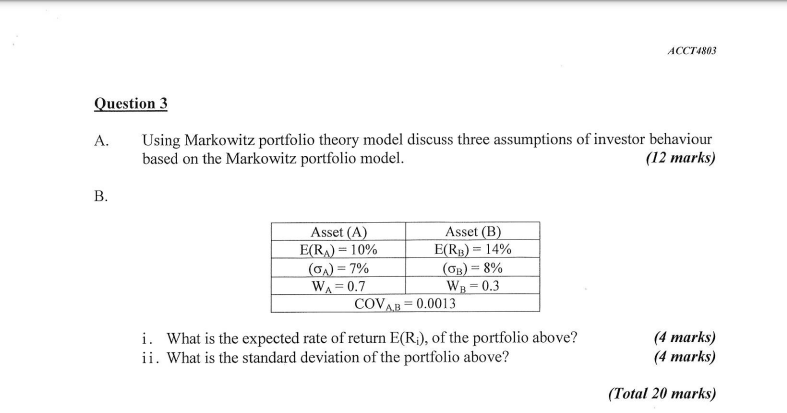

Question: ACCT4803 Question 3 A. Using Markowitz portfolio theory model discuss three assumptions of investor behaviour based on the Markowitz portfolio model. (12 marks) B. Asset

ACCT4803 Question 3 A. Using Markowitz portfolio theory model discuss three assumptions of investor behaviour based on the Markowitz portfolio model. (12 marks) B. Asset (A) Asset (B) E(RA) = 10% E(RB) = 14% (x) = 7% (GB) = 8% WA=0.7 W3 = 0.3 COVAB = 0.0013 i. What is the expected rate of return E(Ri), of the portfolio above? ii. What is the standard deviation of the portfolio above? (4 marks) (4 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts