Question: ACCT 4000 Spring 2018 Group Project Instructions This group project has three parts, the consolidation project, reporting practices for consolidation ar international accounting, and non-profit

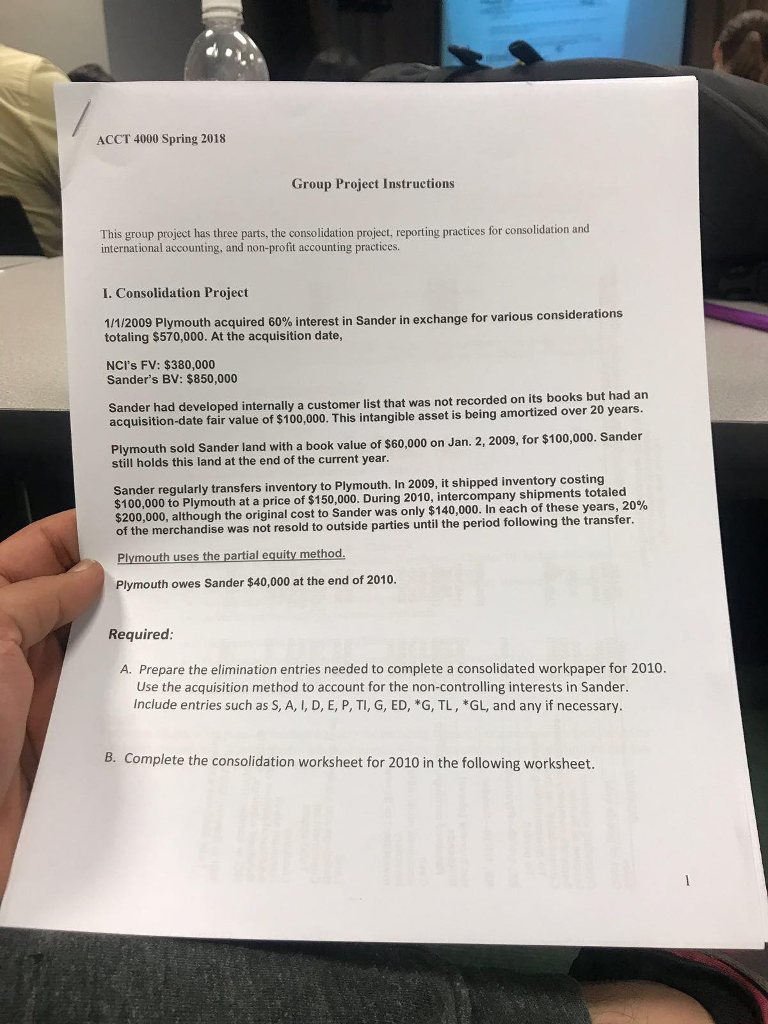

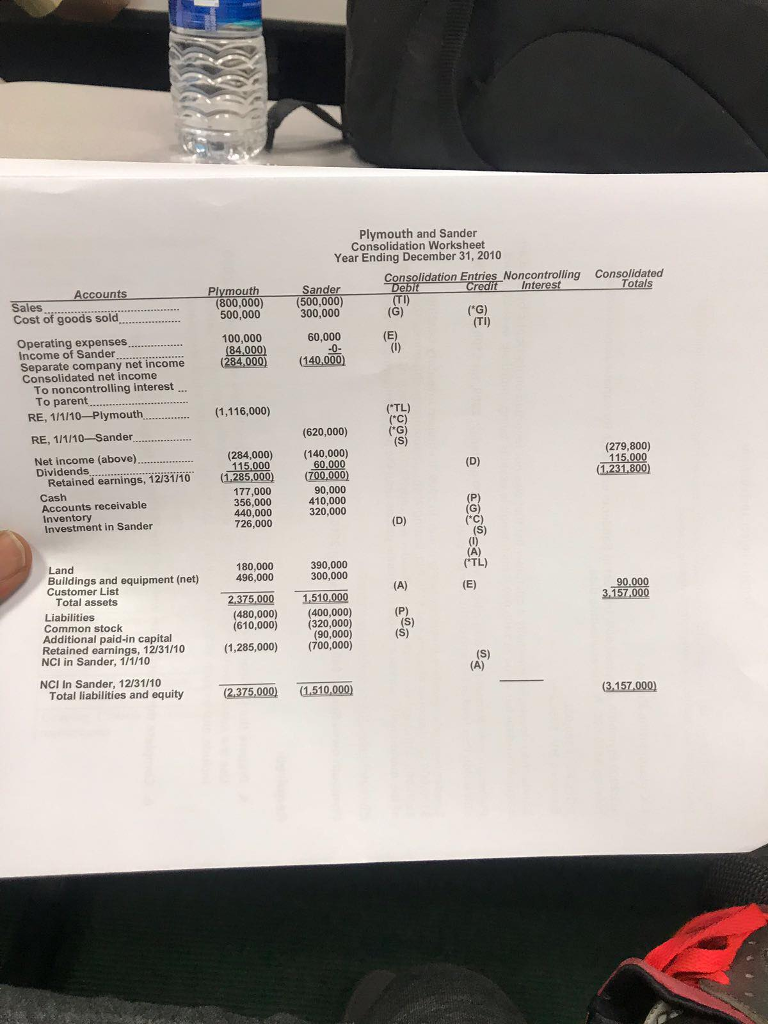

ACCT 4000 Spring 2018 Group Project Instructions This group project has three parts, the consolidation project, reporting practices for consolidation ar international accounting, and non-profit accounting practices. I. Consolidation Project xchange for various considerations 1/1/2009 Plymouth acquired 60% interest in Sander in e totaling $570,000. At the acquisition date, NCI's FV: $380,000 Sander's BV: $850,000 Sander had developed internally a customer list that was not recorded on its books but had an acquisition-date fair value of $100,000. This intangible asset is being amortized over 20 years. Plymouth sold Sander land with a book value of $60,000 on Jan. 2, 2009, for $100,000. Sander still holds this land at the end of the current year. Sander regularly transfers inventory to Plymouth. In 2009, it shipped inventory costing $200,000, although the original cost to Sander Nas only $140,000. In each of these years, 20% to Plymouth at a price of $150,000. During 2010, intercompany shipments totaled merchandise was not resold to outside parties until the period following the transfer of the method. Plymouth owes Sander $40,000 at the end of 2010 Required: A. Prepare the elimination entries needed to complete a consolidated workpaper for 2010. Use the acquisition method to account for the non-controlling interests in Sander Include entries such as S, A, I, D, E, P, TI, G, ED, *G, TL, *GL, and any if necessary B. Complete the consolidation worksheet for 2010 in the following worksheet. ACCT 4000 Spring 2018 Group Project Instructions This group project has three parts, the consolidation project, reporting practices for consolidation ar international accounting, and non-profit accounting practices. I. Consolidation Project xchange for various considerations 1/1/2009 Plymouth acquired 60% interest in Sander in e totaling $570,000. At the acquisition date, NCI's FV: $380,000 Sander's BV: $850,000 Sander had developed internally a customer list that was not recorded on its books but had an acquisition-date fair value of $100,000. This intangible asset is being amortized over 20 years. Plymouth sold Sander land with a book value of $60,000 on Jan. 2, 2009, for $100,000. Sander still holds this land at the end of the current year. Sander regularly transfers inventory to Plymouth. In 2009, it shipped inventory costing $200,000, although the original cost to Sander Nas only $140,000. In each of these years, 20% to Plymouth at a price of $150,000. During 2010, intercompany shipments totaled merchandise was not resold to outside parties until the period following the transfer of the method. Plymouth owes Sander $40,000 at the end of 2010 Required: A. Prepare the elimination entries needed to complete a consolidated workpaper for 2010. Use the acquisition method to account for the non-controlling interests in Sander Include entries such as S, A, I, D, E, P, TI, G, ED, *G, TL, *GL, and any if necessary B. Complete the consolidation worksheet for 2010 in the following worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts