Question: ACCT 312 Accounting Ethics Case 2 - Individual Project As a new staff accountant for the Bestever CPA firm, you have been asked to prepare

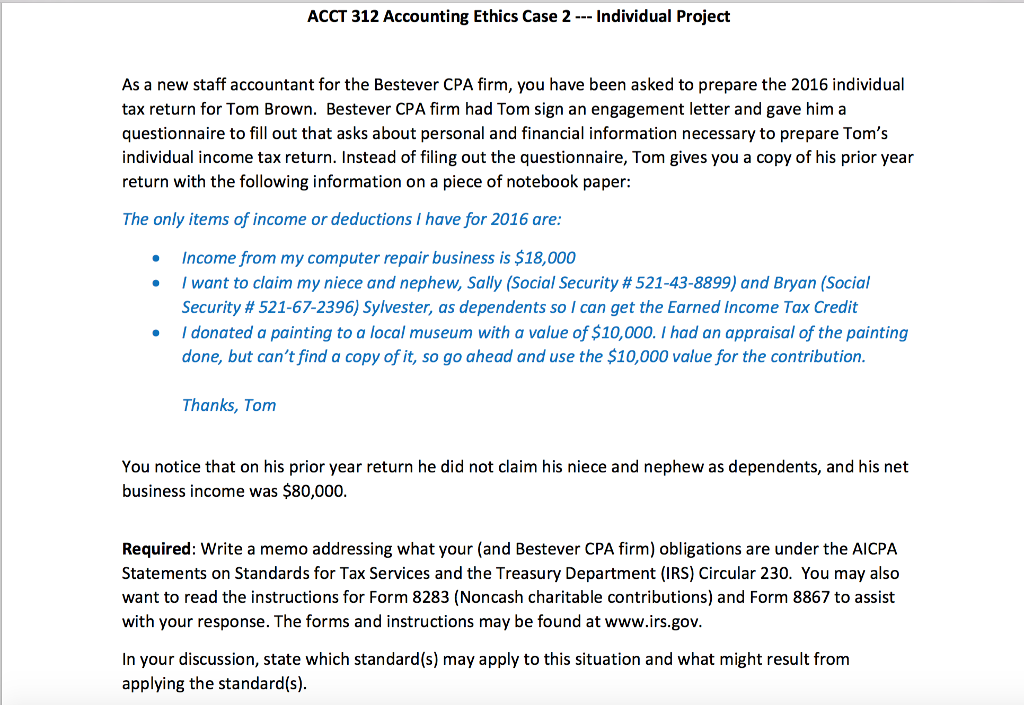

ACCT 312 Accounting Ethics Case 2 - Individual Project As a new staff accountant for the Bestever CPA firm, you have been asked to prepare the 2016 individual tax return for Tom Brown. Bestever CPA firm had Tom sign an engagement letter and gave him a questionnaire to fill out that asks about personal and financial information necessary to prepare Tom's individual income tax return. Instead of filing out the questionnaire, Tom gives you a copy of his prior year return with the following information on a piece of notebook paper: The only items of income or deductions Ihave for 2016 are: Income from my computer repair business is $18,000 I want to claim my niece and nephew, Sally (Social Security # 521-43-8899) and Bryan (Social Security # 521-67-2396) Sylvester, as dependents so I can get the Earned Income Tax Credit Idonated a painting to a local museum with a value of $10,000. I had an appraisal of the painting done, but can't find a copy of it, so go ahead and use the $10,000 value for the contribution. Thanks, Tom You notice that on his prior year return he did not claim his niece and nephew as dependents, and his net business income was $80,000. Required: Write a memo addressing what your (and Bestever CPA firm) obligations are under the AICPA Statements on Standards for Tax Services and the Treasury Department (IRS) Circular 230. You may also want to read the instructions for Form 8283 (Noncash charitable contributions) and Form 8867 to assist with your response. The forms and instructions may be found at www.irs.gov. In your discussion, state which standard(s) may apply to this situation and what might result from applying the standard(s) ACCT 312 Accounting Ethics Case 2 - Individual Project As a new staff accountant for the Bestever CPA firm, you have been asked to prepare the 2016 individual tax return for Tom Brown. Bestever CPA firm had Tom sign an engagement letter and gave him a questionnaire to fill out that asks about personal and financial information necessary to prepare Tom's individual income tax return. Instead of filing out the questionnaire, Tom gives you a copy of his prior year return with the following information on a piece of notebook paper: The only items of income or deductions Ihave for 2016 are: Income from my computer repair business is $18,000 I want to claim my niece and nephew, Sally (Social Security # 521-43-8899) and Bryan (Social Security # 521-67-2396) Sylvester, as dependents so I can get the Earned Income Tax Credit Idonated a painting to a local museum with a value of $10,000. I had an appraisal of the painting done, but can't find a copy of it, so go ahead and use the $10,000 value for the contribution. Thanks, Tom You notice that on his prior year return he did not claim his niece and nephew as dependents, and his net business income was $80,000. Required: Write a memo addressing what your (and Bestever CPA firm) obligations are under the AICPA Statements on Standards for Tax Services and the Treasury Department (IRS) Circular 230. You may also want to read the instructions for Form 8283 (Noncash charitable contributions) and Form 8867 to assist with your response. The forms and instructions may be found at www.irs.gov. In your discussion, state which standard(s) may apply to this situation and what might result from applying the standard(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts