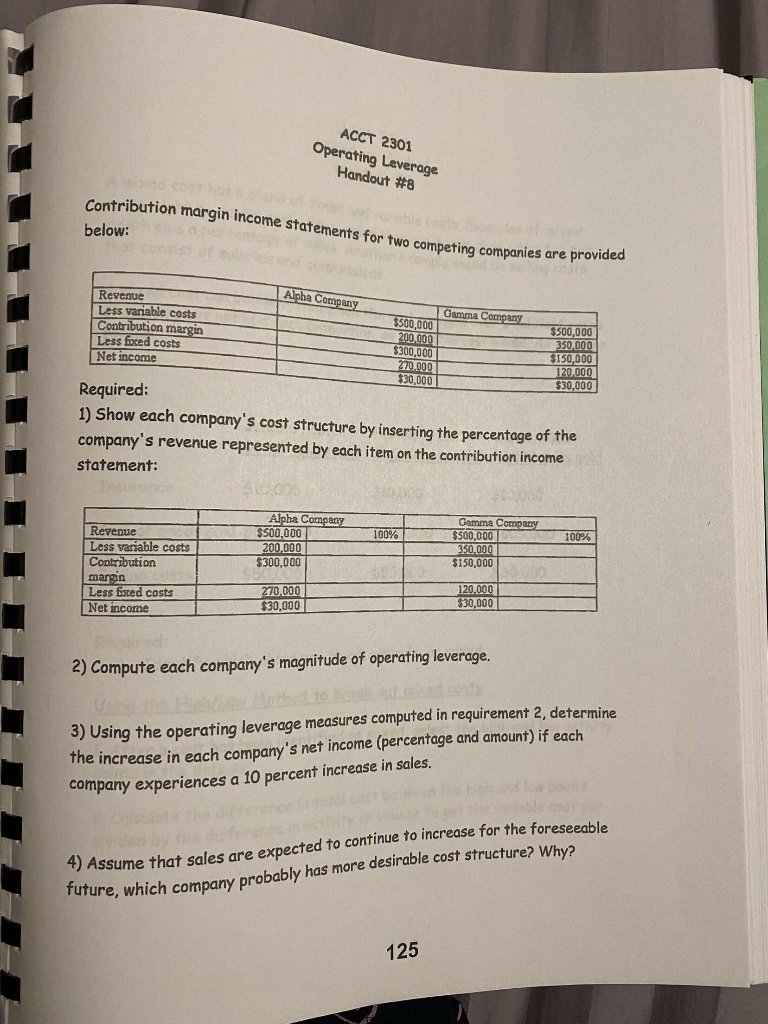

Question: ACCT 2301 Operating Leverage Handout #8 d cot ha Contribution margin income statements for two competing companies are provided below: Anthe Alpha Cempany Revenue Less

ACCT 2301 Operating Leverage Handout #8 d cot ha Contribution margin income statements for two competing companies are provided below: Anthe Alpha Cempany Revenue Less variable costs Contribution margin Less fixed costs Net income Gamma Company $500,000 200.000 $300,000 270.000 $30,000 $500,000 350,000 $150,000 120.000 $30,000 Required: 1) Show each company's cost structure by inserting the percentage of the company's revenue represented by each item on the contribution income statement: Alpha Company $500,000 200,000 $300,000 Gemma Company $s00.000 350,000 $150,000 100% Revenue Less variable costs Contribution margin Less fixed costs Net income 100% 0.000 65 120.000 $30,000 270,000 $30,000 2) Compute each company's magnitude of operating leverage. 3) Using the operating leverage measures computed in requirement 2, determine the increase in each company's net income (percentage and amount) if each company experiences a 10 percent increase in sales. Colkuiete the videa by 4) Assume that sales are expected to continue to increase for the foreseeable TUrure, which company probably has more desirable cost structure? Why? 125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts