Question: ack to Assignment Attempts Keep the Highest / 2 4. Present value of annuities and annuity payments The present value of an annulty is the

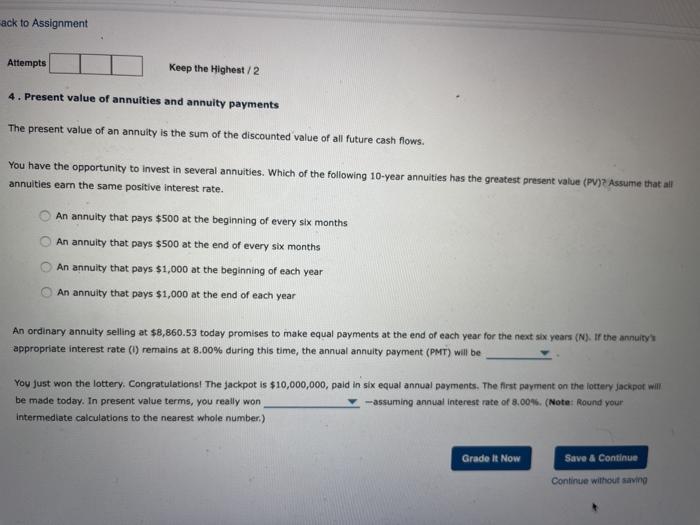

ack to Assignment Attempts Keep the Highest / 2 4. Present value of annuities and annuity payments The present value of an annulty is the sum of the discounted value of all future cash flows. You have the opportunity to invest in several annuities. Which of the following 10-year annuities has the greatest present value (PU)? Assume that all annuities earn the same positive interest rate. An annuity that pays $500 at the beginning of every six months An annuity that pays $500 at the end of every six months An annuity that pays $1,000 at the beginning of each year An annuity that pays $1,000 at the end of each year An ordinary annuity selling at $8,860.53 today promises to make equal payments at the end of each year for the next six years (N). If the annuity appropriate interest rate (1) remains at 8.00% during this time, the annual annuity payment (PMT) will be You just won the lottery. Congratulations. The jackpot is $10,000,000, pald in six equal annual payments. The first payment on the lottery jackpot will be made today. In present value terms, you really won - assuming annual interest rate of 8.00%. (Note: Round your Intermediate calculations to the nearest whole number) Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts