Question: ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) - Microsoft Word age Layout References Mailings Review View FIN 4337 In-Class Problem Two e Corporation has

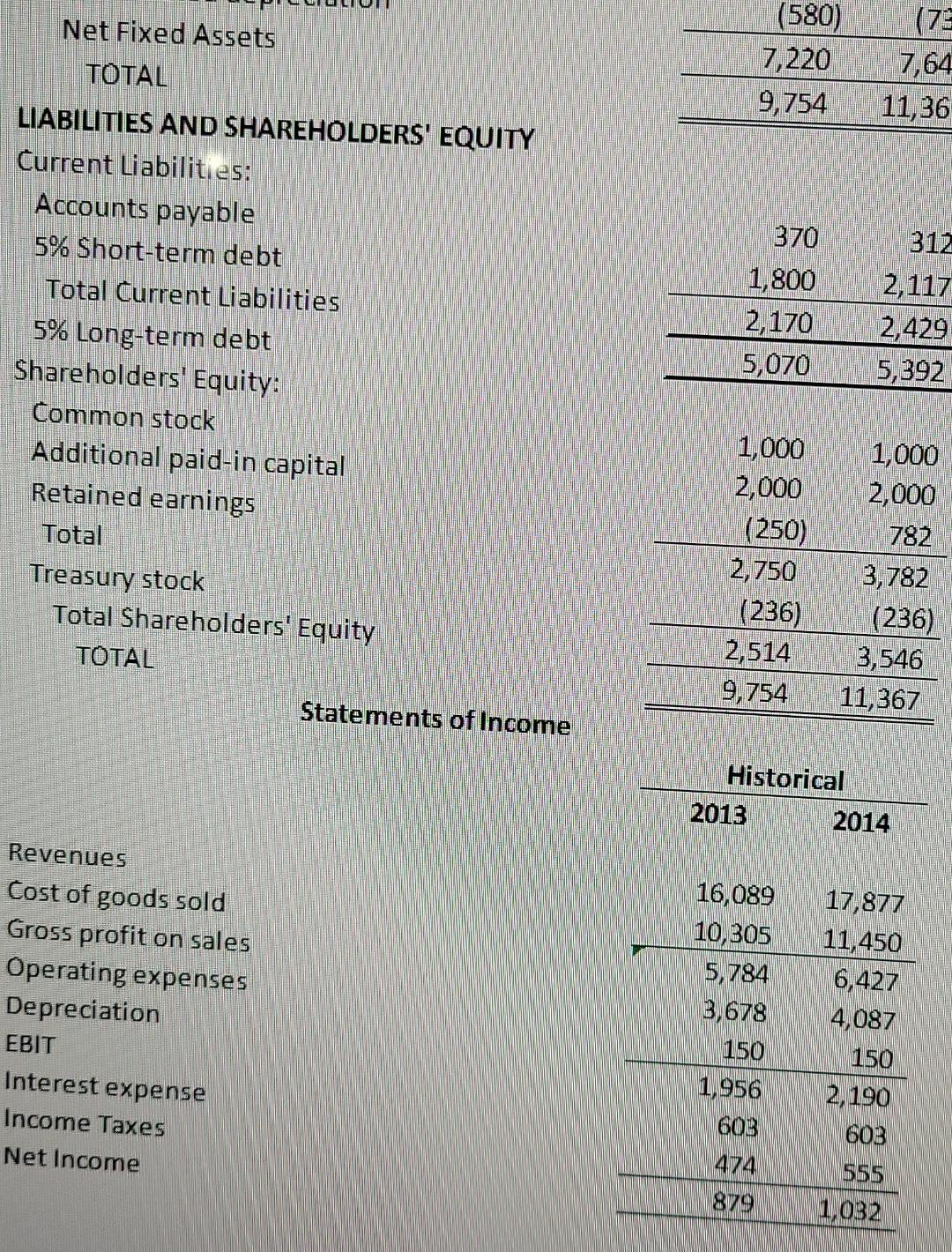

ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) - Microsoft Word age Layout References Mailings Review View FIN 4337 In-Class Problem Two e Corporation has a competitive advantage in certain cosmetics that reduce Fance effects of aging and expects that competitive advantage to last two yea ar 2016. The competitive advantage will allow it to increase sales by 25% for after which its sales will grow at the same rate as the increase in nominal GDP -elow, round to whole dollars. e a proforma income statement, balance sheet and firm free cash flow for Leg nd 2016 (the planning periods) using the following assumptions: es are expected to grow by 25%. et of goods sold and operating expenses are a constant percent of revenues, in of beginning of year (BOY) long-term debt plus short-term debt, depreciation Y total fixed assets (gross, not net) and income taxes are 35% of income before ch changes to balance the balance sheet and the remaining current assets incre portion to sales. ss fixed assets increase 5% each year. ounts payable increases in proportion to sales. ners' equity increases by net income and decreases by dividends. The dividend o is 25% rt-term debt remains the same. Long-term debt is payable, beginning at the en r 2015 and continuing at the end of each year, in equal annual principal paymen 0. ing 2016 capital stock with a par value of $1 was sold for $500. There are no oth apital stock. ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) - Microsoft Word ge Layout References Mailings Review View FIN 4337 In-Class Problem Two 2 Corporation has a competitive advantage in certain cosmetics that reduce the ance effects of aging and expects that competitive advantage to last two years th- er 2016. The competitive advantage will allow it to increase sales by 25% for 2015 fter which its sales will grow at the same rate as the increase in nominal GDP. For elow, round to whole dollars. e a proforma income statement, balance sheet and firm free cash flow for Legarde nd 2016 (the planning periods) using the following assumptions: es are expected to grow by 25%. t of goods sold and operating expenses are a constant percent of revenues, interes of beginning of year (BOY) long-term debt plus short-term debt, depreciation is 10 total fixed assets (gross, not net) and income taxes are 35% of income before tax n changes to balance the balance sheet and the remaining current assets increase portion to sales. ss fixed assets increase 5% each year. unts payable increases in proportion to sales. hers' equity increases by net income and decreases by dividends. The dividend pay is 25%. t-term debt remains the same. Long-term debt is payable, beginning at the end of 2015 and continuing at the end of each year, in equal annual principal payments o . ng 2016 capital stock with a par value of $1 was sold for $500. There are no others epital stock. (580) 7,220 9,754 7,64 11,36 Net Fixed Assets TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable 5% Short-term debt Total Current Liabilities 5% Long-term debt Shareholders' Equity: Common stock Additional paid-in capital Retained earnings Total Treasury stock Total Shareholders' Equity TOTAL Statements of Income 370 1,800 2,170 5,070 312 2,117 2,429 5,392 1,000 2,000 (250) 2,750 (236) 2,514 9,754 1,000 2,000 782 3,782 (236) 3,546 11,367 Historical 2013 2014 Revenues Cost of goods sold Gross profit on sales Operating expenses Depreciation EBIT Interest expense Income Taxes Net Income 16,089 10,305 5,784 3,678 150 1,956 603 474 879 17,877 11,450 6,427 4,087 150 2,190 603 555 1,032 ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) - Microsoft Word age Layout References Mailings Review View FIN 4337 In-Class Problem Two e Corporation has a competitive advantage in certain cosmetics that reduce Fance effects of aging and expects that competitive advantage to last two yea ar 2016. The competitive advantage will allow it to increase sales by 25% for after which its sales will grow at the same rate as the increase in nominal GDP -elow, round to whole dollars. e a proforma income statement, balance sheet and firm free cash flow for Leg nd 2016 (the planning periods) using the following assumptions: es are expected to grow by 25%. et of goods sold and operating expenses are a constant percent of revenues, in of beginning of year (BOY) long-term debt plus short-term debt, depreciation Y total fixed assets (gross, not net) and income taxes are 35% of income before ch changes to balance the balance sheet and the remaining current assets incre portion to sales. ss fixed assets increase 5% each year. ounts payable increases in proportion to sales. ners' equity increases by net income and decreases by dividends. The dividend o is 25% rt-term debt remains the same. Long-term debt is payable, beginning at the en r 2015 and continuing at the end of each year, in equal annual principal paymen 0. ing 2016 capital stock with a par value of $1 was sold for $500. There are no oth apital stock. ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) - Microsoft Word ge Layout References Mailings Review View FIN 4337 In-Class Problem Two 2 Corporation has a competitive advantage in certain cosmetics that reduce the ance effects of aging and expects that competitive advantage to last two years th- er 2016. The competitive advantage will allow it to increase sales by 25% for 2015 fter which its sales will grow at the same rate as the increase in nominal GDP. For elow, round to whole dollars. e a proforma income statement, balance sheet and firm free cash flow for Legarde nd 2016 (the planning periods) using the following assumptions: es are expected to grow by 25%. t of goods sold and operating expenses are a constant percent of revenues, interes of beginning of year (BOY) long-term debt plus short-term debt, depreciation is 10 total fixed assets (gross, not net) and income taxes are 35% of income before tax n changes to balance the balance sheet and the remaining current assets increase portion to sales. ss fixed assets increase 5% each year. unts payable increases in proportion to sales. hers' equity increases by net income and decreases by dividends. The dividend pay is 25%. t-term debt remains the same. Long-term debt is payable, beginning at the end of 2015 and continuing at the end of each year, in equal annual principal payments o . ng 2016 capital stock with a par value of $1 was sold for $500. There are no others epital stock. (580) 7,220 9,754 7,64 11,36 Net Fixed Assets TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable 5% Short-term debt Total Current Liabilities 5% Long-term debt Shareholders' Equity: Common stock Additional paid-in capital Retained earnings Total Treasury stock Total Shareholders' Equity TOTAL Statements of Income 370 1,800 2,170 5,070 312 2,117 2,429 5,392 1,000 2,000 (250) 2,750 (236) 2,514 9,754 1,000 2,000 782 3,782 (236) 3,546 11,367 Historical 2013 2014 Revenues Cost of goods sold Gross profit on sales Operating expenses Depreciation EBIT Interest expense Income Taxes Net Income 16,089 10,305 5,784 3,678 150 1,956 603 474 879 17,877 11,450 6,427 4,087 150 2,190 603 555 1,032

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts