Question: ACCT 4 1 1 _ Financial Auditing Problem 5 In connection with your audit of the financial statements of Echo Corporation ( the Company )

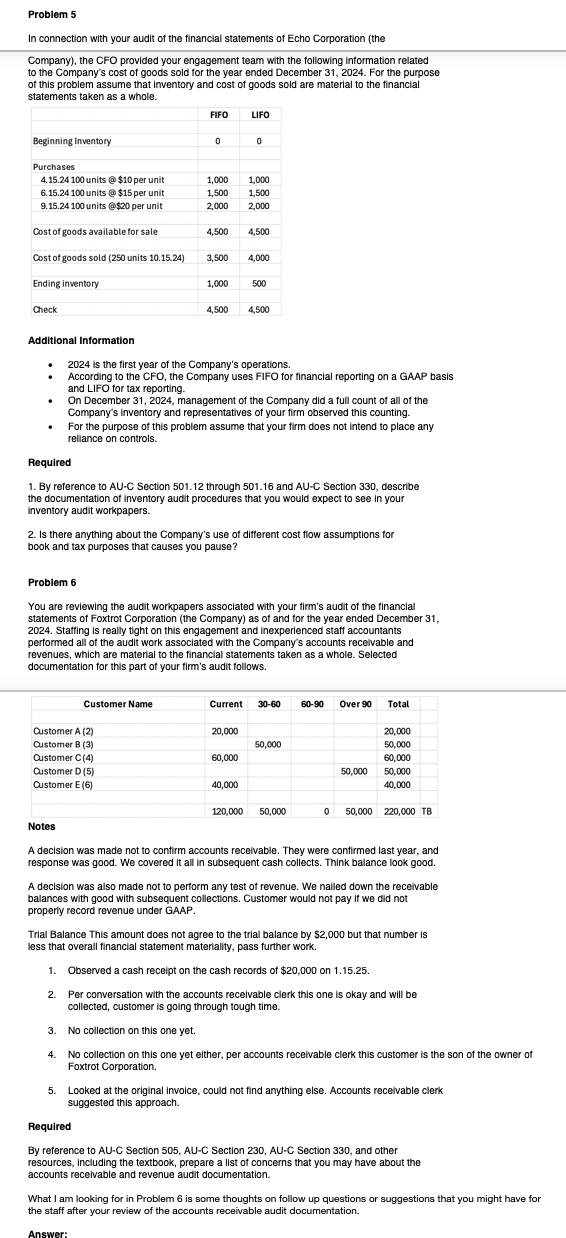

ACCTFinancial Auditing Problem In connection with your audit of the financial statements of Echo Corporation the Company the CFO provided your engagement team with the following information related to the Companys cost of goods sold for the year ended December For the purpose of this problem assume that inventory and cost of goods sold are material to the financial statements taken as a whole. Additional Information is the first year of the Companys operations. According to the CFO, the Company uses FIFO for financial reporting on a GAAP basis and LIFO for tax reporting. On December management of the Company did a full count of all of the Companys inventory and representatives of your firm observed this counting. For the purpose of this problem assume that your firm does not intend to place any reliance on controls. Required By reference to AUC Section through and AUC Section describe the documentation of inventory audit procedures that you would expect to see in your inventory audit workpapers. Is there anything about the Companys use of different cost flow assumptions for book and tax purposes that causes you pause?

Problem

You are reviewing the audit workpapers associated with your firms audit of the financial

statements of Foxtrot Corporation the Company as of and for the year ended December

Staffing is really tight on this engagement and inexperienced staff accountants

performed all of the audit work associated with the Companys accounts receivable and

revenues, which are material to the financial statements taken as a whole. Selected

documentation for this part of your firms audit follows.

Notes

A decision was made not to confirm accounts receivable. They were confirmed last year, and

response was good. We covered it all in subsequent cash collects. Think balance look good.

A decision was also made not to perform any test of revenue. We nailed down the receivable

balances with good with subsequent collections. Customer would not pay if we did not

properly record revenue under GAAP.

Trial Balance This amount does not agree to the trial balance by $ but that number is

less that overall financial statement materiality, pass further work.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock