Question: ACCT 355 - Spring 2024 Itemized Deduction Assignment (Assignment 2) Worth 10 points Due Thursday, Feb. 29 by 11:59 pm Attach your Excel file (not

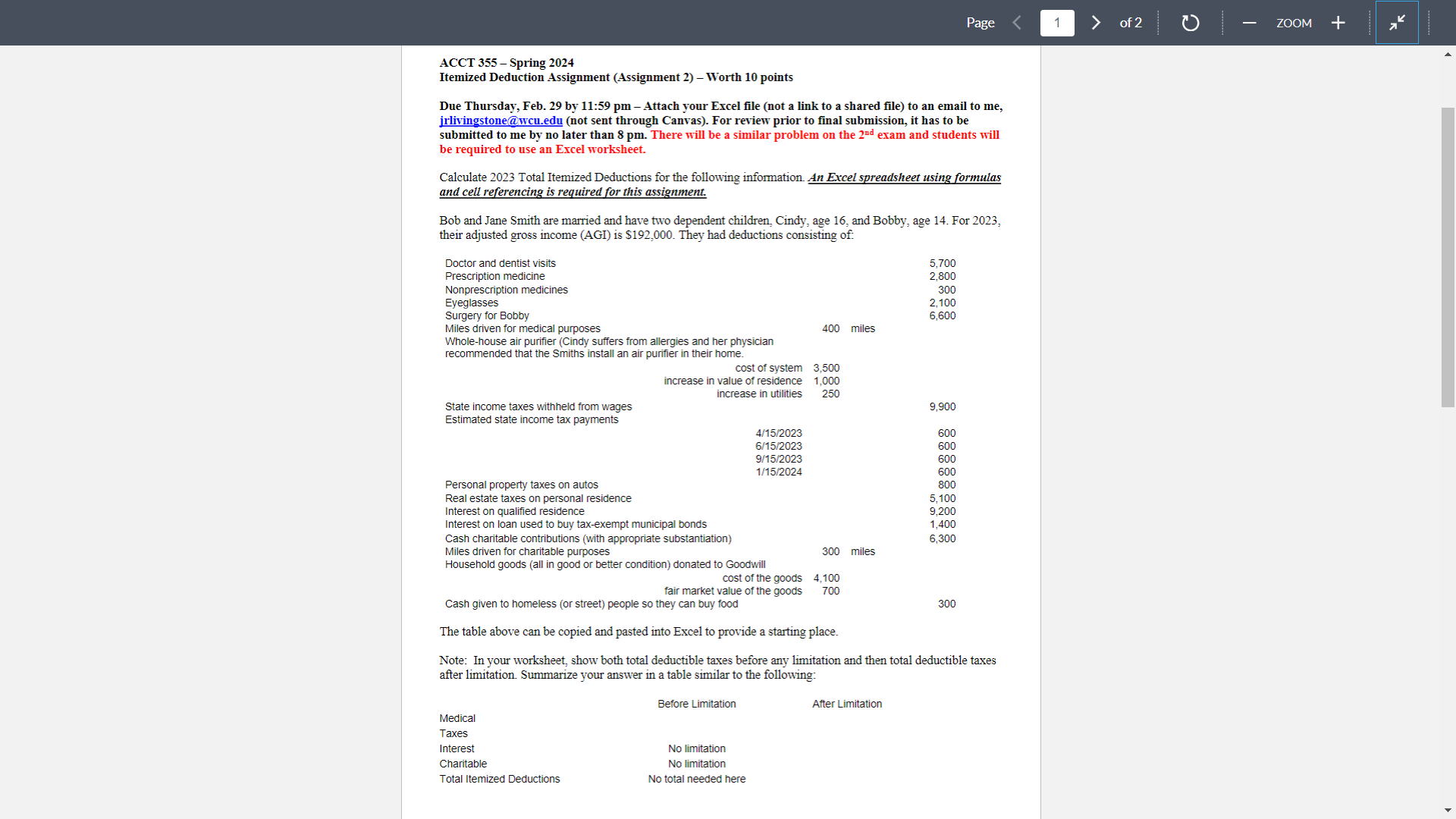

ACCT 355 - Spring 2024 Itemized Deduction Assignment (Assignment 2) Worth 10 points Due Thursday, Feb. 29 by 11:59 pm Attach your Excel file (not a link to a shared file) to an email to me, jrlivingstone@yeu.edu (not sent through Canvas). For review prior to final submission, it has to be submitted to me by no later than $ pm. There will be a similar problem on the 2* exam and students will be required to use an Excel worksheet. Calculate 2023 Total Itemized Deductions for the following information. An Excel spreadsheet using formulas and cell referencing is required for this assignment. Bob and Jane Smith are married and have two dependent children. Cindy. age 16 and Bobby, age 14. For 2023, their adjusted gross income (AGI) 1s $192.000. They had deductions consisting of: Doctor and dentist visits Prescription medicine Nonprescription medicines Eyeglasses Surgery for Bobby Miles driven for medical purposes Whole-house air purifier (Cindy suffers from allergies and her physician recommended that the Smiths install an air purifier in their home. 400 miles cost of system 3,500 increase in value of residence 1,000 increase in utilities State income taxes withheld from wages Estimated state income tax payments 411512023 6/15/2023 9/15/2023 1/1572024 Personal property taxes on autos Real estate taxes on personal residence Interest on qualified residence Interest on loan used to buy tax-exempt municipal bonds Cash charitable centributions (with appropriate substantiation) Miles driven for charitable purposes Household geods (all in good or better condition) donated to Goodwill 250 300 mies cost of the goods 4,100 fair market value of the goods Cash given to homeless (or street) people so they can buy food 700 The table above can be copied and pasted info Excel to provide a starting place. Note: In your worksheet, show beth total deductible taxes before any limitation and then total deductible taxes after limitation. Summarize your answer in a table similar to the following: Before Limitation After Limitafion Medical Taxes Interest No limitation Charitable No limitation Total Itemized Deductions Ne total needed here 5,700 2,800 300 2,100 6,500 9.900 600 600 600 600 800 5,100 9,200 1,400 6,300 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts