Question: ACCT 3210: IN CLASS TAX RETURN PREPARATION EXERCISE (10 POINTS) INSTRUCTIONS: Based on the facts below, prepare a federal individual income tax return (Form 1040)

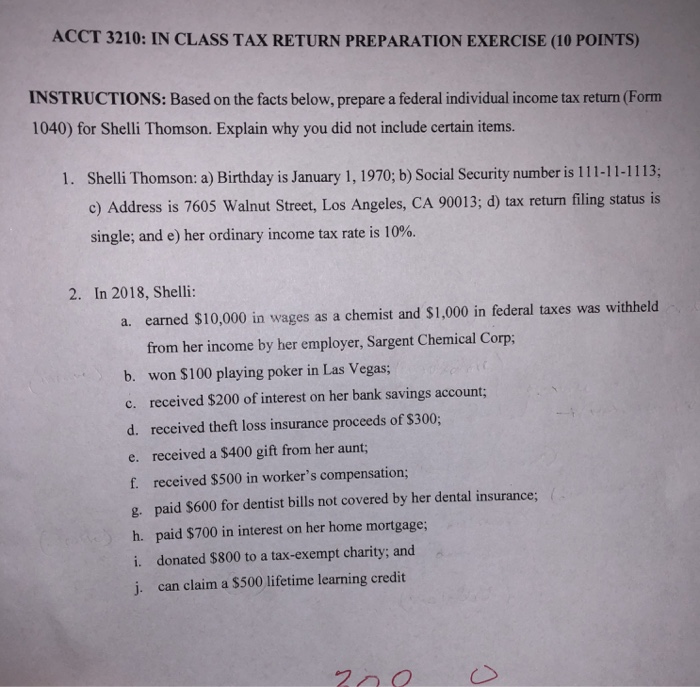

ACCT 3210: IN CLASS TAX RETURN PREPARATION EXERCISE (10 POINTS) INSTRUCTIONS: Based on the facts below, prepare a federal individual income tax return (Form 1040) for Shelli Thomson. Explain why you did not include certain items. 1. Shelli Thomson: a) Birthday is January 1, 1970; b) Social Security number is 111-11-1113; c) Address is 7605 Walnut Street, Los Angeles, CA 90013; d) tax return filing status is single, and e) her ordinary income tax rate is 10% 2. In 2018, Shelli: a. earned $10,000 in wages as a chemist and $1,000 in federal taxes was withheld from her income by her employer, Sargent Chemical Corp; b. won $100 playing poker in Las Vegas; c. received $200 of interest on her bank savings account; d. received theft loss insurance proceeds of $300; e. received a $400 gift from her aunt f. received $500 in worker's compensation; g. paid $600 for dentist bills not covered by her dental insurance; h. paid $700 in interest on her home mortgage; i. donated $800 to a tax-exempt charity; and j. can claim a $500 lifetime learning credit ACCT 3210: IN CLASS TAX RETURN PREPARATION EXERCISE (10 POINTS) INSTRUCTIONS: Based on the facts below, prepare a federal individual income tax return (Form 1040) for Shelli Thomson. Explain why you did not include certain items. 1. Shelli Thomson: a) Birthday is January 1, 1970; b) Social Security number is 111-11-1113; c) Address is 7605 Walnut Street, Los Angeles, CA 90013; d) tax return filing status is single, and e) her ordinary income tax rate is 10% 2. In 2018, Shelli: a. earned $10,000 in wages as a chemist and $1,000 in federal taxes was withheld from her income by her employer, Sargent Chemical Corp; b. won $100 playing poker in Las Vegas; c. received $200 of interest on her bank savings account; d. received theft loss insurance proceeds of $300; e. received a $400 gift from her aunt f. received $500 in worker's compensation; g. paid $600 for dentist bills not covered by her dental insurance; h. paid $700 in interest on her home mortgage; i. donated $800 to a tax-exempt charity; and j. can claim a $500 lifetime learning credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts