Question: ack to Assignment Attempts Average/2 10. Problem 14.09 (Recapitalization) eBook Tartan Industries currently has total capital equal to $9 million, has zero debt, is in

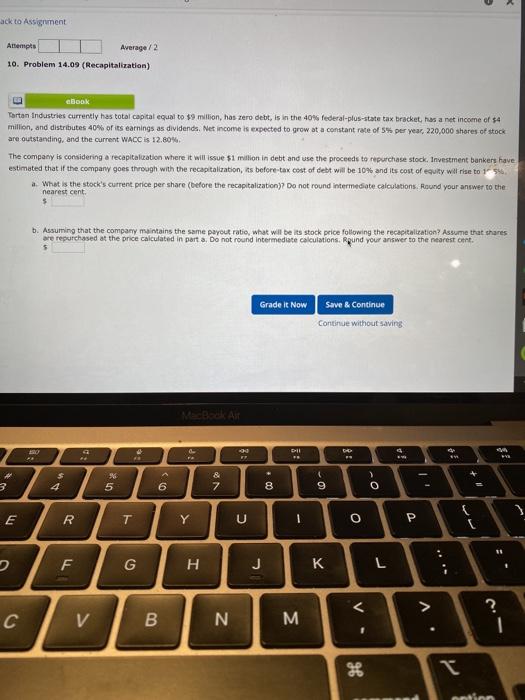

ack to Assignment Attempts Average/2 10. Problem 14.09 (Recapitalization) eBook Tartan Industries currently has total capital equal to $9 million, has zero debt, is in the 40% federal-plus-state tax bracket has a net income of $4 million, and distributes 40% of its earnings as dividends. Net income is expected to grow at a constant rate of 5% per year, 220,000 shares of stock are outstanding, and the current WACC IS 12.80% The company is considering a recapitalization where it will issue $1 million in debt and use the proceeds to purchase stock. Investment bankers have estimated that if the company goes through with the recapitalization, its before tax cost of debt will be 10% and its cost of equity will rise to 1 54 a What is the stock's current price per share (before the recapitalization)? Do not round Intermediate calculations, Round your answer to the nearest cent b. Assuming that the company maintains the same payout ratio, what will be its stock price following the recapitalization? Assume that shares are repurchased at the price calculated in part a. Do not round Intermediate calculations. Round your answer to the nearest cont. 5 Grade It Now Save & Continue Continue without saving MacBook Air je 3 4 & 7 6 5 8 -O 9 E R T Y U 0 F G H J K r ? V 00 N M tien

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts