Question: Acct 500 Week 2 Homework help please. Exercise 3.2 (Algo) Using T accounts to analyze transactions. LO 32 Derrick Wells decided to start a dental

Acct 500 Week 2 Homework help please.

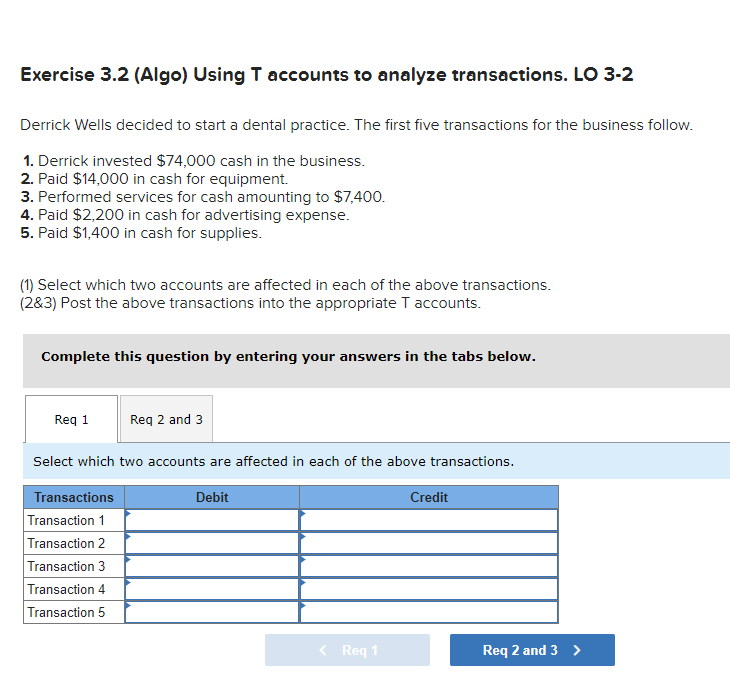

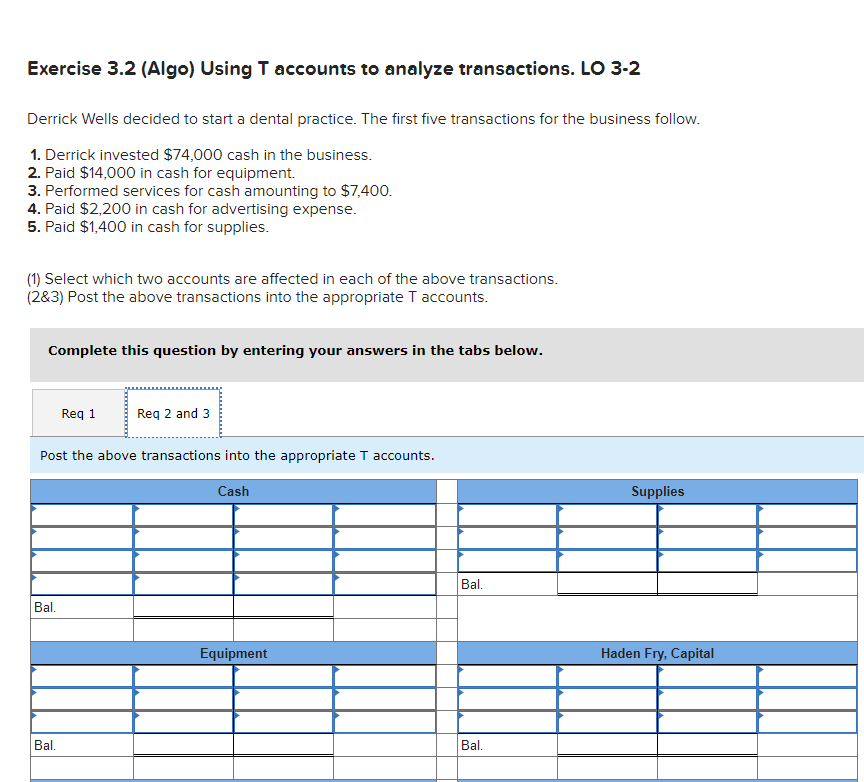

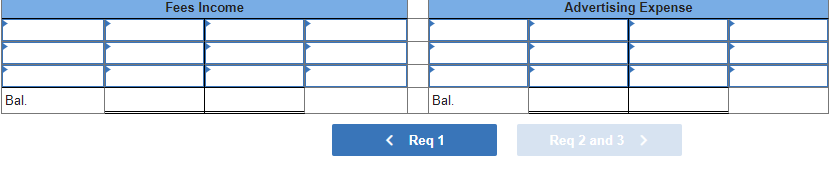

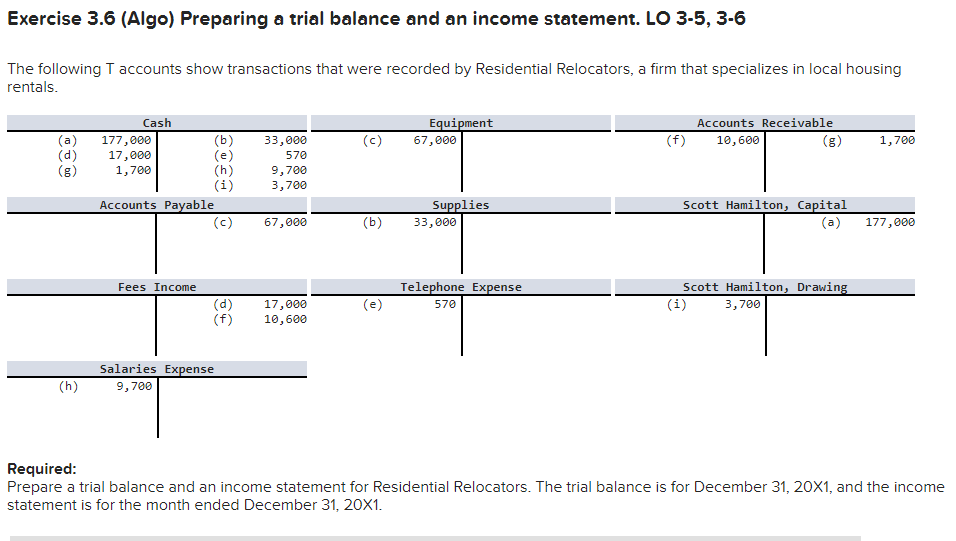

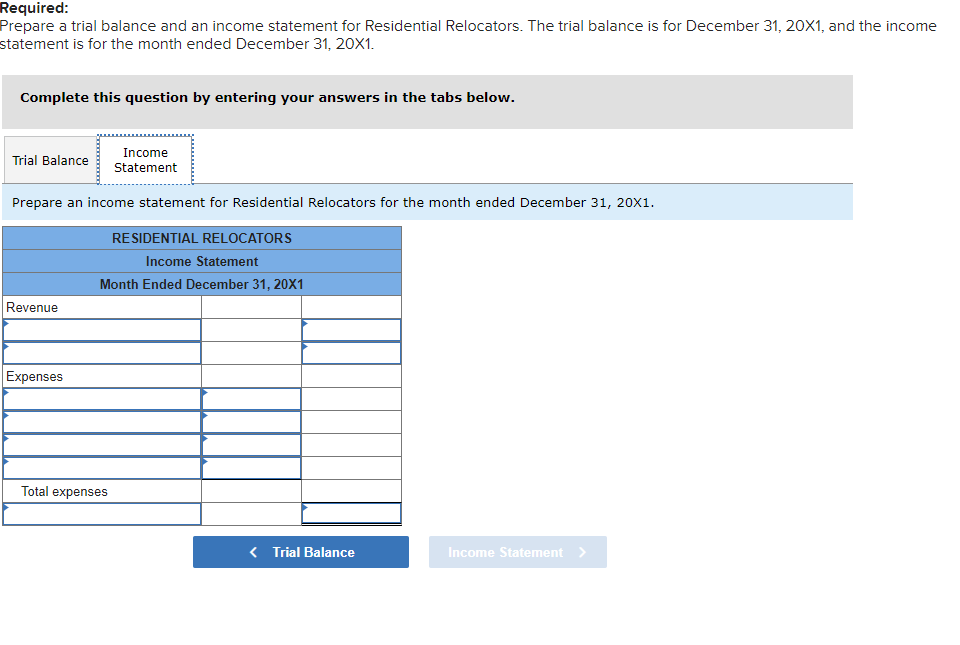

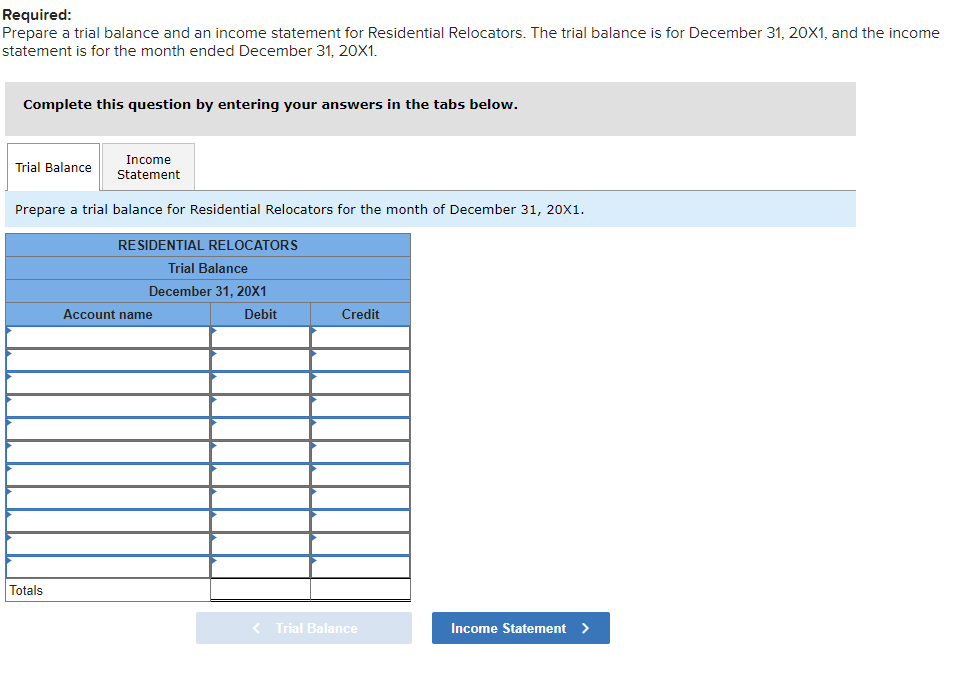

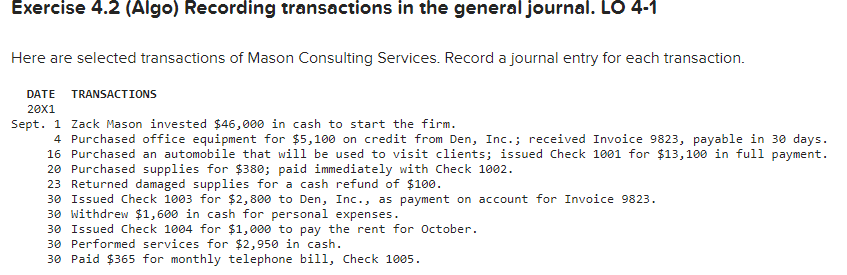

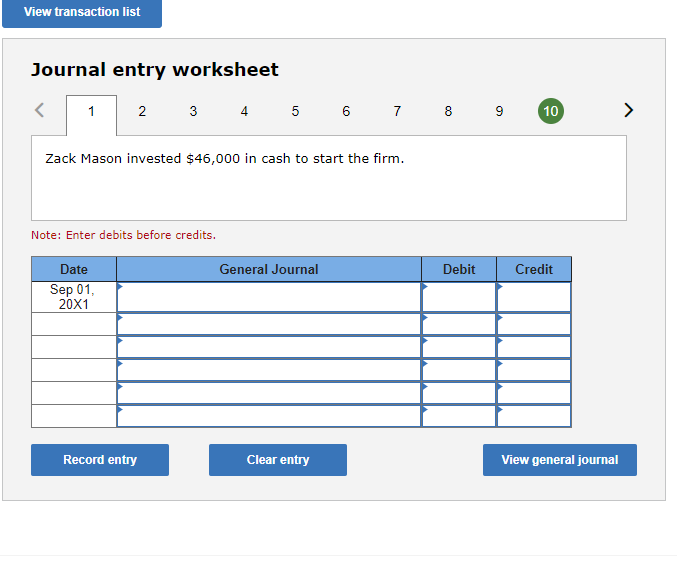

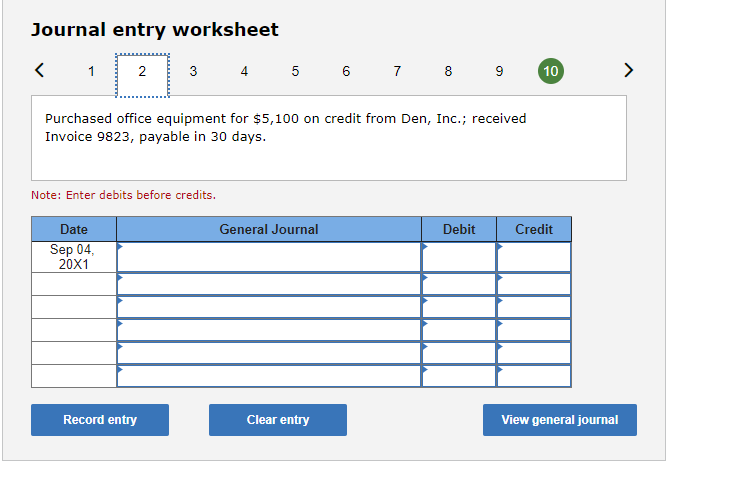

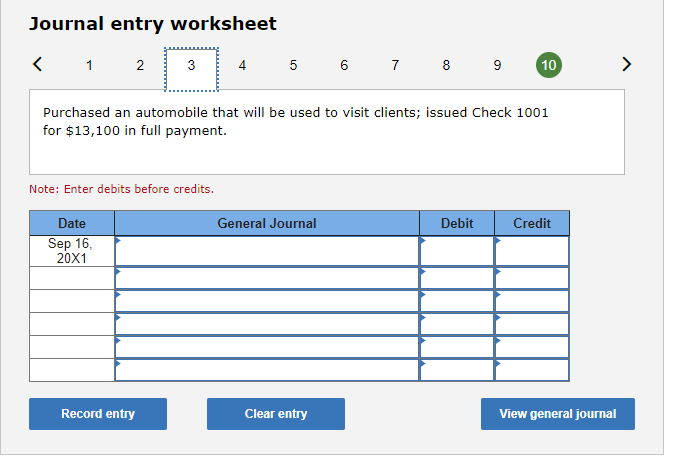

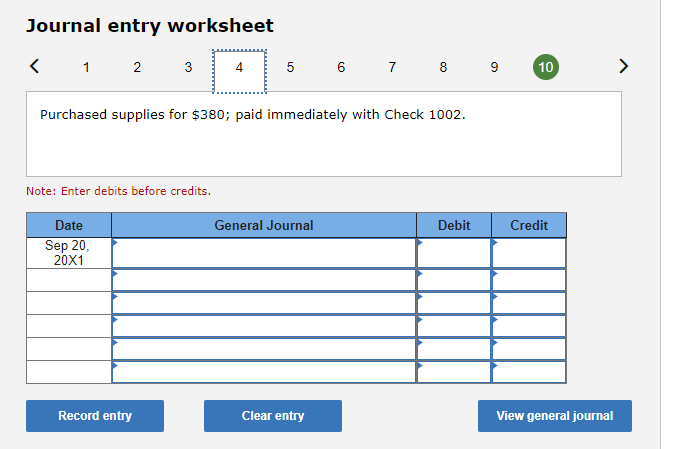

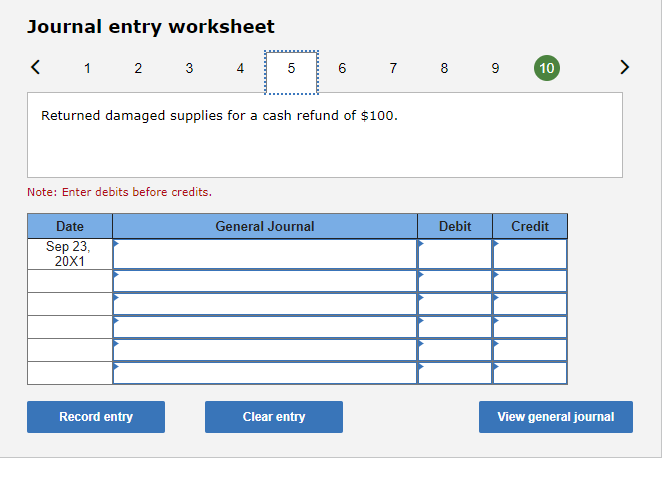

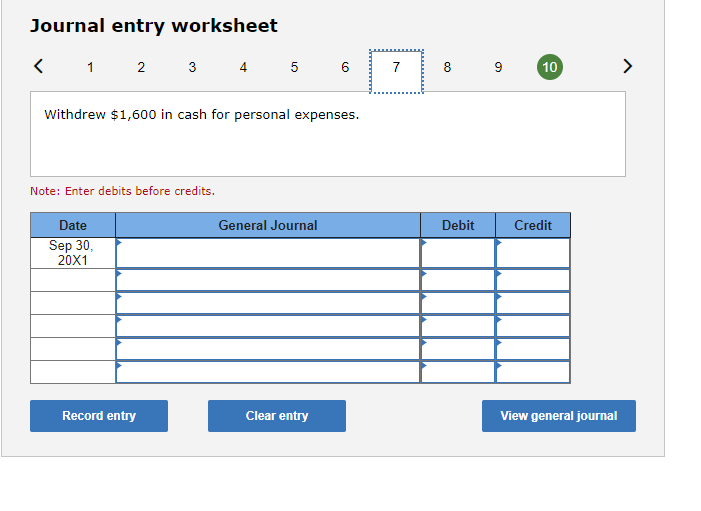

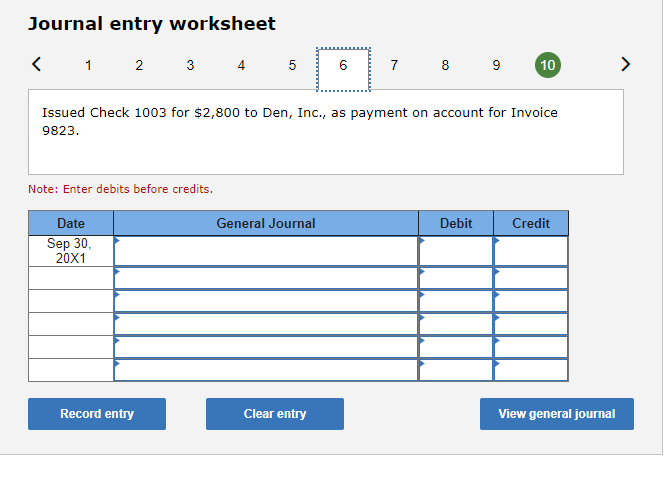

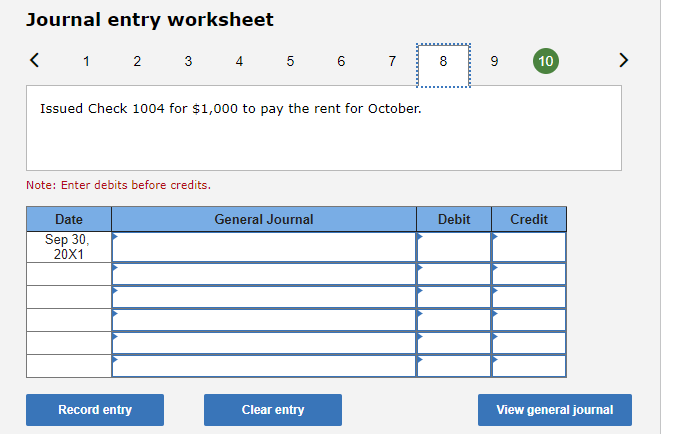

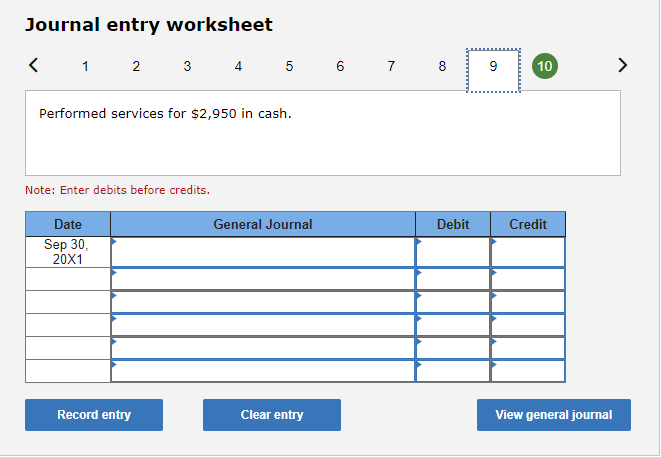

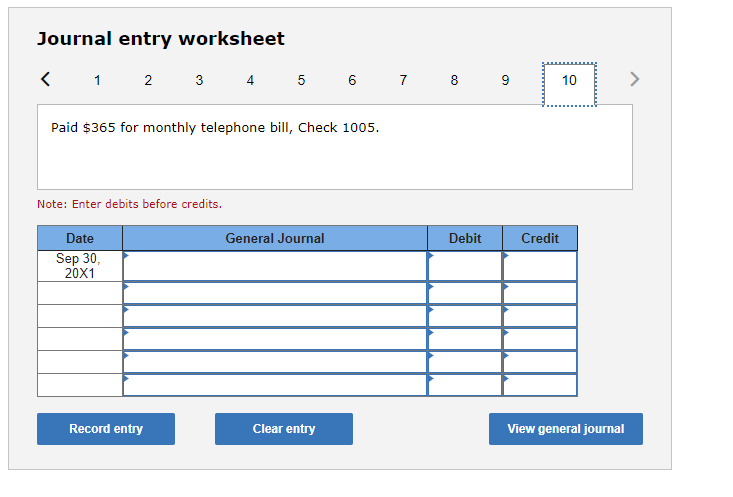

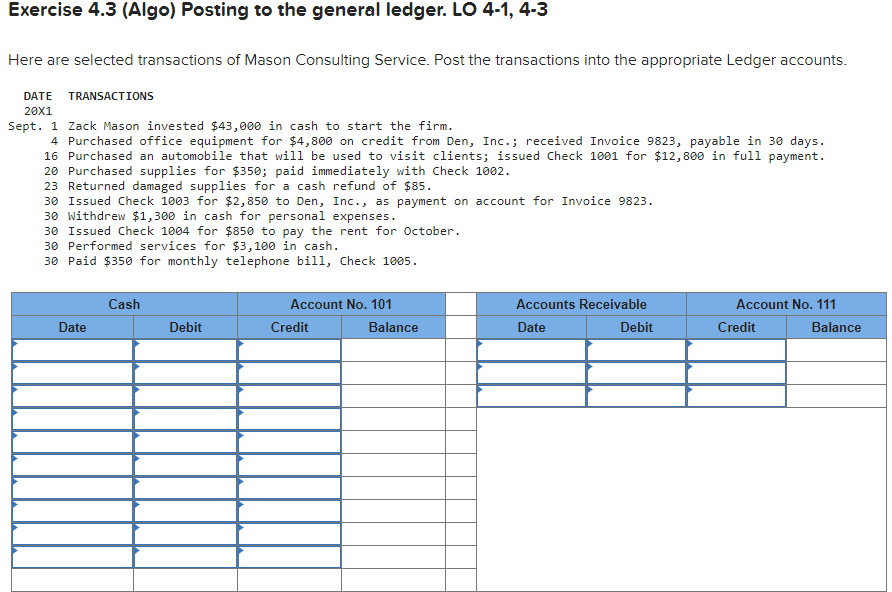

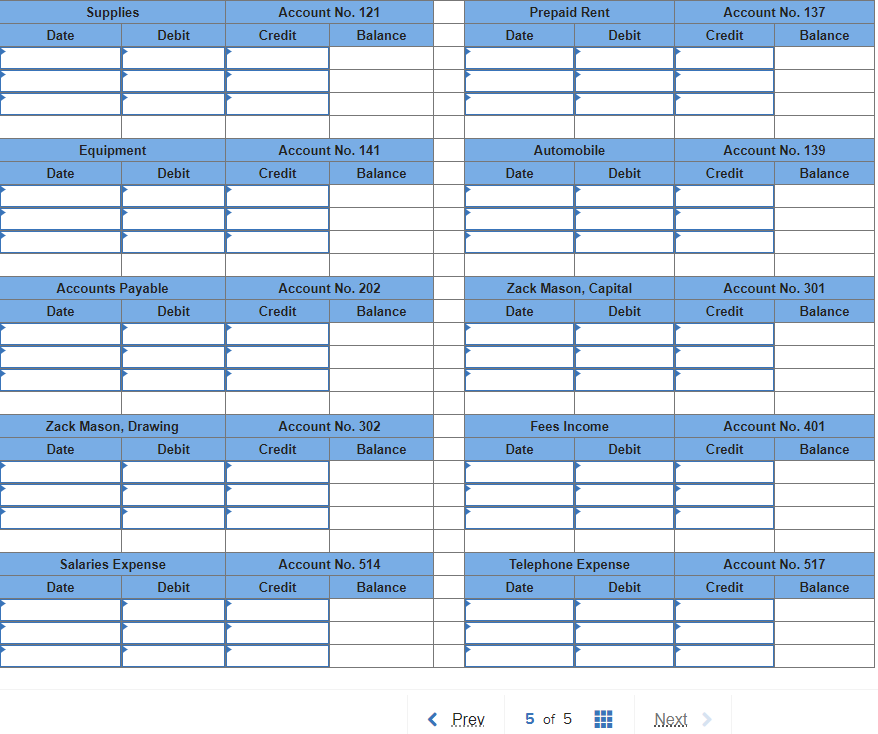

Exercise 3.2 (Algo) Using T accounts to analyze transactions. LO 32 Derrick Wells decided to start a dental practice. The first five transactions for the business follow. 1. Derrick invested $74,000 cash in the business. 2. Paid $14,000 in cash for equipment. 3. Performed services for cash amounting to $7,400. 4. Paid $2,200 in cash for advertising expense. 5. Paid $1,400 in cash for supplies. (1) Select which two accounts are affected in each of the above transactions. (2\&3) Post the above transactions into the appropriate T accounts. Complete this question by entering your answers in the tabs below. Select which two accounts are affected in each of the above transactions. Exercise 3.2 (Algo) Using T accounts to analyze transactions. LO 32 Derrick Wells decided to start a dental practice. The first five transactions for the business follow. 1. Derrick invested $74,000 cash in the business. 2. Paid $14,000 in cash for equipment. 3. Performed services for cash amounting to $7,400. 4. Paid $2,200 in cash for advertising expense. 5. Paid $1,400 in cash for supplies. (1) Select which two accounts are affected in each of the above transactions. (2\&3) Post the above transactions into the appropriate T accounts. Complete this question by entering your answers in the tabs below. Post the above transactions into the appropriate T accounts. \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Fees Income } & \\ \hline & & & & \\ \hline & & & & \\ \hline Bal. & & & Bal. \\ \hline & & & Req 1 \\ \hline \end{tabular} \begin{tabular}{l|l|l} \multicolumn{2}{c}{ Advertising Expense } \\ \hline & & \\ \hline & & \\ \hline \hline \end{tabular} Req 2 and 33 Exercise 3.6 (Algo) Preparing a trial balance and an income statement. LO 3-5, 3-6 The following T accounts show transactions that were recorded by Residential Relocators, a firm that specializes in local housing rentals. Required: Prepare a trial balance and an income statement for Residential Relocators. The trial balance is for December 31,201, and the income statement is for the month ended December 31,201. Prepare a trial balance and an income statement for Residential Relocators. The trial balance is for December 31,201, and the incom tatement is for the month ended December 31,201. Complete this question by entering your answers in the tabs below. Prepare an income statement for Residential Relocators for the month ended December 31,201. Required: Prepare a trial balance and an income statement for Residential Relocators. The trial balance is for December 31,201, and the income statement is for the month ended December 31,201. Complete this question by entering your answers in the tabs below. Prepare a trial balance for Residential Relocators for the month of December 31,201. Exercise 4.2 (Algo) Recording transactions in the general journal. LO 4-1 Here are selected transactions of Mason Consulting Services. Record a journal entry for each transaction. DATE TRANSACTIONS 201 Sept. 1 Zack Mason invested $46,000 in cash to start the firm. 4 Purchased office equipment for $5,100 on credit from Den, Inc.; received Invoice 9823 , payable in 30 days. 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,100 in full payment. 20 Purchased supplies for $380; paid immediately with Check 1002. 23 Returned damaged supplies for a cash refund of $100. 30 Issued Check 1003 for $2,800 to Den, Inc., as payment on account for Invoice 9823. 30 Withdrew $1,600 in cash for personal expenses. 30 Issued Check 1004 for $1,000 to pay the rent for October. 30 Performed services for $2,950 in cash. 30 Paid $365 for monthly telephone bill, Check 1005. Journal entry worksheet 567 Zack Mason invested $46,000 in cash to start the firm. Note: Enter debits before credits. Journal entry worksheet 56789 Purchased office equipment for $5,100 on credit from Den, Inc.; received Invoice 9823, payable in 30 days. Note: Enter debits before credits. Journal entry worksheet 8 9 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,100 in full payment. Note: Enter debits before credits. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts