Question: ACCT B460 / Hw#1 / Foreign Currency Problems / Page 2 of 2 3. On December 1, 2018, Lane Corp., a US-based company, entered into

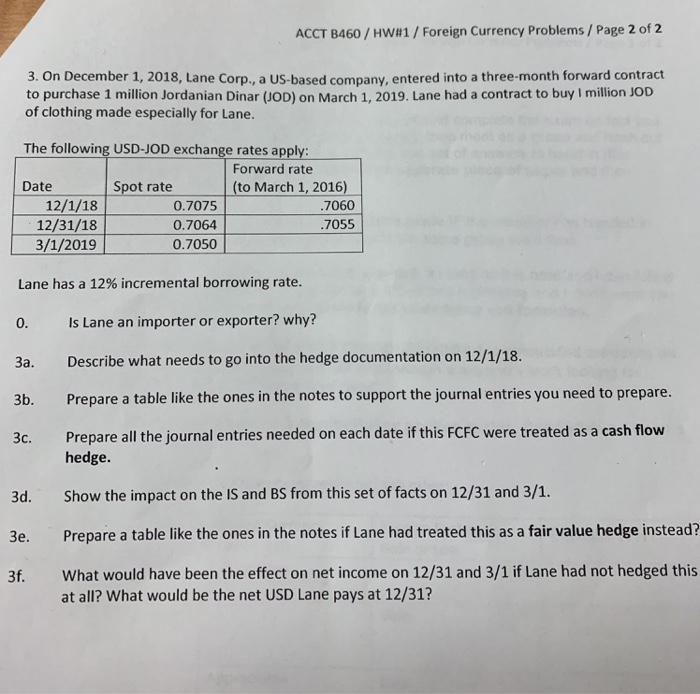

ACCT B460 / Hw#1 / Foreign Currency Problems / Page 2 of 2 3. On December 1, 2018, Lane Corp., a US-based company, entered into a three-month forward contract to purchase 1 million Jordanian Dinar (JOD) on March 1, 2019. Lane had a contract to buy I million JOD of clothing made especially for Lane. The following USD-JOD exchange rates apply: Forward rate Spot rate(to March 1, 2016) Date 12/1/18 0.7075 0.7064 0.7050 7060 7055 12/31/18 3/1/2019 Lane has a 12% incremental borrowing rate. 0. Is Lane an importer or exporter? why? 3a. Describe what needs to go into the hedge documentation on 12/1/18. 3b. Prepare a table like the ones in the notes to support the journal entries you need to prepare. 3c. Prepare all the journal entries needed on each date if this FCFC were treated as a cash flow hedge. 3d. Show the impact on the IS and BS from this set of facts on 12/31 and 3/1. 3e. Prepare a table like the ones in the notes if Lane had treated this as a fair value hedge instead? 3f What would have been the effect on net income on 12/31 and 3/1 if Lane had not hedged this at all? What would be the net USD Lane pays at 12/31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts