Question: Ace Construction which has a calendar year end, has entered into a non-cancellable fixed priced contract of $2,800,000 beginning August 1, 2020 to build

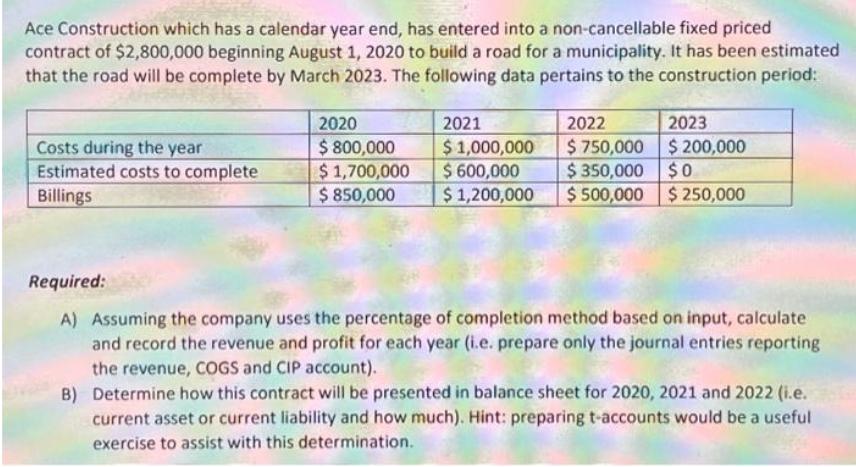

Ace Construction which has a calendar year end, has entered into a non-cancellable fixed priced contract of $2,800,000 beginning August 1, 2020 to build a road for a municipality. It has been estimated that the road will be complete by March 2023. The following data pertains to the construction period: Costs during the year Estimated costs to complete 2020 $800,000 $1,700,000 Billings $850,000 2021 $1,000,000 $600,000 $1,200,000 2022 2023 $750,000 $200,000 $350,000 $0 $500,000 $250,000 Required: A) Assuming the company uses the percentage of completion method based on input, calculate and record the revenue and profit for each year (i.e. prepare only the journal entries reporting the revenue, COGS and CIP account). B) Determine how this contract will be presented in balance sheet for 2020, 2021 and 2022 (i.e. current asset or current liability and how much). Hint: preparing t-accounts would be a useful exercise to assist with this determination.

Step by Step Solution

There are 3 Steps involved in it

A Assuming the company uses the percentage of completion method the revenue and profit for each year ... View full answer

Get step-by-step solutions from verified subject matter experts