Question: Acenova Company is considering a project having net present value of $63,900. The estimated life of the project is 8 years. The discount rate

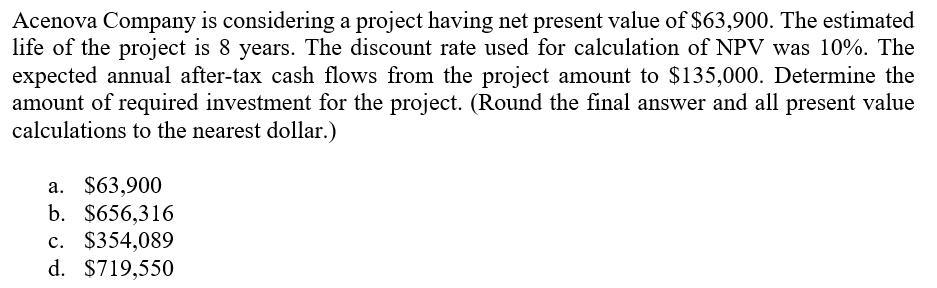

Acenova Company is considering a project having net present value of $63,900. The estimated life of the project is 8 years. The discount rate used for calculation of NPV was 10%. The expected annual after-tax cash flows from the project amount to $135,000. Determine the amount of required investment for the project. (Round the final answer and all present value calculations to the nearest dollar.) a. $63,900 b. $656,316 c. $354,089 d. $719,550

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To determine the r... View full answer

Get step-by-step solutions from verified subject matter experts