Question: ACCT 405-DeVry University Case Study 1 - Due Week 4 On January 1, 2020, Innovus, Inc., acquired 100 percent of the common stock of ChipTech

ACCT 405-DeVry University

Case Study 1 - Due Week 4

On January 1, 2020, Innovus, Inc., acquired 100 percent of the common stock of ChipTech Company for $670,000 in cash and other fair-value consideration. ChipTech's fair value was allocated among its net assets as follows:

| Fair value of consideration transferred for ChipTech | $670,000 | |

| Book value of ChipTech: | ||

| Common stock and Additional Paid-in Capital (APIC) | $130,000 | |

| Retained earnings | 370,000 | 500,000 |

| Excess fair value over book value to | 170,000 | |

| Trademark (10-year remaining life) | $40,000 | |

| Existing technology (5-year remaining life) | 80,000 | 120,000 |

| Goodwill | $ 50,000 |

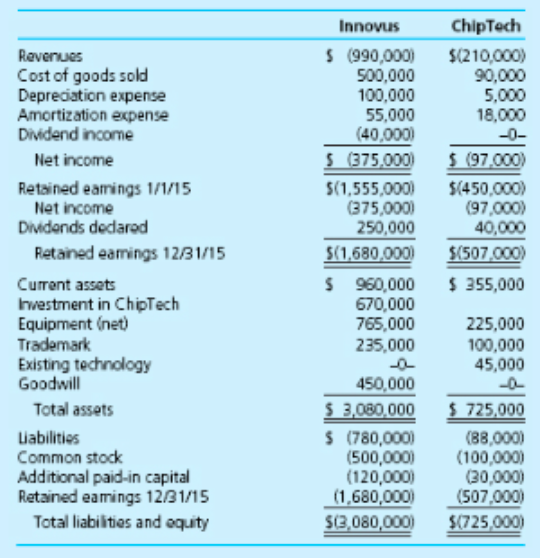

The December 31, 2021, trial balances for the parent and subsidiary follow (there were no intra-entity payables on that date):

Using Excel, compute consolidated balances for Innovus and ChipTech by completing the provided worksheet.

To better help me understand, can you PLEASE include the calculations...

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock