Question: Acct301 ezto.mheducation.com/ext/map/index.html Week 5: Homeworki Saved 6 A machine purchased three years ago for $318,000 has a current book value using straight-line depreciation of $175,000;

Acct301

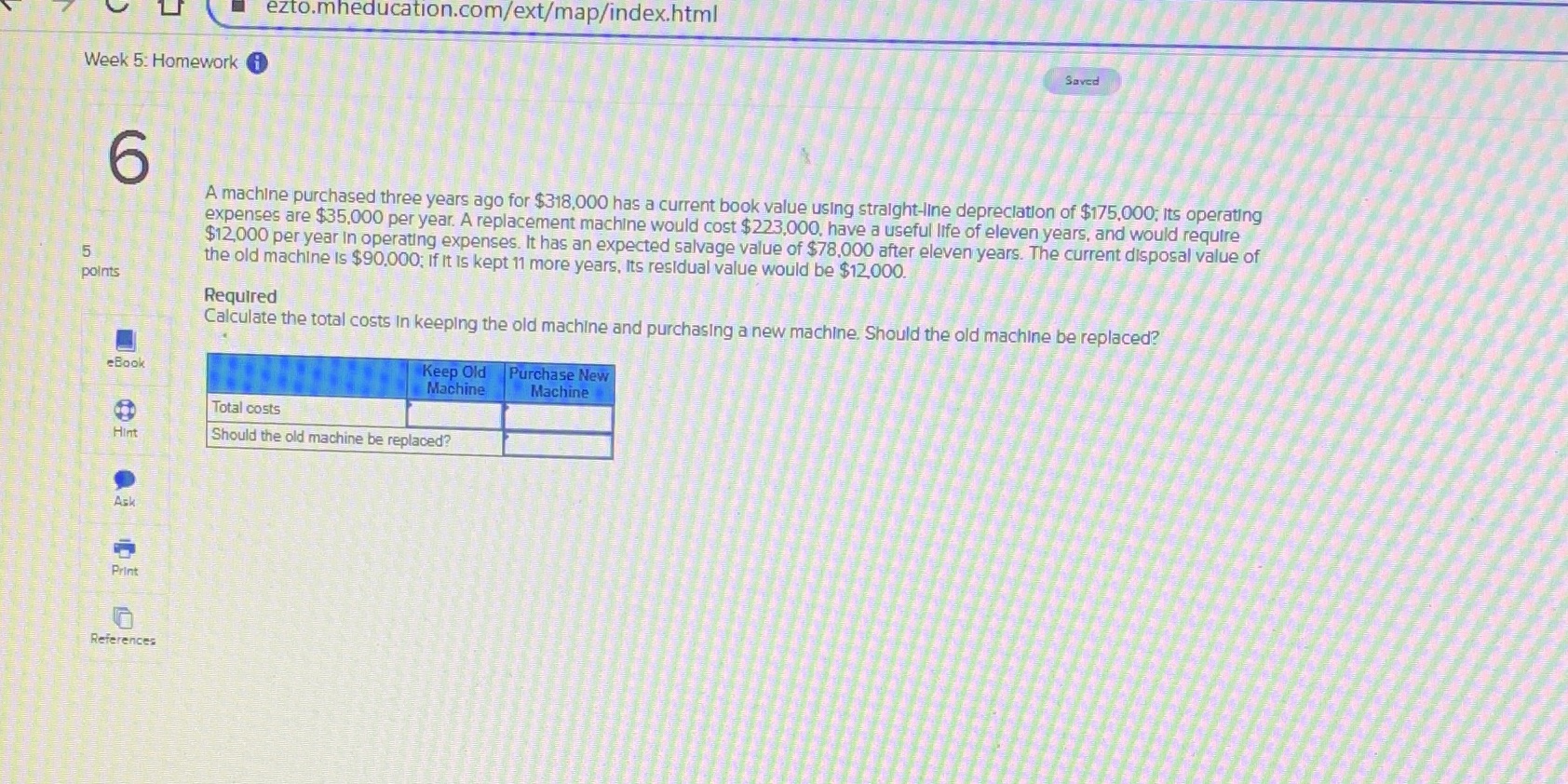

ezto.mheducation.com/ext/map/index.html Week 5: Homeworki Saved 6 A machine purchased three years ago for $318,000 has a current book value using straight-line depreciation of $175,000; Its operating expenses are $35,000 per year. A replacement machine would cost $223,000, have a useful life of eleven years, and would require $12,000 per year In operating expenses. It has an expected salvage value of $78,000 after eleven years. The current disposal value of 5 the old machine is $90,000; If it is kept 11 more years, Its residual value would be $12,000. points Required Calculate the total costs In keeping the old machine and purchasing a new machine. Should the old machine be replaced? Book Keep Old Purchase New Machine Machine Total costs Hint Should the old machine be replaced? Ask Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts