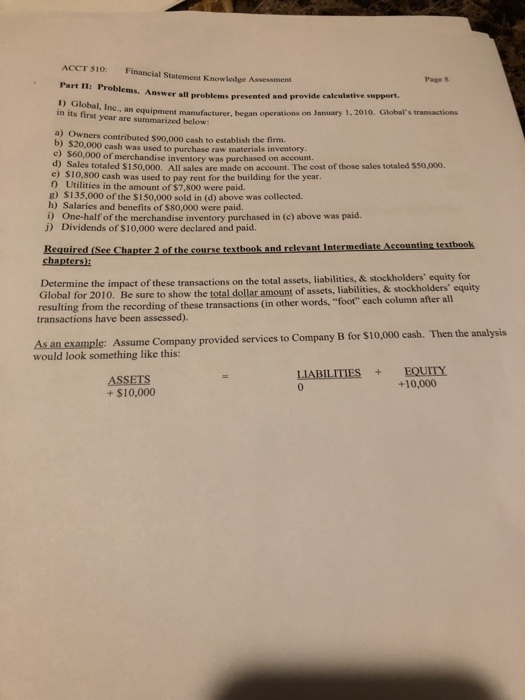

Question: ACCT 510: Financial Statement Knowledge Assessment Page 8 Part I1: Problems. Answer all problems presented and provide calculative support. in its firt wpment manufacturer, began

ACCT 510: Financial Statement Knowledge Assessment Page 8 Part I1: Problems. Answer all problems presented and provide calculative support. in its firt wpment manufacturer, began operations on January 1,2010. Global's transactions year are summarized below a) Owners contributed $90,000 cash to establish the firm. b) $20,000 cash was used to purchase raw c) $60,000 of merchandise inventory was pure d) hased on aceount. Sales totaled $150,000. e) $10,800 cash was used to pay rent for the building for the year D Utilities in the amount of $7,800 were paid. g) All sales are made on account. The cost of those sales totaled S50,000. $135,000 of the S150,000 sold in (d) above was collected. h) Salaries and benefits of $80,000 were paid. i) One-half of the merchandise inventory purchased in (c) above was paid. j) Dividends of $10,000 were declared and paid. chapters): Determine the impact of these transactions on Global for 2010. Be sure to show the total dollar amount resulting from the recording of these transactions (in other words. "foot" each column after all the total assets, liabilities, & stockholders' equity for of assets, liabilities, & stockholders' equity transactions have been assessed). As an example: Assume Company provided services to Company B for S$10,000 cash. Then the analysis would look something like this: ASSETS + $10,000 LIABILITIES+EQUITY 0 +10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts