Question: ACCY 131 - In-Class Assignment 4 1. You are auditing company XYZ, an entity that rents numerous business properties to serve as offices and warehouses

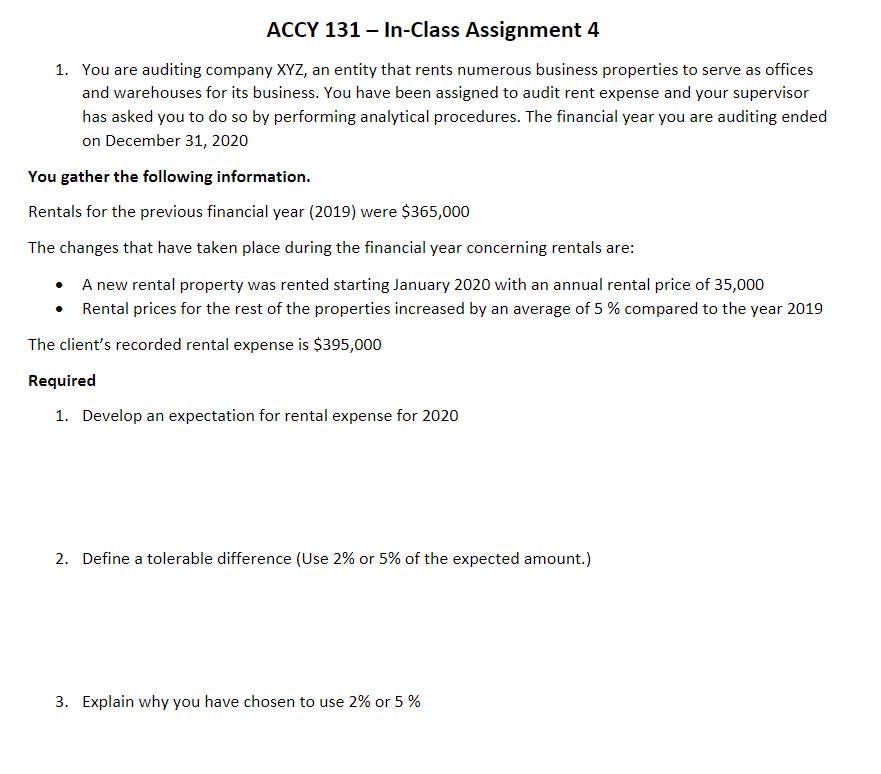

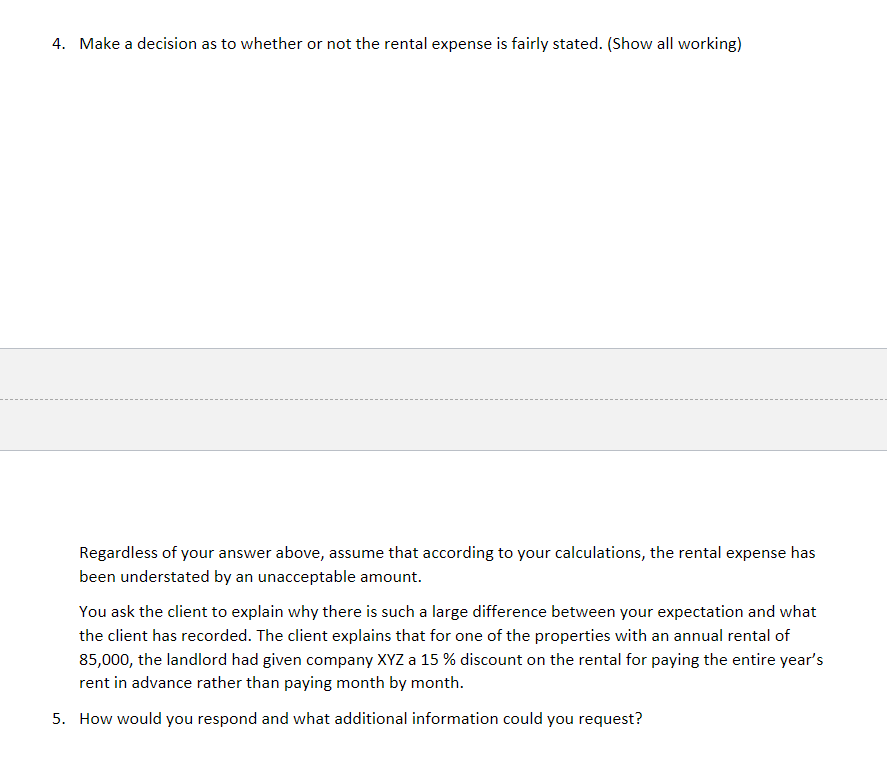

ACCY 131 - In-Class Assignment 4 1. You are auditing company XYZ, an entity that rents numerous business properties to serve as offices and warehouses for its business. You have been assigned to audit rent expense and your supervisor has asked you to do so by performing analytical procedures. The financial year you are auditing ended on December 31, 2020 You gather the following information. Rentals for the previous financial year (2019) were $365,000 The changes that have taken place during the financial year concerning rentals are: A new rental property was rented starting January 2020 with an annual rental price of 35,000 Rental prices for the rest of the properties increased by an average of 5 % compared to the year 2019 The client's recorded rental expense is $395,000 Required 1. Develop an expectation for rental expense for 2020 2. Define a tolerable difference (Use 2% or 5% of the expected amount.) 3. Explain why you have chosen to use 2% or 5 % 4. Make a decision as to whether or not the rental expense is fairly stated. (Show all working) Regardless of your answer above, assume that according to your calculations, the rental expense has been understated by an unacceptable amount. You ask the client to explain why there is such a large difference between your expectation and what the client has recorded. The client explains that for one of the properties with an annual rental of 85,000, the landlord had given company XYZ a 15 % discount on the rental for paying the entire year's rent in advance rather than paying month by month. 5. How would you respond and what additional information could you request? 6. Show the steps you would take to complete this audit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts