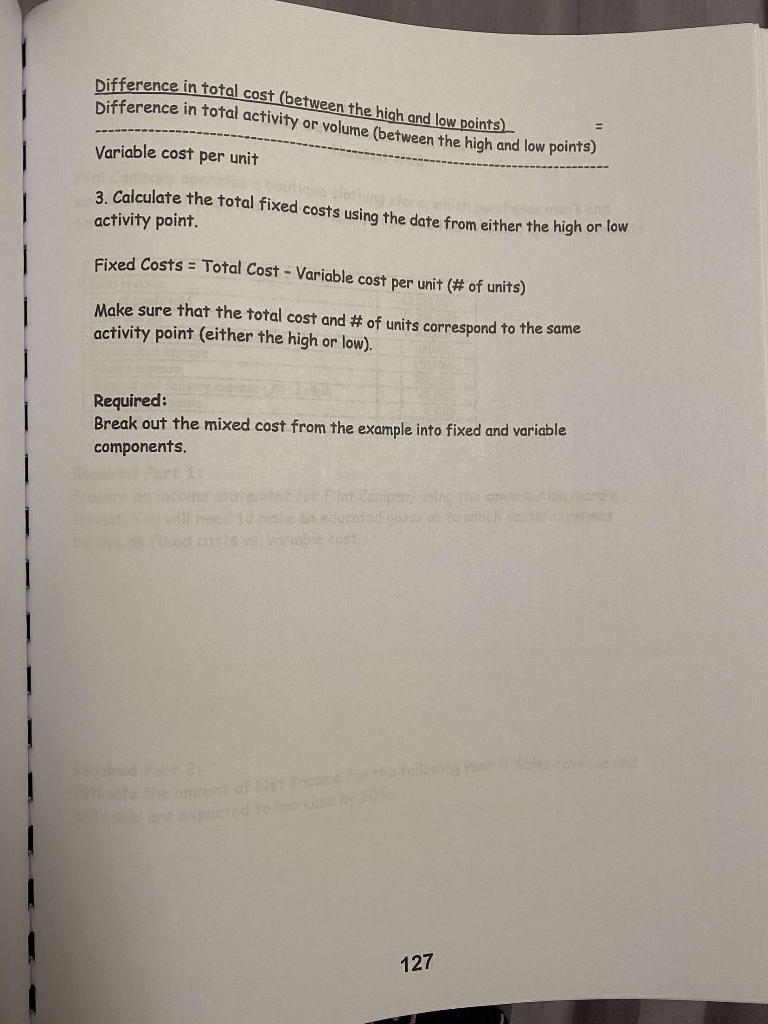

ACCT 2301 High/Low Method Handout #9 mixed cost has a blend of fixed and variable costs. Examples of mixed costs might be rental costs for a store that are based upon a flat fee month plus a percentage of sales. Another example would be selling cost that consist of salaries and commissions. A mixed cost can be identified when the cost changes over a relevant range of activity but not in direct proportion, as a variable cost would. An examp follows: January, 2012 February, 2012 March, 2012 30,000 units sold 35 000 units sold 40,000 units sold Insurance $10,000 $10,000 $10,000 Cost of goods sold $600,000 $700,000 $800,000 Selling costs $50,000 $55,000 $60,000 Required: 1. Identify which costs are fixed, variable, or mixed. Using the High/Low Method to break out mixed costs 1. After a cost has been identified as mixed, select the high and low activity points in the data set. 2. Calculate the difference in total cost between the high and low points divided by the difference in activity or volume to get the variable cost per unit. 126 fference in total cost (between the high and low points) Difference in total activity or volume (between the high and low points Variable cost per unit 3. Calculate the total fixed costs using the date from either the high or lo activity point. Fixed Costs = Total Cost - Variable cost per unit (# of units) Make sure that the total cost and # of units correspond to the same activity point (either the high or low). Required: Break out the mixed cost from the example into fixed and variable components. will need to n Os onducted obie cost 127

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts