Question: ACCT&203 Unit 4 Review - Cost-Volume-Profit Analysis, Absorption and Variable Costing Try to complete all problems without using your class notes or textbook. 19. The

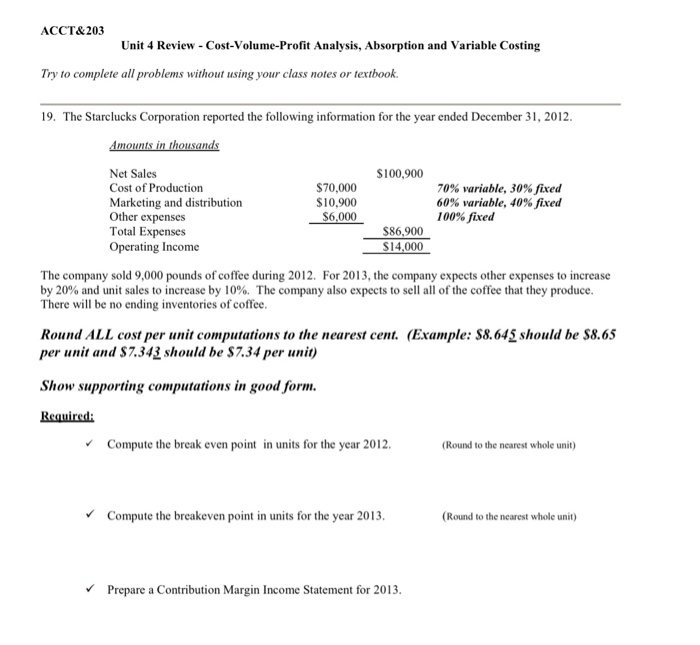

ACCT&203 Unit 4 Review - Cost-Volume-Profit Analysis, Absorption and Variable Costing Try to complete all problems without using your class notes or textbook. 19. The Starclucks Corporation reported the following information for the year ended December 31, 2012. Amounts in thousands Net Sales $100,900 Cost of Production $70,000 70% variable, 30% fixed Marketing and distribution $10,900 60% variable, 40% fixed Other expenses $6,000 100% fixed Total Expenses $86,900 Operating Income $14,000 The company sold 9,000 pounds of coffee during 2012. For 2013, the company expects other expenses to increase by 20% and unit sales to increase by 10%. The company also expects to sell all of the coffee that they produce. There will be no ending inventories of coffee. Round ALL cost per unit computations to the nearest cent. (Example: $8.645 should be $8.65 per unit and $7.343 should be $7.34 per unit) Show supporting computations in good form. Required: Compute the break even point in units for the year 2012. (Round to the nearest whole unit) Compute the breakeven point in units for the year 2013. (Round to the nearest whole unit) Prepare a Contribution Margin Income Statement for 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts