Question: ACCT 315 Prect - Fall 2022 Master Budget Background Information: You are the Controller for a Manufacturing Company. As controller, you are responsible for the

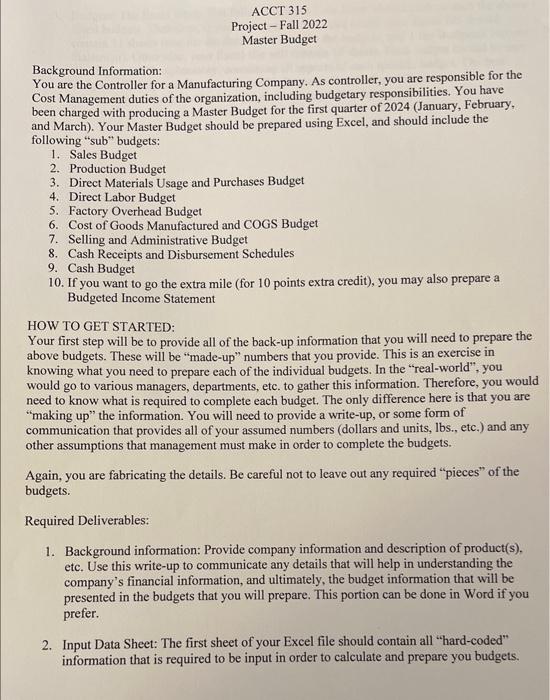

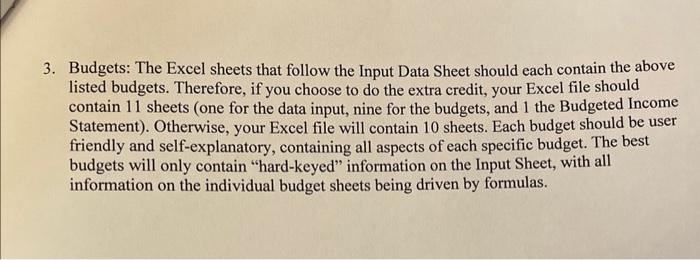

ACCT 315 Prect - Fall 2022 Master Budget Background Information: You are the Controller for a Manufacturing Company. As controller, you are responsible for the Cost Management duties of the organization, including budgetary responsibilities. You have been charged with producing a Master Budget for the first quarter of 2024 (January, February, and March). Your Master Budget should be prepared using Excel, and should include the following "sub" budgets: 1. Sales Budget 2. Production Budget 3. Direct Materials Usage and Purchases Budget 4. Direct Labor Budget 5. Factory Overhead Budget 6. Cost of Goods Manufactured and COGS Budget 7. Selling and Administrative Budget 8. Cash Receipts and Disbursement Schedules 9. Cash Budget 10. If you want to go the extra mile (for 10 points extra credit), you may also prepare a Budgeted Income Statement HOW TO GET STARTED: Your first step will be to provide all of the back-up information that you will need to prepare the above budgets. These will be "made-up" numbers that you provide. This is an exercise in knowing what you need to prepare each of the individual budgets. In the "real-world", you would go to various managers, departments, etc. to gather this information. Therefore, you would need to know what is required to complete each budget. The only difference here is that you are "making up" the information. You will need to provide a write-up, or some form of communication that provides all of your assumed numbers (dollars and units, lbs., etc.) and any other assumptions that management must make in order to complete the budgets. Again, you are fabricating the details. Be careful not to leave out any required "pieces" of the budgets. Required Deliverables: 1. Background information: Provide company information and description of product(s), etc. Use this write-up to communicate any details that will help in understanding the company's financial information, and ultimately, the budget information that will be presented in the budgets that you will prepare. This portion can be done in Word if you prefer. 2. Input Data Sheet: The first sheet of your Excel file should contain all "hard-coded" information that is required to be input in order to calculate and prepare you budgets. 3. Budgets: The Excel sheets that follow the Input Data Sheet should each contain the above listed budgets. Therefore, if you choose to do the extra credit, your Excel file should contain 11 sheets (one for the data input, nine for the budgets, and 1 the Budgeted Income Statement). Otherwise, your Excel file will contain 10 sheets. Each budget should be user friendly and self-explanatory, containing all aspects of each specific budget. The best budgets will only contain "hard-keyed" information on the Input Sheet, with all information on the individual budget sheets being driven by formulas. ACCT 315 Prect - Fall 2022 Master Budget Background Information: You are the Controller for a Manufacturing Company. As controller, you are responsible for the Cost Management duties of the organization, including budgetary responsibilities. You have been charged with producing a Master Budget for the first quarter of 2024 (January, February, and March). Your Master Budget should be prepared using Excel, and should include the following "sub" budgets: 1. Sales Budget 2. Production Budget 3. Direct Materials Usage and Purchases Budget 4. Direct Labor Budget 5. Factory Overhead Budget 6. Cost of Goods Manufactured and COGS Budget 7. Selling and Administrative Budget 8. Cash Receipts and Disbursement Schedules 9. Cash Budget 10. If you want to go the extra mile (for 10 points extra credit), you may also prepare a Budgeted Income Statement HOW TO GET STARTED: Your first step will be to provide all of the back-up information that you will need to prepare the above budgets. These will be "made-up" numbers that you provide. This is an exercise in knowing what you need to prepare each of the individual budgets. In the "real-world", you would go to various managers, departments, etc. to gather this information. Therefore, you would need to know what is required to complete each budget. The only difference here is that you are "making up" the information. You will need to provide a write-up, or some form of communication that provides all of your assumed numbers (dollars and units, lbs., etc.) and any other assumptions that management must make in order to complete the budgets. Again, you are fabricating the details. Be careful not to leave out any required "pieces" of the budgets. Required Deliverables: 1. Background information: Provide company information and description of product(s), etc. Use this write-up to communicate any details that will help in understanding the company's financial information, and ultimately, the budget information that will be presented in the budgets that you will prepare. This portion can be done in Word if you prefer. 2. Input Data Sheet: The first sheet of your Excel file should contain all "hard-coded" information that is required to be input in order to calculate and prepare you budgets. 3. Budgets: The Excel sheets that follow the Input Data Sheet should each contain the above listed budgets. Therefore, if you choose to do the extra credit, your Excel file should contain 11 sheets (one for the data input, nine for the budgets, and 1 the Budgeted Income Statement). Otherwise, your Excel file will contain 10 sheets. Each budget should be user friendly and self-explanatory, containing all aspects of each specific budget. The best budgets will only contain "hard-keyed" information on the Input Sheet, with all information on the individual budget sheets being driven by formulas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts