Question: Acct301 DeVry Student Portal X Week 6: Homework X Question 4 - Week 6: Homework X + - CD ezto.mheducation.com/ext/map/index.html Week 6: Homework Saved 4

Acct301

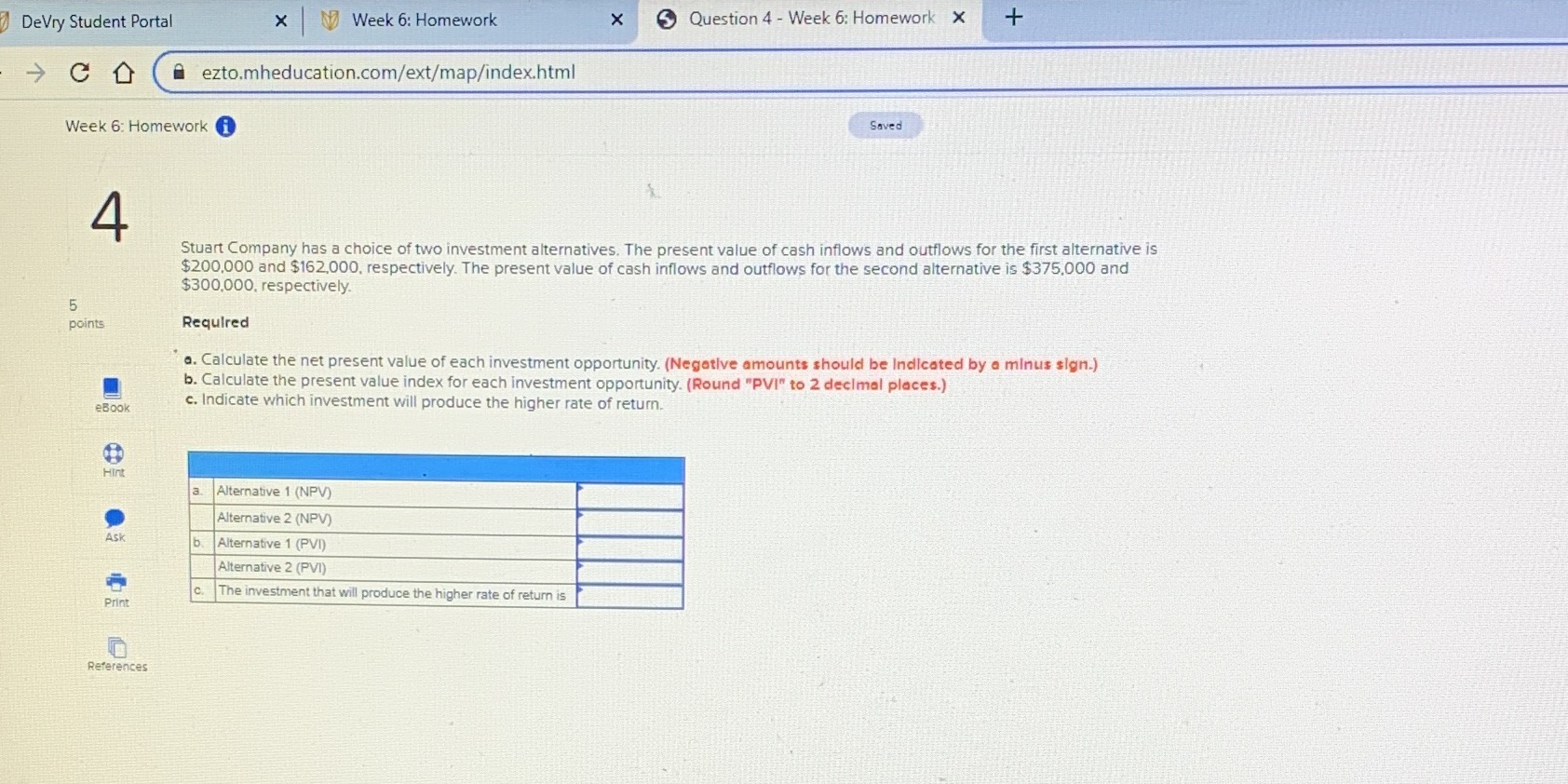

DeVry Student Portal X Week 6: Homework X Question 4 - Week 6: Homework X + - CD ezto.mheducation.com/ext/map/index.html Week 6: Homework Saved 4 Stuart Company has a choice of two investment alternatives. The present value of cash inflows and outflows for the first alternative is $200,000 and $162,000, respectively. The present value of cash inflows and outflows for the second alternative is $375,000 and $300,000, respectively. 5 points Required a. Calculate the net present value of each investment opportunity. (Negative amounts should be Indicated by a minus sign.) b. Calculate the present value index for each investment opportunity. (Round "PVI" to 2 decimal places.) Book c. Indicate which investment will produce the higher rate of return. Hint a. Alternative 1 (NPV) Alternative 2 (NPV) Ask b. Alternative 1 (PVI) Alternative 2 (PVI) The investment that will produce the higher rate of return is Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts