Question: Acctg 1A - Chapter 10 (Current Liabilities) Scenario #1: The president of Johnson, Inc. has hired your com Inc. purchased a building by signing a

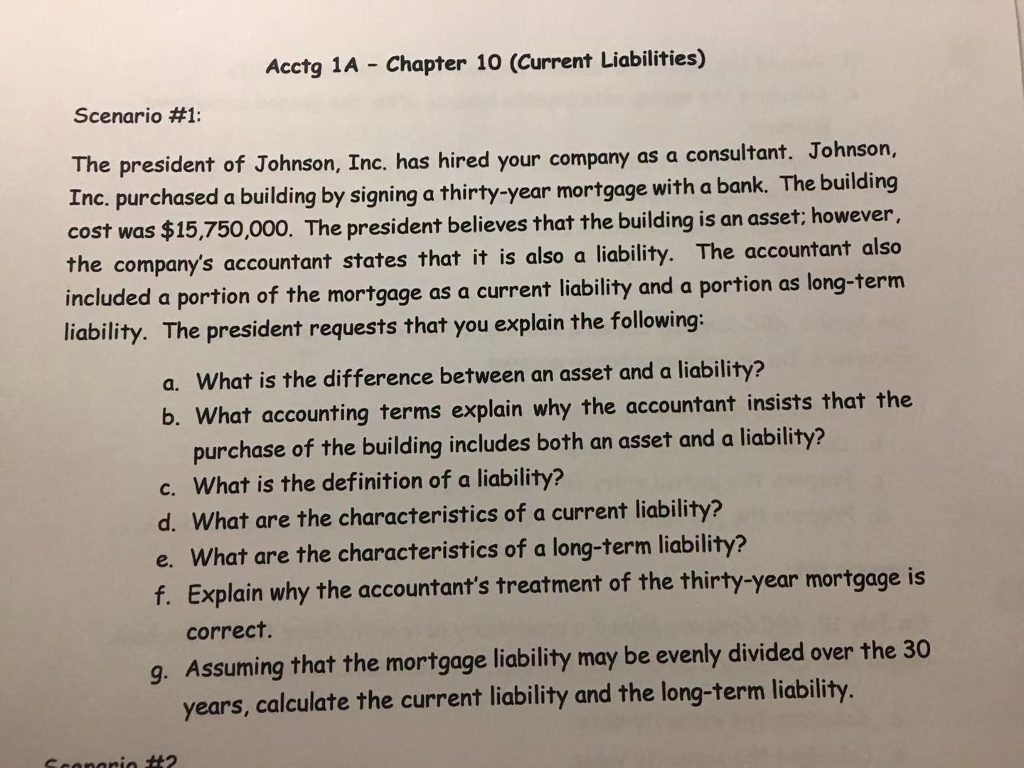

Acctg 1A - Chapter 10 (Current Liabilities) Scenario #1: The president of Johnson, Inc. has hired your com Inc. purchased a building by signing a thirty-year mortgage with a bank. The building cost was $15,750,000. The president believes that the building is an asset: however the company's accountant states that it is also a liability. The accountant also included a portion of the mortgage as a current liability and a portion as long-term liability. The president requests that you explain the following pany as a consultant. Johnson, a. What is the difference between an asset and a liability? b. What accounting terms explain why the accountant insists that the purchase of the building includes both an asset and a liability? c. What is the definition of a liability? d. What are the characteristics of a current liability? e. What are the characteristics of a long-term liability? f. Explain why the accountant's treatment of the thirty-year mortgage is correct g. Assuming that the mortgage liability may be evenly divided over the 30 years, calculate the current liability and the long-term liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts