Question: ACG 2 0 1 1 Milestone Assignment # 1 Instructions Version 2 3 . A Chart of Accounts Step 1 : Journalize the following transactions.

ACG Milestone Assignment # Instructions

Version A

Chart of Accounts

Step : Journalize the following transactions.

Enter the following on page of the general journal.

June J Harris contributes cash of $ and accounts receivable of $ to a new partnership,

Top Tier Interior Design. S Grant contributes $ cash and $ of supplies to the

partnership. The partners agree that $ is a reasonable amount for the allowance for

doubtful accounts for the contributed accounts receivable.

Paid rent for the June through August, $

Purchased equipment paying cash, $

Purchased a used van for $ The partnership paid $ cash as a down payment

and signed a note for the remainder.

Received an advance payment of $ for services to be provided in the future.

Purchased supplies on credit, $

Received cash for job completed, $

Recorded jobs completed on account and sent invoices to customers, $

Received an invoice in the mail for vanrelated expenses, to be paid in September $

Paid miscellaneous expenses, $

Paid utilities expense, $

Enter the following on page of the general journal.

Paid wages of employees, $

The partners agree to write off $ of their accounts receivable as uncollectible.

Received cash from customers on account, $

Paid creditor a portion of the amount owed for supplies purchased earlier in the

month, $

J Harris withdrew cash for personal use, $

Step : Post the journal entries in Step to a fourcolumn general ledger.

Step : Prepare an unadjusted trial balance for Top Tier Interior Design as of June

Step : Journalize the following adjusting entries for the end of the month.

a Supplies on hand on June are $

b The partnership uses the straightline method to depreciate the equipment. The

estimated residual value is $ and the estimated useful life is years.

c The partnership uses the straightline method to depreciate the van. The residual value

is estimated to be $ and the estimated useful life is years.

d Wages owed on June are $

e Rent expired during June is $

f Unearned revenue on June is $

g An analysis of accounts receivable at the end of the month indicates that the allowance

for doubtful accounts should be reported at $

h Recorded accrued interest of $

Step : Post the adjusting entries in step to the general ledger.

Step : Prepare an adjusted trial balance for Top Tier Interior Design as of June

Step : Prepare a SingleStep Income Statement, Statement of Partners' Equity, and Classified Balance

Sheet for Top Tier Interior Design as of June The partnership agreement states that net income

and net losses will be divided according to the following: each partner will receive interest on their original

contributions and any remainder will be divided equally. Treat all liabilities as current liabilities.

Step : Journalize the closing entries for the month.

Step : Post the closing entries in step to the fourcolumn general ledger.

Step : Prepare a postclosing trial balance for Top Tier Interior Design as of June

GENERAL JOURNAL

ACG Milestone Assignment # Instructions

Version A

Chart of Accounts

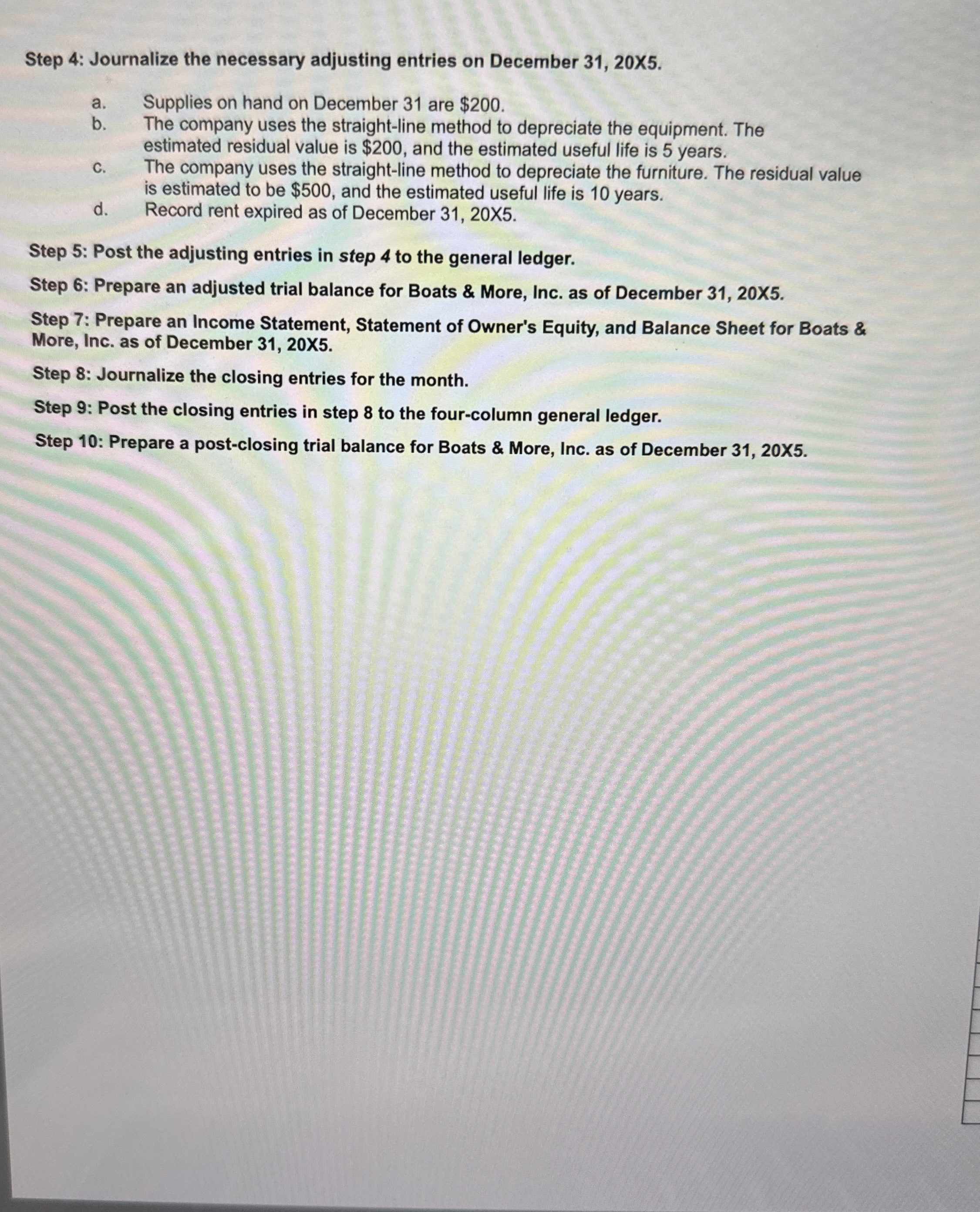

Step : Journalize the following transactions for a new corporate retail company, Boats & More, Inc.,

for

Enter the following on page of the general journal.

Issued shares of $ par value common stock for $ per share.

Paid rent for the January through December, $

Purchased equipment on credit, $

Purchased inventory, paying $

Paid cash for furniture for the office, $

Paid cash for supplies, $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock